Credit Crisis Money Printing Crack Up Boom Reflections

Stock-Markets / Credit Crisis 2008 May 23, 2008 - 07:52 AM GMTBy: Ty_Andros

As regular readers know, I believe the banking and credit crisis has a long way to go. We are in the 2 nd to 3 rd inning of a nine-inning ballgame. The solution the G7 public servants and central banks will propose is they WILL PRINT THE MONEY as they always have and always will. They are confronted with the reality of INFLATE or die, as to not do so invites a deflationary depression and the complete and total BANKRUPTCY of the financial and banking systems. The human emotion of SELF-preservation insures they will try to avoid the bullet that is leveled at the head of the G7 financial system. “They will duck” and let you take the bullet of inflation, the result of letting their financial systems substitute an ever growing financial and banking sector for private sector wealth generation.

As regular readers know, I believe the banking and credit crisis has a long way to go. We are in the 2 nd to 3 rd inning of a nine-inning ballgame. The solution the G7 public servants and central banks will propose is they WILL PRINT THE MONEY as they always have and always will. They are confronted with the reality of INFLATE or die, as to not do so invites a deflationary depression and the complete and total BANKRUPTCY of the financial and banking systems. The human emotion of SELF-preservation insures they will try to avoid the bullet that is leveled at the head of the G7 financial system. “They will duck” and let you take the bullet of inflation, the result of letting their financial systems substitute an ever growing financial and banking sector for private sector wealth generation.

Note to readers regarding Tedbits availability: Starting in June, Tedbits publications will be available to registered subscribers 2-3 days earlier than to the general public. If you are not a registered subscriber, sign up now.

See Tedbits live on web T.V. Weekly interviews with Ty Andros are back on Yorba TV. Catch the live interviews on Wednesdays at 3:30 U.S. Central Time at www.Yorba.tv .

The money printing serves many purposes. It is a stealth tax that confiscates your wealth while it sits in your bank accounts and transfers it to their constituents in the banking and financial system, which are the MOST powerful masters of the public servants. Contrary to public perception, the G7 central banks are very political animals and are now caught in the web of their own making since Bretton Woods II forever severed REAL backing of money and substituted the full faith and backing of government.

Governments have been making empty promises for decades and these are no different. Their G7 currencies are worthless promises to pay you nothing. They are IOU's of morally challenged “something for nothing” deadbeats, public servants and the central banks they control and socialists. These pieces of money are of the same caliber as a mortgage of a SUB PRIME mortgage holder. Ultimately worthless! At least the sub prime mortgage has the intrinsic value represented by the house; a G7 currency has little intrinsic value.

Therefore we are in the early stages of a GIGANTIC “Crack up Boom” (See Ted bits archives at www.TraderView.com ) as outlined by Ludvig Von Mises. The “Crack up boom” is an exercise in growing inflation as the holders of FIAT currencies seek the shelter of the “Indirect Exchange” into “things which can't be printed” to preserve their purchasing power and value of their holdings. Argentina and the Weimar Republic are historical examples of this phenomenon, and more recent ones include Venezuela and Zimbabwe . The final result will be no different. Inflation of things that are REAL, such as property/real estate, stocks (units of production which will reprice to reflect the debasing currency in which it is denominated) and at some point a collapse in economic production. Commodity inflation is running away as supply is constrained. Demand-led bull markets combine with deflating G7 currencies (loss of purchasing power due to printing press) to move prices of everything considerably HIGHER.

In a four-part edition of the Tedbits 2008 outlook entitled “Thrill Ride” (See Ted bits archives at www.TraderView.com ), we predicted a collapse in incomes in the G7 on all levels of the economies - individual, corporate, municipal, state and federal. This is happening. It is a blistering attack on the middle class as they succumb to the lowered purchasing power of the constantly debasing currency in which they are paid and hold their wealth. Look no further than this chart of REAL inflation versus the statistically fictional inflation measures of government: (courtesy of John Williams at www.shadowstats.com )

This is a picture of income collapse courtesy of runaway confiscation of purchasing power via FIAT currency and credit creation. At this rate of inflation consumers, corporations, municipalities, states, and federal governments are suffering a 12% loss of income yearly and a 50% loss of income every six years. The only recipe that slows this growth is the elixir of capitalism, which is the disinflationary “more of everything for less”. As socialism creeps in this becomes the inflation definition of “less of everything for more”, which is the definition of government, its mandates and taxes. This decline in the standard of living is what drives people into seeking “something for nothing” as they no longer can afford what they used to pay for themselves. This decline in income is global, but in places were growth, capitalism, and wealth creation still occurs it is far less of a problem. For those economies that no longer grow and create rising incomes it is what drives them into populous public servants' arms.

