The Fed’s New Labor-Market Measure

Economics / Employment Oct 21, 2014 - 07:06 PM GMTBy: Frank_Shostak

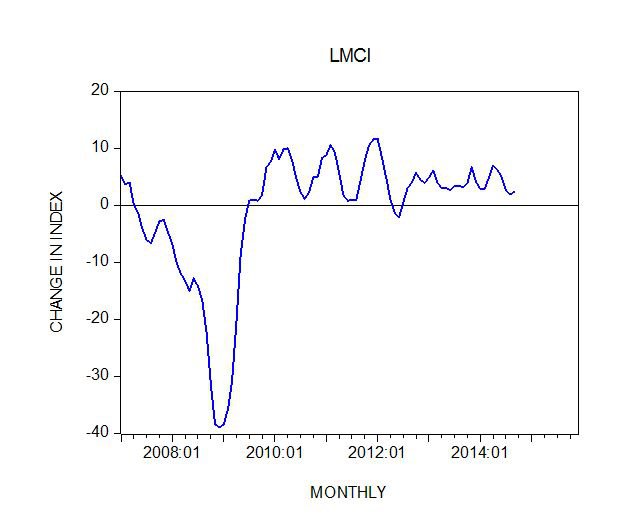

Economists at the Federal Reserve have devised a new indicator, which they hold will enable US central bank policymakers to get better information regarding the state of the labor market. The metric is labeled as the Labor Market Conditions Index (LMCI).

Economists at the Federal Reserve have devised a new indicator, which they hold will enable US central bank policymakers to get better information regarding the state of the labor market. The metric is labeled as the Labor Market Conditions Index (LMCI).

Note that one of the key data points Fed policymakers are paying attention to is the labor market. The state of this market dictates the type of monetary policy that is going to be implemented.

Fed policymakers are of the view that it is the task of the central bank to navigate the economy toward a path of stable self-sustaining economic growth.

One of the indicators that is believed could inform policymakers about how far the economy is from this path is the state of the labor market.

A strengthening of the labor market is seen as indicative that the economy may not be far from the desired growth path.

A weakening in the labor market is interpreted as indicating that the distance is widening and the economy’s ability to stand on its own feet is diminishing.

Once the labor market shows strengthening this also raises the likelihood that the Fed will reduce its support to the economy. After all, to provide support while the economy is on a path of stable self-sustained growth could push the economy away from this path toward a path of accelerating price inflation, so it is held.

Conversely, weakening labor market conditions raises the likelihood that the Fed will either maintain or strengthen its loose monetary stance. Failing to do so, it is held, could push the economy onto a path of price deflation and economic crisis.

The uniqueness of the LMCI, it is held, is that it covers a broader range of labor market pieces of information thereby raising the likelihood of depicting a more correct state of labor market conditions than an individual piece of information could provide.

The LMCI is derived from nineteen indicators such as the number of people employed full time and part time, the labor participation rate, the hiring rate, hiring plans, etc.

When the index is rising above the zero line it is interpreted that labor market conditions are strengthening. A fall in the index below the zero line is taken as a deterioration in the labor market.

In September, the index rose by 2.5 points after gaining 2 points in August. Note, however, that in April this year the index increased by 7.1 points. Following the logic of Fed policymakers and assuming that they will pay some attention to the LMCI, if the index were to continue strengthening then the Fed may start considering tightening its monetary stance.

We suggest that the Fed’s responses to the LMCI are not going to bring the economy onto a path of stability and self-sustaining economic growth, but on the contrary will lead to more instability and economic impoverishment.

The state of a particular indicator such as the LMCI cannot tell us the state of the pool of real wealth (i.e., whether it is expanding or shrinking).

Wealth Creation More Important Than Employment

It is not important to have people employed as such but to have them employed in wealth-generating activities. Employment such as digging ditches and building non-wealth generating projects are only depriving wealth generators from the expansion of the pool of real wealth. This undermines the ability to grow the economy and leads to economic misery.

The belief that the Fed can navigate and grow the economy is wishful thinking. All that Fed officials can do is to pump money and tamper with the interest rate structure. None of this however can lead to economic growth.

The key to economic growth is the expansion in capital goods per individual. This expansion however must be done in accordance with the dictates of the free market and not on account of an artificial lowering of interest rates and monetary pumping.

Loose monetary policy will only result in the expansion of capital goods for non-wealth generating projects (i.e., capital consumption).

Only by means of the allocation of resources in accordance with the dictates of the market can a wealth generating infrastructure be established. Such infrastructure is going to lead to economic prosperity.

Conclusion

To conclude then, the Fed’s new indicator adds more means for US central bank officials to tamper with the economy, but what is required is not information about the strength of the labor market as such but information on how changes in labor market conditions are related to the wealth generation process.

The LMCI doesn’t provide this. Since Fed officials are likely to react to movements in the LMCI we hold this will only lead to a deepening in the misallocation of resources and to a further weakening of the wealth generation process.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See Frank Shostak's article archives. Comment on the blog.![]()

© 2013 Copyright Frank Shostak - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.