This Little Piggy Bent The Market

Politics / Gold and Silver 2014 Oct 28, 2014 - 03:33 PM GMTBy: John_Mauldin

About 18 months ago, I had a very pleasant chat with a gentleman by the name of Luzi Stamm.

About 18 months ago, I had a very pleasant chat with a gentleman by the name of Luzi Stamm.

You may detect some measure of surprise in my words, and the reason for that is quite simple: Luzi Stamm is a politician; and, as regular readers will know, I am no fan of that particular class.

But Herr Stamm was different.

An MP representing the Swiss People’s Party, Stamm was spearheading a federal popular initiative which needed 100,000 signatures in order to comply with the Swiss parliamentary system’s rigid framework regarding referendums. (OK all you “referenda” people out there, I know, OK? But I’m going with “referendums,” so pipe down).

That initiative was one of three being pursued: firstly, a motion to limit immigration into Switzerland to 0.2% per year; secondly, a drive to abolish the flat tax system and for resident, nonworking foreigners to be taxed based instead on their income and their assets; and thirdly, Stamm’s initiative... Well, we’ll get to that shortly; but before we do, we need to understand a little about how Swiss democracy works.

(Wikipedia): Switzerland’s voting system is unique among modern democratic nations in that Switzerland practices direct democracy (also called semi-direct democracy), in which any citizen may challenge any law approved by the parliament or, at any time, propose a modification of the federal Constitution. In addition, in most cantons all votes are cast using paper ballots that are manually counted. At the federal level, voting can be organised for:

Elections (election of the Federal Assembly)

Mandatory referendums (votation on a modification of the constitution made by the Federal Assembly)

Optional referendums (referendum on a law accepted by the Federal Assembly and that collected 50,000 signatures of opponents)

Federal popular initiatives (votation on a modification of the constitution made by citizens and that collected 100,000 signatures of supporters)

Approximately four times a year, voting occurs over various issues; these include both referendums, where policies are directly voted on by people, and elections, where the populace votes for officials. Federal, cantonal and municipal issues are polled simultaneously, and the majority of people cast their votes by mail. Between January 1995 and June 2005, Swiss citizens voted 31 times, to answer 103 questions (during the same period, French citizens participated in only two referendums)

In Swiss law, any popular initiative which achieves the milestone of 100,000 signatures MUST be put to the citizens of the country as a referendum, and in a country of just 8,061,516 people (according to the July 2014 count — never let it be said that the Swiss aren’t precise), that’s a pretty big ask; but the Swiss do love their votes — so much so that, since 1798, there has been a seemingly never-ending procession of issues which the Swiss people have been entrusted by their leaders to decide:

In 2014 alone there have already been three referendums concerning such diverse issues as the minimum wage, abortion, and the financing and development of railway infrastructure. (For those of you just dying to know the outcomes, the abortion referendum, which would have dropped abortion coverage from public health insurance, failed by a large margin, with about 70% of participating voters rejecting the proposal. The railway financing was approved by 62% of the voters, and the motion that would have given Switzerland the highest minimum wage in the world — 22 francs ($23.29) an hour — was soundly defeated, with 76% of the voters saying “nein.”)

One wonders what the outcome would be of a similar motion to hike the minimum wage to such lofty heights in the US. Or in Great Britain.

The bottom line? The Swiss just think (and, importantly, vote) differently.

But back to Luzi Stamm and the SPP initiative.

Immigration and taxes aren’t uppermost in Stamm’s mind. What he IS concerned about is gold.

When we spoke on the telephone last year, Stamm explained to me that he hadn’t really properly understood the part gold played in the Swiss monetary equation until he’d had it explained to him by a friend more versed in finance (Stamm is a lawyer by background but with an economics degree from the University of Zurich); but once he understood how it all worked, Stamm realized that the changes to Swiss monetary prudence which had occurred in just a few short years were (a) potentially disastrous for the country and (b) not remotely understood by his countrymen (and women).

