Don't Get Ruined by These 10 Popular Investment Myths (Part IV)

InvestorEducation / Learning to Invest Sep 10, 2014 - 06:02 PM GMTBy: EWI

Interest rates, oil prices, earnings, GDP, wars, terrorist attacks, inflation, monetary policy, etc. -- NONE have a reliable effect on the stock market

Interest rates, oil prices, earnings, GDP, wars, terrorist attacks, inflation, monetary policy, etc. -- NONE have a reliable effect on the stock market

You may remember that during the 2008-2009 financial crisis, many called into question traditional economic models.

Why did the traditional financial models fail? And more importantly, will they warn us of a new approaching doomsday, should there be one?

This series gives you a well-researched answer.

Here is Part IV; come back soon for Part V.

Myth #4: "Earnings drive stock prices."

By Robert Prechter (excerpted from the monthly Elliott Wave Theorist; published since 1979)

This belief powers the bulk of the research on Wall Street. Countless analysts try to forecast corporate earnings so they can forecast stock prices. The exogenous-cause [i.e., news-driven -- Ed.] basis for this research is quite clear:

Corporate earnings are the basis of the growth and the contraction of companies and dividends. Rising earnings indicate growing companies and imply rising dividends, and falling earnings suggest the opposite. Corporate growth rates and changes in dividend payout are the reasons investors buy and sell stocks.

Therefore, if you can forecast earnings, you can forecast stock prices.

Suppose you were to be guaranteed that corporate earnings would rise strongly for the next six quarters straight. Reports of such improvement would constitute one powerful "information flow." So, should you buy stocks?

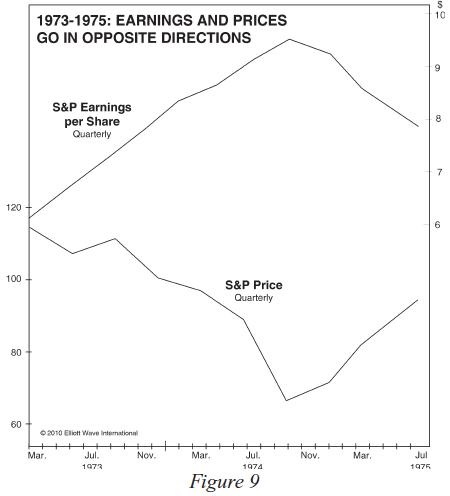

Figure 9 shows that in 1973-1974, earnings per share for S&P 500 companies soared for six quarters in a row, during which time the S&P suffered its largest decline since 1937-1942.

This is not a small departure from the expected relationship; it is a history-making departure. Earnings soared, and stocks had their largest collapse for the entire period from 1938 through 2007, a 70-year span! Moreover, the S&P bottomed in early October 1974, and earnings per share then turned down for twelve straight months, just as the S&P turned up!

An investor with foreknowledge of these earnings trends would have made two perfectly incorrect decisions, buying near the top of the market and selling at the bottom.

In real life, no one knows what earnings will do, so no one would have made such bad decisions on the basis of foreknowledge. Unfortunately, the basis that investors did use -- and which is still popular today -- is worse:

They buy and sell based on estimated earnings, which incorporate analysts' emotional biases, which are usually wrongly timed.

But that is a story we will tell later. Suffice it for now to say that this glaring an exception to the idea of a causal relationship between corporate earnings and stock prices challenges bedrock theory. ...

(Stay tuned for Part V of this important series, where we examine another popular investment myth: Namely, that "GDP drives stock prices.")

Free Report:

|

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.