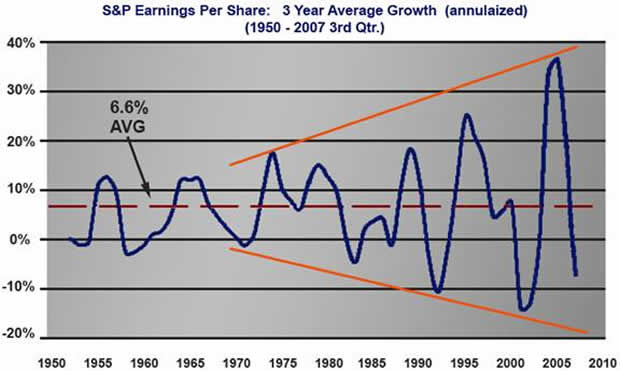

The pattern of the year in the 2008 Outlook was a WOLF wave of the S&P 500 going back to the early 1970's when FIAT currency and credit creation became the basis of a transition to ASSET BACKED economies, rather the virtuous wealth-generating Austrian ones:

In the 1 st quarter of 2008 S&P 500 profits have declined 25.9% year over year (so we are now touching or penetrating the bottom trendline), primarily reflecting the financial sectors. Take out oil sector profits and profits are down 30% year over year, but rising input prices and declining credit availability signal a broadening collapse in business REAL incomes spilling into the real economy from Wall Street. The collapse in income from the WOLF wave is BITING! Income-short, heavily indebted G7 economies are just beginning their trials and tribulations. Reconstructed M3 in the US , M4 in the UK and EU are averaging about 15% growth. YOY growth and globally central bank reserves are accumulating at almost a 27% rate.

It is so much easier for public servants to substitute easy money (monetary policy and inflation) and asset inflation for the fiscal policies of growth (less taxes and innovation stifling regulations and mandates). It pays them more as industries are forced into the arms of government as they fail from its policies. Once on the subsidy bandwagon permanent political constituencies are the result! Look no further than the G7 agricultural and GREEN energy sectors to see this.

Money printing drives more and more people into government dependence. Less taxes, regulations and mandates drive constituents to freedom. Which do you think government wishes to do? Asset-backed economies rely on fixed assets growing faster then the stated rate of inflation, creating the illusion of growth and rising incomes. It is the way public servants PUSH their constituents into the arms of government solutions, which when implemented serve the government's elite constituents and ever-growing legion of government bureaucrats at the expense of the broad public which have placed their trust and votes in them. All solutions lead to more of the government and less in the private sectors. So it's less for you, me and our families and more for them. ALL GOVERNMENT SOLUTIONS ARE “less of everything for more money”. Understand they hold NO value in the practical world, only in the politically correct one. Politically correct means practically incorrect.

This is a picture of REALITY and something that we are powerless to change it as it will continue until the demise of the G7 EMPIRE, as it has in all empires throughout time. However, it is identifiable and offers the astute investor great OPPORTUNITIES for those who can look forward rather then in the rear view mirror. Assumptions which have served investors for decades are in many ways no longer true. Those that recognize the new REALITIES can benefit from them. Those that don't will in all probability be severely diminished by them.

You need to recognize what is unfolding and set your investments in such a way as you would a sailboat so the wind fills the sails of your investing sailboat. If you invest into headwinds you will find it hard to move forward. If you invest with them they will drive your portfolio forward with elegance and power. So let's look at which way the economic winds are blowing:

Reflections

Last week I included a weekly chart of the CRB showing a symmetric pennant breaking out in the direction of the previous BULL trend, and I want to build upon the message in that chart as it is REFLECTED in a number of other markets. It would appear that after several months of CORRECTIVE activity that many markets are ready to resume their previous long-term trends.