So Stamm decided he ought to do something about it.

The Swiss had accumulated a significant gold reserve the old-fashioned way — through seemingly constant current account surpluses — over many decades, but in May 1992 they finally joined the IMF.

Once THAT little genie was unleashed, things began to change.

In November of 1996, the Swiss Federal Council issued a draft for a new Federal Constitution, and contained within that draft was an amended position on monetary policy (article 89, in case you’re wondering) which severed the Swiss franc’s link to gold and reaffirmed the SNB’s constitutional independence:

Money and currency are a federal matter. The Confederation shall have the exclusive right to coin money and issue banknotes.

As an independent central bank, the Swiss National Bank shall follow a monetary policy which serves the general interest of the country; it shall be administered with the cooperation and under the supervision of the Confederation.

The Swiss National Bank shall create sufficient monetary reserves from its profits.

At least two-thirds of the net profits of the Swiss National Bank shall be credited to the Cantons.

Spiffy.

In April 1999, the revision of the Federal Constitution was approved (how else than through a referendum?), and it came into effect on January 1, 2000.

Oh... sorry... I almost forgot to mention that in September 1999 — after the revision had been adopted but before it had been officially enacted — the SNB became one of the signatories to the Washington Agreement on Gold Sales, meaning that all that lovely Swiss gold which had been sitting there, steadily accumulating and making the Swiss franc one of the last remaining “hard” currencies on the planet, was eligible to be sold.

A single line in the Swiss National Bank’s own history of monetary policy identifies the beginning of the demise of one of the world’s great currencies:

On 2 May, the SNB begins selling gold holdings no longer required for monetary policy purposes.

And there you have it. “No longer required for monetary policy purposes.”

That’s what happens when you finally embrace the beauty of fiat. Not only do you get to sell gold, you get to call the proceeds of those sales “profits.”

The absurdity borders on breathtaking.

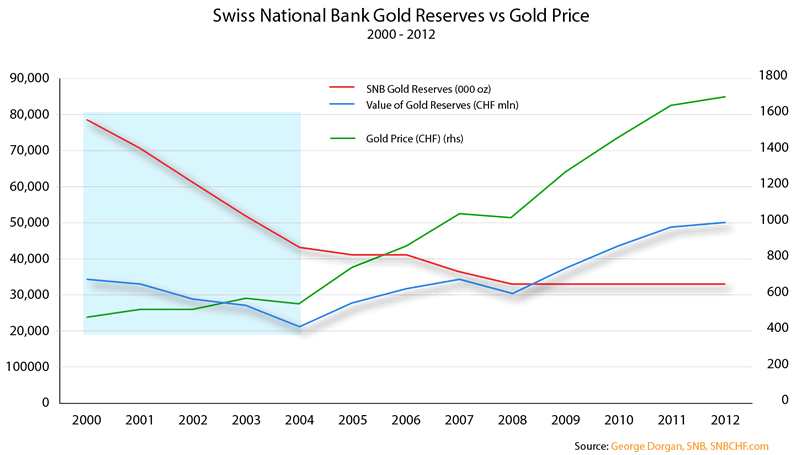

At the beginning of 2000, the Swiss National Bank (SNB) held roughly 2,600 tonnes of gold in its reserves. That equated to approximately 8% of total global central bank gold reserves. After the revised constitution became law, the Washington Agreement took over and... Bingo!:

Swiss gold reserves were plundered gently sold in line with the Washington Agreement, and the “profits” (the language used by the SNB themselves) were distributed amongst the Swiss cantons; so everybody in a position to raise questions ended up getting a nice, fat slug of “profit” to keep them quiet help their Canton pay the bills.

Now, does anyone notice anything particular about the period when the Swiss gold sales were at their highest? Yessss... that’s right (as with the UK’s sales), the bulk of Swiss sales were made at the lows in the gold price (between $300 and $500 per ounce — blue shaded area).

