Deflation's Final Curtain Call - Part II

Economics / Deflation Aug 22, 2014 - 04:29 PM GMTBy: Clif_Droke

As the 60-year cycle enters its final few weeks of descent, a few conclusions can be made. We can also make some projections as to what the foreseeable future might hold based on the upcoming bottom of this important economic cycle.

As the 60-year cycle enters its final few weeks of descent, a few conclusions can be made. We can also make some projections as to what the foreseeable future might hold based on the upcoming bottom of this important economic cycle.

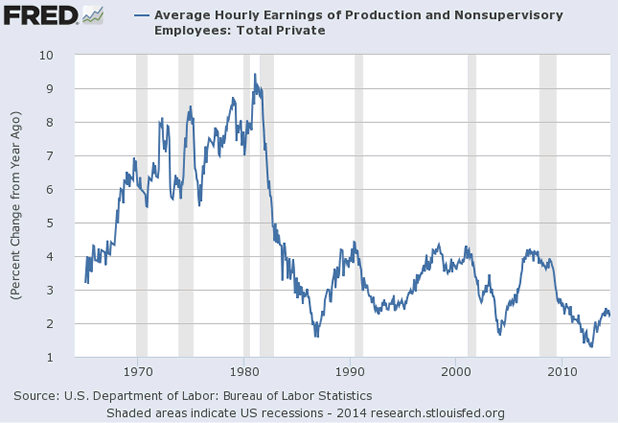

Since the 60-year cycle is the primary cycle governing inflation and deflation, it makes sense that its impact will be most strongly felt in the prices of inflation-sensitive commodities. Its force is also evident in wages, interest rates, and other factors which influence the general course of the economy. One of the biggest areas affected by the cycle is in earnings and income growth.

The graph below shows the year over year change in total earnings in the U.S. since the 1960s. The peak in earnings on a percentage change basis occurred around the time of the last 60-year cycle peak in the early 1980s. After the plunge of the 1980s, earnings growth for production and nonsupervisory workers has never come close to regaining the peak from 30+ years ago. This exhibit provides some context for the influence of the economic long-wave and the economic trends it generates.

Many observers have noted the disparity of fortunes in recent years between the upper and lower classes within the U.S. The recovery of the last five years has unquestionably benefited the upper class (the so-called "1 percent"). The massive rebound in equity prices has helped the rich much more than the middle class due to the increased exposure to the stock market enjoyed by the former group. The middle class by contrast has seen its fortunes wane since the crisis years of 2007-2008. This is due in part to the middle class's lower exposure to equities and can also be attributed to the lack of wage growth.

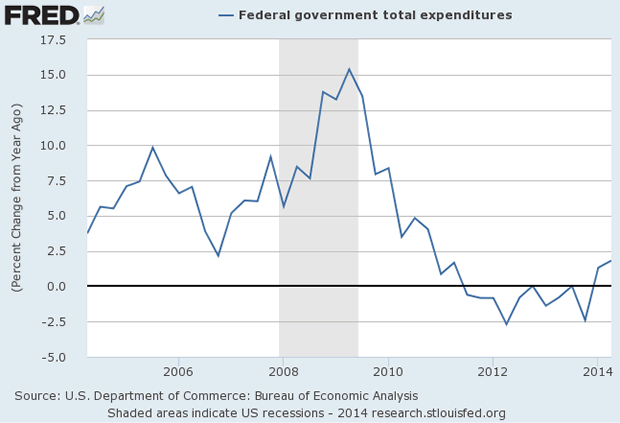

Another important reason for the lack of a strong rebound in the middle class economy can be seen in the following graph.

The above graph shows the expenditures of the federal government going back the last several years. Following a brief spike in government spending in the post-credit crisis period, the rate of change in expenditures plummeted and has never quite recovered to its much higher historical average. This is one of the key reasons why the middle class economy has been relatively slow to recovery since 2008.

During the last five years the middle class has seen its tax burden rise along with cost of living increases, yet there has been no commensurate rise in services provided. In other words, the government has continuously taken from the pockets of the working class without giving back in the form of direct spending, such as infrastructural repairs, contract building, etc. This refusal to spend by the government during a time of acute crisis for the middle class is effectively an austerity policy. Government has persistently focused on lowering the budget deficit in recent years by raising taxes and through forced spending (e.g. Obamacare) instead of cutting taxes, which paradoxically would have increased government tax receipts through the higher levels of consumer and business spending it would have engendered.

What we have witnessed during the past five years has been a dual fiscal and monetary policy of both austerity and stimulus: government fiscal policy has been austere while central bank monetary policy has been liberal. The net result of this conflicting set of policies has been to force the brunt of the deflationary 60-year cycle upon the middle class while shielding the moneyed classes from its effects.

Indeed, the Fed's loose monetary policy known as QE has all but blunted the impact of the final deflationary leg of the 60-year cycle for the financial sector. Equity prices were largely exempt from the final 5-6 years of the deflationary long-wave. The 2008 credit crash was essentially the "super crash" that many long-wave analysts were calling for. It arrived a few years ahead of schedule but was still within the final "hard down" phase of the 60-year cycle (defined as the last 10 percent of the cycle's duration). The recovery since the 2008 super crash was fierce and unprecedented, thanks largely to the scope and scale of the Fed's intervention.

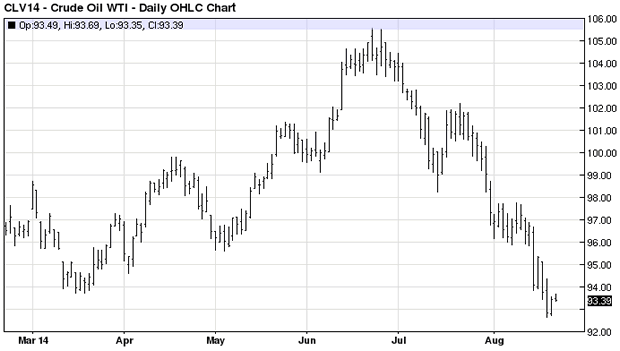

Now that the 60-year cycle is winding down we can see the last vestiges of its deflationary pressure in certain inflation-sensitive commodities. The crude oil price has been in decline since June, as you can see in the following graph. Since a wide range of retail consumer prices are based on the oil price, the lower the price of oil goes, the better it will bode for the retail economic outlook entering 2015 once the new 60-year up-cycle kicks off.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market’s intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor’s success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book “Kress Cycles,” the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.