First, let's review last week's chart of the continuous Commodity Index as Tuesday's close was significant confirmation of the patterns message:

Now let's look at the Swiss Franc, Euro and Australian dollar on a weekly basis:

All three are MIRRORS of each other reflecting Fibonacci retracements of 30 to 62 %, relative strength indexes and slow stochastics retreating to neutral after being overbought and MACD either turning up or giving a buy signal in the Aussie dollar. The Aussie dollar is giving a buy signal and the pattern signals a move of 8 cents in the direction of the breakout. In longer term charts such as monthlies and quarterlies all the previous highs were CONFIRMED in the internals shown. Signaling these are corrective patterns rather then tops. The next move is PROBABLY higher from these CORRECTIVE patterns.

Now let's look at the dollar, gold and silver:

The dollar has corrected a weak Fibonacci 38% of the previous down move and gold has corrected a DEEP 62% and silver 50% of the previous up moves. All have moved back into the neutral territory where resumption of the trend should materialize if still valid. Relative strength indexes have gone to neutral and slow stochastics are about turndown or turn-up depending on the previous trends. A PERFECT Elliot wave ABC correction and the downtrend has been broken as can be seen in the gold and silver chart. Now we have a special treat from John Kosar of Asbury Research ( www.asburyresearch.com ), detailing the probable end of the rally in the dollar as measured in bullish or bearish sentiment and the subsequent action:

As you can see the bell is ringing on the dollar, foreign currencies and the precious metals. It's off to the races at this point. The caterwauling on Wall Street , Washington and Brussels can be heard around the world. I covered the myth of lower oil prices in last weeks Ted bits (see Archives at www.TraderView.com ) so I won't cover it today. Public serpents—er, servants are holding hearings in the U.S. Congress today trying to pin the tail on the donkey for their own mismanagement of practical energy policies and long term plans. SPECULATORS! SPECULATORS! SPECULATORS! Greedy oil companies, OIL cartels, IT IS ALL HOGWASH! LIES TO FOOL YOU!

G7 public servants haven't had or implemented practical energy policies for DECADES and now they and YOU are paying the piper for their own poor fiduciary actions. If you think windmills or ethanol are going to substitute for oil and gas wells, coal and nuclear power plants and new refineries, then you must be prepared to pay $2500 for your monthly energy bill rather than $300. Their solutions are your demise, and a great treat for their SUBSIDIZED constituent's energy follies. Who pays? Not the public serpents - you do. It is wishful and fairy tale thinking and nothing else. There is no such thing as a free lunch. Don't let a public serpent—er, servant, tell you there is!

The footprint of the something- for-nothing social trend is all over this problem. The something for nothings believe you can have cheap energy supplies but never build a domestic power plant, refinery or allow oil and gas drilling. NIMBY (not in my back yard) policies are NOT PRACTICAL! They outsourced those needs to OFF SHORE suppliers and now wonder why costs are skyrocketing as domestic industry CANNOT deliver today's requirements! WINDMILLS are not a solution. We all want clean energy but it must be at a practical price NOT impossible ones. The solutions take decades and practical policies lie at MUCH higher prices.

Now let's look at another picture of the RAW MATERIALS sector from John and Asbury research ( www.asburyreasearch.com ), also known as a broad range of industrial materials and commodities:

Talk about a macro pattern. Corrective activity is OVER. This little doozy projects a 22% move higher, confirming ALL the previous charts. This pattern was almost a year in the making. It is powerful . What do you think higher input prices and lower purchasing power mean FOR YOU? For the company you work for? For your ability to support your family? For the ability of your employer to give you a raise?

Now let's take a look at the MAIN stock index in the world, the S&P 500 cash:

Wow, a PERFECT Fibonacci retracement into the BOX (the 50 to 62 % retracement level as termed by Dennis Gartman www.thegartmanletter.com ). This is a weekly and in terms of time and price it is poised and ready to rumble DOWN in resumption of the long-term DOWNTREND.

The losses in the financial sectors have hardly BEGUN. Next up: consumer car and credit card loans, EXPLODING ARMS, and commercial real estate loans. The average car loan in America is $4800 dollars in NEGATIVE equity. Do you think that may be a problem? From mailing in the “Keys to the house” (see Ted bits archives at www.Traderview.com ) to the “Keys to the Car” especially the TRUCKS and SUV's which have become America 's darlings and now a millstone around their necks! SUV's and trucks bought last year are selling at 47 cents on the dollar. They were bought with NO MONEY down, get low teens MPG and cost a hundred dollars to fill up. What a recipe for disaster and misery for all involved! Do you think the people that bought the securitized debt from these car loans might have a few concerns ?

