Gold Miners Consolidate and Hold Support

Commodities / Gold and Silver Stocks 2014 Aug 29, 2014 - 06:59 PM GMTBy: Jordan_Roy_Byrne

Precious metals miners have successfully digested their sharp gains from early summer. The miners have continued to hold above key retracements as well as 200-day moving averages that are now sloping up. The miners, despite some fear from market participants remain in position for a September breakout to the upside.

Precious metals miners have successfully digested their sharp gains from early summer. The miners have continued to hold above key retracements as well as 200-day moving averages that are now sloping up. The miners, despite some fear from market participants remain in position for a September breakout to the upside.

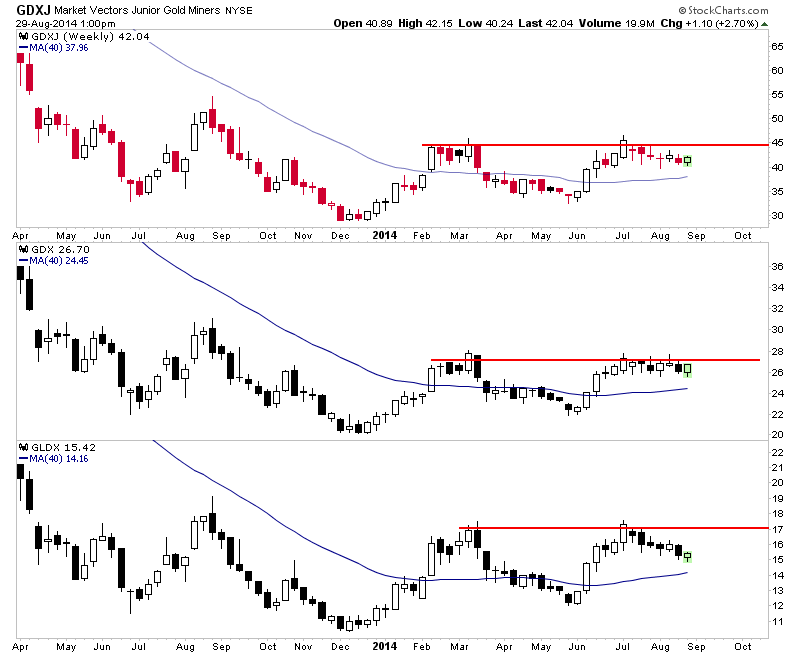

Below is a weekly candle plot showing GDXJ, GDX and GLDX. Each index has held most of its gains and is holding well above the moving average which is now sloping up. While GLDX is holding above the 50% retracement of recent gains, both GDX and GDXJ are holding above the 38% retracement of their recent gains. Moreover, note how GDXJ has formed large tails during three of the five negative weeks. That signals weakness is being bought.

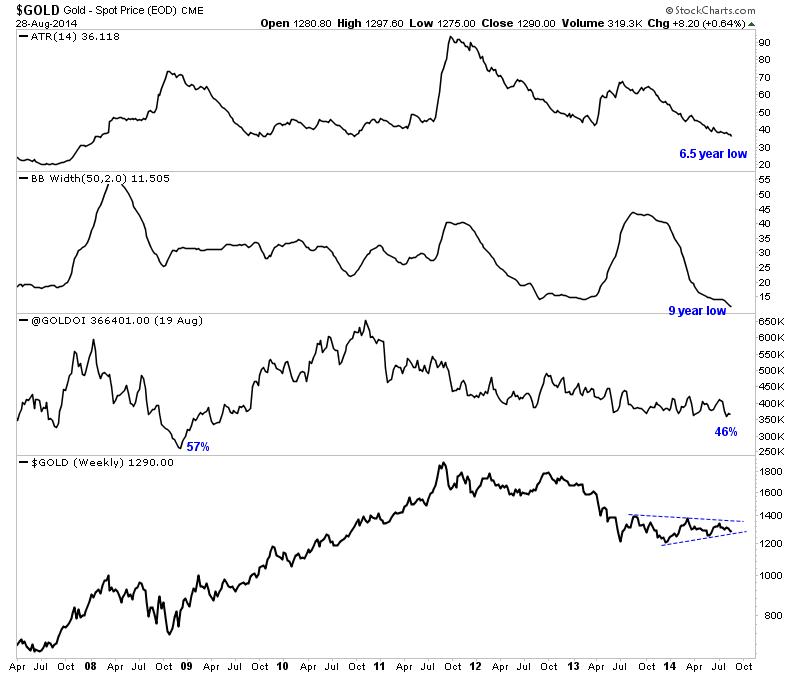

Meanwhile, Gold remains in a listless, trendless state. Volatility indicators are at multi-year lows while open interest is down 46% and recently touched a five year low. These conditions can lead to big moves but not always and not immediately. The price action of Gold suggests that a big move is not necessarily imminent. In any event, Gold is likely to follow the direction of the miners. If the miners breakout in September, it is reasonable to assume that Gold will climb upwards and eventually above $1400.

There have been quite a few reasons to worry about the miners. The US Dollar is rallying. Commodities have plunged in recent months. The COT for Gold and Silver looks bearish. Gold has not put in an “official” bottom (according to some). Moreover, the miners were up substantially since the start of the year, providing an excellent opportunity to take profits. Yet, despite all these negatives the miners have held support and digested their gains in bullish fashion. That in itself shows strength and perhaps signals the transition from bear to bull.

September, a month of breakdowns and breakouts (as we previously mentioned) now awaits us. We are positioned for the breakout. The evidence favors the bulls. If something changes then we will review the situation. If we get the breakout then the key for us speculators and investors will be company selection.If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.