Gold and Real Interest Rate

Commodities / Gold and Silver 2014 Oct 22, 2014 - 10:54 AM GMTBy: P_Radomski_CFA

Arkadiusz Sieron writes: Teaser: Does gold respond to the inflation or rather to the real interest rate? Paul Krugman said once that the reason behind the high real price of gold between 2001 and 2011 was low real interest rates, not the expected inflation. Is he right and are real interest rates really the main driver of the yellow metal price? How do they affect the gold market?

Arkadiusz Sieron writes: Teaser: Does gold respond to the inflation or rather to the real interest rate? Paul Krugman said once that the reason behind the high real price of gold between 2001 and 2011 was low real interest rates, not the expected inflation. Is he right and are real interest rates really the main driver of the yellow metal price? How do they affect the gold market?

During the last boom, the gold price was stubbornly rising, but inflation was low. Not surprisingly the relationship between real interest rates (nominal interest rates less inflation) and gold increasingly attracted more and more interest. If gold responds mainly to the real interest rate, it makes its inflation hedge character questionable. This was the opinion of, for example, Paul Krugman, a Nobel Laureate in economics. Krugman claimed that the reason behind the high real price of gold until 2011 was low real interest rates, not the expected inflation.

Was he right? Are real interest rates really the main driver of the yellow metal price? How do they affect the gold market?

Generally, the real interest rates are negatively correlated with the gold price, i.e. the rising interest rates adversely impact the yellow metal. The intuition behind this is that higher interest rates mean higher opportunity costs of holding non-interest bearing assets, like precious metals, making them relatively less attractive. Basically, gold pays neither dividend nor interest. Thus, it is relatively expensive to hold in the portfolio when real interest rates are high, and relatively cheap when real interest rates are low. In other words, the higher the interest rates are, the higher are carrying costs.

Moreover, we should not forget about two other factors. First, higher storage costs due to higher interest rates also raise the carrying costs. Second, for many years central banks were leasing part of their gold reserves. Then as interest rates fall, gold leasing becomes less attractive for central banks, so less gold is leased, which positively affects its price.

This negative relationship has quite strong support in the academic literature, as well in the statistics. In the article from 1985 Gibson's Paradox and the Gold Standard Robert B. Barsky and Lawrence H. Summers showed that variation in the real interest rate appeared to be responsible for the year-to-year movement in the relative price of gold from 1973 to 1984. According to their explanation, gold is a durable real asset, therefore willingness to hold it depends on the rate of return available on alternative assets.

In the more recent article from 2013, The Golden Dilemma, Claude Erb and Campbell Harvey also found a very strong negative correlation between real interest rates and gold prices (from 1997 to 2012), such as -0.82 (while -1 means a perfect negative correlation).

The World Gold Council in the third edition of its Gold Investor from 2013 also found that real rate regimes are negatively correlated to returns. The best returns (1.5% monthly) in the period from January 1975 to May 2013 have been achieved in the times of low real rates (lower than 0%). During moderate real rate periods (between 0 and 4%) the average monthly rate of return was 0.7%, generally in line with the long-term average, while high real rate environments (more than 4%) were associated with monthly average returns of -1%. Additionally, WGC found that gold's volatility is significantly lower in a moderate than in a low or high real rate environment.

This relationships is not linear, however. Gold prices tend to increase significantly only during the periods of negative real interest rates. This is because the negative interest rates, i.e. the situation when the inflation rate is higher than nominal interest rate (the rate which is actually paid), means that creditors are losing money, therefore they are more prone to buy gold, even it does not bear interest nor dividends. In other words, gold reclaims then its traditional role as money and a store of wealth, which will at least keep pace with inflation to preserve the purchasing power of their capital, while bonds guarantee a real loss at negative real interest rates. Therefore, in asense the adverse relationship between gold prices and real interest rates confirms that gold is an inflationary hedge. Investors shift their capital into gold market - they do not want to suffer losses because of nominal interest rates lower than the inflation rate.

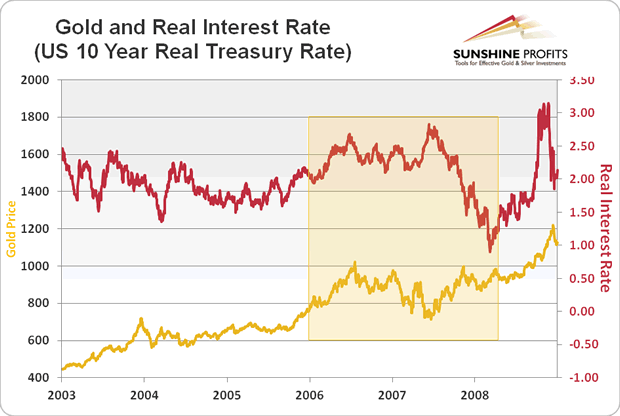

Few historical examples confirm the adverse relationship between real interest rates and gold prices. In the second half of the 1970s, both nominal interest rates and inflation rates were high. What is important, is that inflation exceeded the nominal returns on bonds, therefore investors shifted their capital into gold. As long as the real interest was negative, the price of gold rose, reaching its ultimate high. However, as soon as the Paul Volcker hiked the short-term nominal interest rates and real interest came back into positive territory, thegold boom ended. Interesingly, the significant downtrend in the gold market continued until 2001, when the Fed, trying to reinflate a stock bubble, cut nominal interest rates so much that real interest rates fell to zero. As we can see in the graph, the consolidation from mid-2006 was caused by the hike in the real interest rates. However, in late 2007 the Fed cut nominal rates again, and then real rates plummeted and the gold price simultanously soared.

Graph: Gold (yellow line, left scale) and Real Interest Rate (US 10 Year Real Treasury Rate; red line, right scale) from 2003 to 2008

Changes in the real interest rates are crucial to understanding movements in the gold price. The adverse relationship between real interest rates and gold price is quite well-established in the literature and was confirmed by a few empirical experiences. The biggest booms in the gold market occurred during the negative real rates environments, firstly during 1970s, when both nominal interest rates and inflation rates were high, and later in 2000s, when both nominal interest rates and inflation rates were low. On the other hand, the secular bear during 1980s and 1990s lasted when the real interest rates were low.

Summing up, although gold also gains during moderate positive real interest rates, negative real interest rates are the one of the most important drivers of gold prices. Do you want to know what else affects the price of gold in the long run? That's what we discuss in ou monthly gold Market Overview reports. Please take some time to consider subscribing.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.