As I said when the correction was looming in the Ides of March (see Ted bits archives at www.Traderview.com ), beware a corrective period, but that nothing has changed . This technical analysis generally goes back to last summer, and that was the first leg of the moves. We have now corrected those excesses and the next leg higher and lower depending on the market you are following. Look for it to equal or exceed the last moves as we are in the fat part of the trends. “IMPULSE WAVES”. Interest rates have backed up and you can look for a rally directly ahead. Grains are in short supply and they will get scarcer. Those volcanoes in South America are going to wreak HAVOC on this year's grain production.

Bubbles, tops in commodities, crude going down – experts, my ass. Bought and paid for Wall Streeters and public serpents are positioning you for ANOTHER fleecing if you follow their HEADLINE illusions brought to you from the MAIN stream financial media and the FAR left main stream press. Their solutions are always going to be higher taxes and less free markets which ALWAYS cost you money and transfer that money to themselves and their elite campaign supporters. If you followed their investing advice over the last ninety days you are being severely injured and the carnage to you has just BEGUN!

Say “thank you” to the gang of 545 and the bourgeoisie in Brussels whom manage our economy based on one metric: buying votes, collecting power over others to sell, and the next election .

Predictions: Gold is going to new highs and then much higher, corn at 10 dollars a bushel, crude oil $150 heading to $300, stocks are headed lower (the blistering debasement of the dollars in which they are denominated create an illusion of high prices as they are nominal). Priced in REAL terms (basket of commodities, gold or oil), they already are plummeting. The dollar is headed to new lows, but ultimately will go 40% lower. The Euro will go to a new high at $1.60 but ultimately probably 2 dollars per Euro (it is $1.57 now). Bonds will rally, then at some time in a year or two COLLAPSE to reflect the debasement (loss of purchasing power from printing press) of the currency in which they are denominated— U.K. pounds, euros, dollars, etc.

The fun has just begun…

In conclusion: THIS IS ONLY THE BEGINNING AND THE LONGER THEY SAY “BUBBLE”, THE FURTHER IT IS GOING TO GO! And when they say “bubble” or “speculator”, it implies there is not a problem except in respect to greedy evil CAPITALIST markets and PROFITEERS and pushes REAL practical solutions into the future. These are not the villains. The public serpents, special interests and entrenched corporate elites, financial and banking industries are the REAL CULPRITS.

When the broad public hears these false, untrue and illusionary headlines they want public serpents—er, servants, to DO SOMETHING! And of course they will. They will do something—substituting PRACTICAL solutions to long-term problems for those politically correct ones that accrue to themselves and their elite campaign contributors. These solutions torture and penalize the FAKE culprits with windfall taxes, price controls, smothering regulations, and the funding of the subsidies for the “politically correct” policies which provide no solutions; further damaging future prospects for a practical solution.

The public servants and their main stream media stooges are like the “boy who cried wolf”, AKA LIARS! They are the wolves and the public are their sheep . Once prices rise to intolerable levels, at that point and only then will they will finally create PRACTICAL solutions rather then politically correct, fairy tale, you can have something for nothing garbage solutions.

MAKE NO MISTAKE: THERE IS SO SUCH THING AS A FREE LUNCH, SOMEBODY ALWAYS PAYS. And when you look around the table and try to figure out who the patsy is? It usually is YOU! The broad G7 public is about to learn this lesson over and over and over again until they realize these truths. There is no such thing as free health care, food, mortgage assistance, ethanol subsidies, windmill energy: ALL COME AT A PRICE. Is it one you can afford? In most cases at this time it is NO.

Don't despair, instead celebrate. The wonderful reality of this is that you know these things and can create OPPORTUNITIES for yourself and your investment portfolio. They are multi-generational in nature and economic upheaval is an OPPORTUNITY . EVERYTHING is mispriced and the new prices must BE FOUND and they are a LONG way from here. So “make lemonade out of lemons”. Take these fraudsters to the bank rather then letting them take you. You can be a winner in this. Figure it out, and find the methods to benefit from this REALITY. I know that's what I do. Markets are mispriced for the reality of the unfolding “Crack up Boom”. And on that note, we are happy to ANNOUNCE that the “Crack up Boom” series will RETURN next week, as it is front and center.

Please remember that beginning the first week in June subscribers will receive Tedbits two to three days before it is posted on the web. Subscribers will also start getting guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.