Silver Presents Huge Opportunities for Investors

Commodities / Gold & Silver May 21, 2008 - 09:24 AM GMTBy: Mark_OByrne

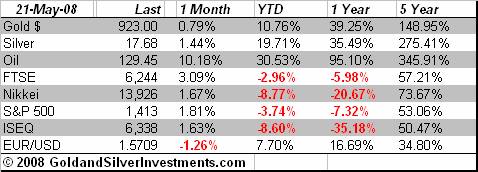

Gold and silver continued to surge yesterday with gold up 1.6% and silver up over 4%. They have continued to rally in Asia and early trade in Europe.

Gold and silver continued to surge yesterday with gold up 1.6% and silver up over 4%. They have continued to rally in Asia and early trade in Europe.

Gold has risen on the continuing oil surge with oil reaching new record highs (above $130) again this morning. There are fears of shortages and possible rationing in the next few years as the markets gradually and belatedly realize the reality that is peak oil. The FT reports that the fear of a global oil shortage within five years propelled oil futures prices to well above $130 a barrel, further stoking inflationary pressures in the global economy.

Investors rushed to buy oil futures contracts as far forward as December 2016, pushing prices as high as $139.30 a barrel, up $9 on the day. Veteran traders said they had never seen such a jump. Contracts to be delivered at the end of 2012 have soared almost 60 per cent while near-term prices have risen by 35 per cent since January.

The dollar has again fallen sharply versus the euro and Australian dollar but is flat against sterling and up versus some of the Asian currencies (SGD) and Scandinavian currencies (SEK, DKK).

Today's Data and Influences

The focus will switch to the US later in the day with the minutes of the last FOMC meeting due for release at 19.00.

Silver Surges and Remains One of the Worst Analysed Commodity Markets

Silver futures for July delivery rose 69.7 cents, or 4.1 percent, to $17.725 an ounce. The price has advanced 19 percent this year, while gold climbed 9.8 percent.

Silver remains one of the worst and most inaccurately analysed of all the commodity markets and this creates a huge opportunity for investors who are willing to do their own research and go against the herd. Incidentally the herd were wrong on the NASDAQ, on property and they will be wrong on assuming that this will be another short benign recession.

The article below is slightly out of date but all the fundamentals remain the same. Most institutions have been bearish on silver since it was above $7 per ounce and continue to be as they fail to look at the big picture reality as looked at in this article. http://www.gold.ie/documents /articles_of_interest/AOI_08 -05-07_Why_the_Silver_Price_Is _Set_to_Soar.htm .

Many silver experts and analysts said that it was the best analysis of the silver market they had encountered and it was picked up internationally and syndicated and referenced in papers such as the International Herald Tribune.

While gold was up some 2% yesterday, silver was up by more than 4% and we expect this outperformance of silver vis-à-vis gold and all other commodities to continue in the coming months. With regards to the price of gold and silver - after the recent healthy correction, they are both now cheap vis-à-vis other commodities and especially against black gold or oil.

Gold, silver and oil are highly correlated over the medium to long term. But oil can often outperform them in the short term prior to the precious metals catching up when higher oil prices lead to inflation hedging buying of silver and gold. Not to mention safe haven buying when higher oil prices lead to slowing economic growth.

The long term average gold to oil ratio is 15 to 1 or 15 barrels of oil to one ounce of gold (see chart below). Today, the ratio is near record lows at 7.1 ($865/ $127 = 6.8). Oil is at over $125 per barrel and so if we multiply it by 15 we get a gold price of $1,875. At the higher end of the scale gold has traded at over 30 times a barrel of oil which based on today's oil price would result in a gold price of $3,750.

Thus based on today's oil price of $125, the gold/oil ratio would suggest that gold is very undervalued at a near historic low of 6.8. The ratio will revert to the mean in the coming weeks and months and will thus see gold reaching its inflation adjusted high of some $2,400 per ounce in the coming years.

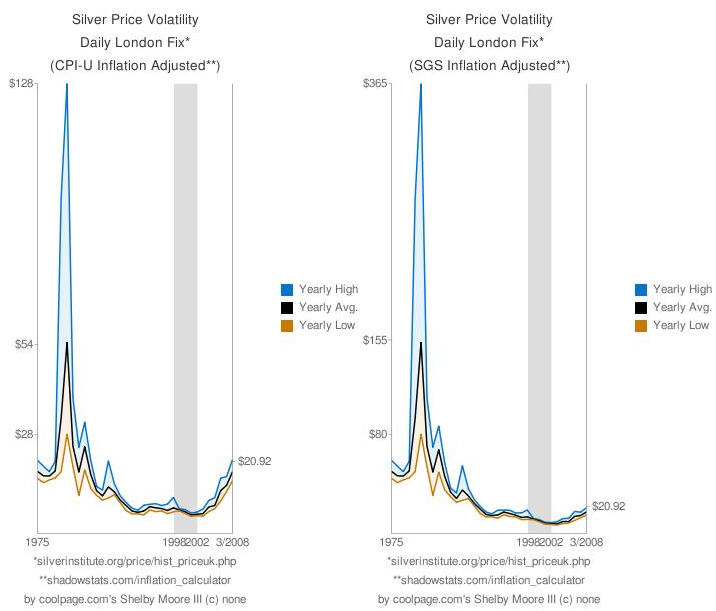

Similarly with the silver/ oil ratio. The average is 4.4 but at the moment it is at 7.6 or 7.6 ounces of silver required to buy one barrel of oil ($127 / $17.03 = 7.6). Should there be a classic reversion to the mean average of 4.4 that would result in silver prices rising to over $28 per ounce (127/ 4.4).

www.silverseek.com

This happened as recently as 2002 and 2004 and is more than likely to happen again. Indeed the ratio was as low as 2.4 as recently as 1999 when oil traded at $10 a barrel and silver at some $4.50 per ounce. At the higher end of the scale, in the 1970's silver traded at a ratio with oil of between 3:1 and 1:1. At today's oil prices that would mean silver trading at between $42 and $127 per ounce.

Silver

Silver is trading at $17.75/17.80 per ounce at 1200 GMT.

PGMs

Platinum is trading at $2177/2187 per ounce (1200 GMT).

Palladium is trading at $446/450 per ounce (1200 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.