To look at it another way, the Swiss National Bank went from being one of the soundest central banking institutions on Earth to just another in the morass of apologist financial institutions that lost sight of their mandates while grasping for a Keynesian free lunch, egged on by a new breed of politicians who knew nothing of the principles of sound money or, if they did, were happy to put them to the back of their minds as they extended their hands.

Sadly, as went the soundness of the SNB, so went the soundness of the Swiss franc itself.

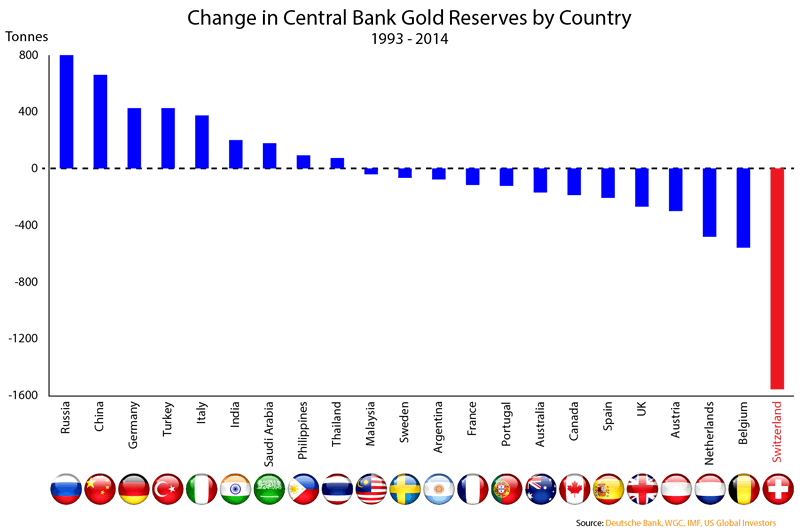

As you can see from the chart above, the SNB has, over the last two decades, oustripped its nearest rival in gold sales by a factor of three.

Adding to the fun and games was the decision in September 2011, at the height of the euro crisis, to peg the Swiss franc to the euro (something that obviously couldn’t have been done prior to breaking the gold peg) in order to stop it appreciating.

How? Why through literally unlimited printing of Swiss francs to stop the exchange rate breaking 1.20.

At the time, the SNB was unequivocal:

The current massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development. The Swiss National Bank is therefore aiming for a substantial and sustained weakening of the Swiss franc.

All this talk of “massive overvaluation of the Swiss franc” is utter bollocks a little disingenuous. (“Surely not!” I hear you cry.)

Between 1970 and 2008, the strength of the Swiss franc was legendary. During that time, it appreciated by 330% against the US dollar and by 57% versus the Deutsche mark/euro. Consequently, a strong currency went hand-in-hand with a strong economy. How awful.

The problem was NOT in the OVERvaluation of the Swiss franc, as the SNB would have you believe, but rather in the UNDERvaluation of the competition; and the only thing the SNB could do was to join in the great devaluation race.

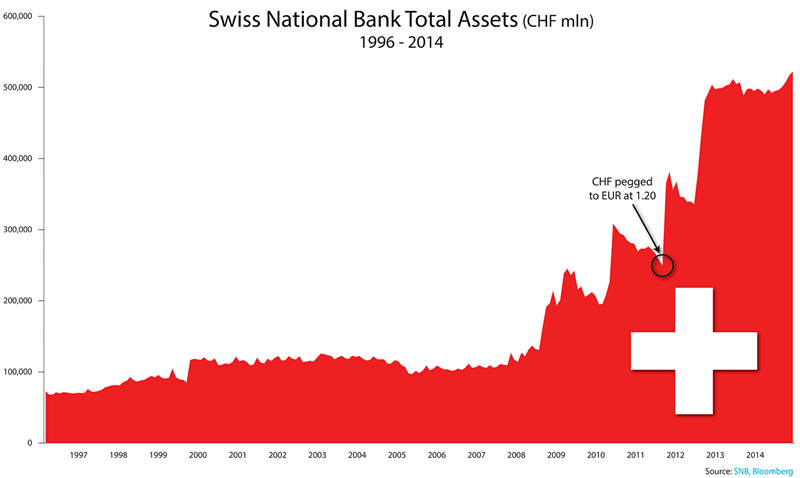

That move weakened the currency by about 9% in 15 minutes, and the immediate effect on the SNB’s balance sheet was obvious:

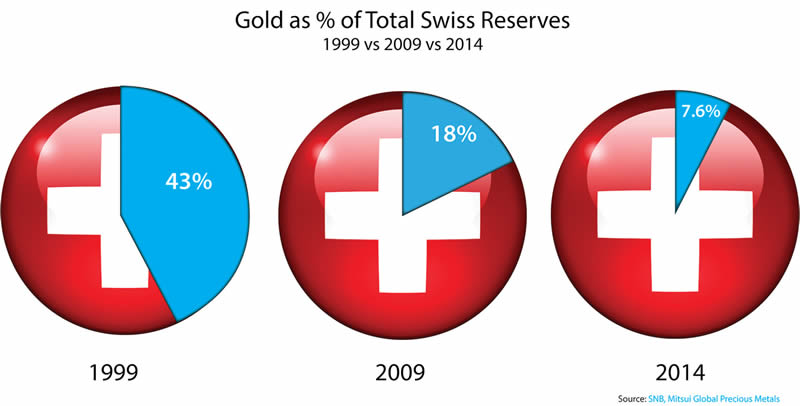

(Mitsui Global Precious Metals): As late as the end of 2009, the SNB held 38.1 billion CHF in gold out of total reserves of 207.3 billion CHF, with gold representing a touch over 18 per cent of all its reserves. At the end of July 2014, it owned 39.1 billion Swiss Francs in gold (or 1,040 tonnes) from total reserves of 517.3 billion CHF, meaning that roughly 7.6 per cent of its assets were in the form of the yellow metal.

Note that the rise in value of Swiss gold by CHF 1 billion wasn’t enough to counter the destructive nature of overt and unchecked money printing.

Like the Fed, the BoJ, and the BoE before them, the SNB became, at a stroke, another previously sound institution that unhesitatingly ripped its balance sheet to shreds:

Since 2009, the SNB has quintupled its balance sheet, making it (on a relative basis) the most prolific of the central bank printing machines. Not bad for the world’s 96th-largest nation.

Since the EUR peg was instituted just three years ago, the SNB’s balance sheet has more than doubled.

So, with the Swiss franc’s soundness under attack from within its own borders, Luzi Stamm decided to try to use the Swiss love for referendums and the rigidity of the Swiss political process to try to reinstate the Swiss franc as a sound currency.

To that end, Stamm proposed the Swiss Gold Initiative (“Save Our Swiss Gold”).

Funnily enough, the proposal was rejected by lawmakers, but Stamm gathered three like-minded MPs and, more importantly, enough signatures on his petition (100,000) to ensure that a referendum on the proposal would take place; and that vote will happen on November 30th — six weeks from now.

Stamm pulled off a masterstroke in securing the involvement in the Swiss Gold Initiative of Egon von Greyerz who, along with being one of the most highly respected figures in the gold industry, happens to be one of the world’s nicest human beings.

We’ll get to Egon’s involvement shortly, but first let’s take a look at the motions that make up the Swiss Gold Initiative, which are threefold:

1. The gold of the Swiss National Bank must be stored physically in Switzerland.

2. The Swiss National Bank does not have the right to sell its gold reserves.

3. The Swiss National Bank must hold at least 20% of its total assets in gold.

(NB. Before we get to the part of this story where the SNB tell us how big a nightmare it would be to force them to hold 20% of their reserves in gold (come on, you KNEW that was coming), I’d point you back to the chart on page 8. Remember? The one that showed the Swiss held 18% of their reserves in gold just five short years ago?)

Click here to continue reading this article from Things That Make You Go Hmmm… – a free newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.