Why Gold and U.S. Dollar Do Not Always Move Inversely?

Commodities / Gold and Silver 2014 Nov 19, 2014 - 12:50 PM GMTBy: P_Radomski_CFA

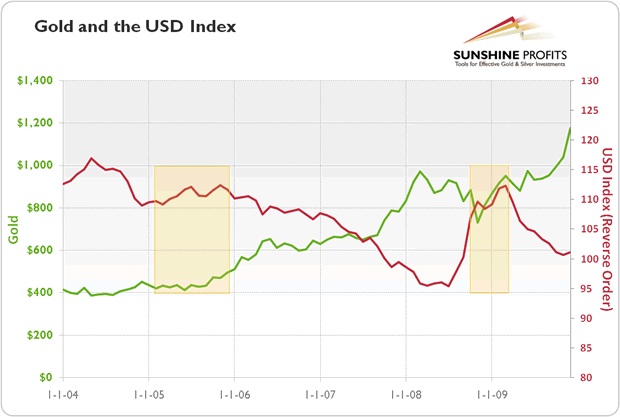

Arkadiusz Sieron writes: The strength (or weakness) in the U.S. dollar is one of the most important drivers of price of gold. However, this is not always true and there are times when they rise or fall simultaneously. The positive correlation between U.S. dollar and gold occurred, for instance, from May through December 1993, from May until November 2005, and at the turn of the 2008 and 2009.

Arkadiusz Sieron writes: The strength (or weakness) in the U.S. dollar is one of the most important drivers of price of gold. However, this is not always true and there are times when they rise or fall simultaneously. The positive correlation between U.S. dollar and gold occurred, for instance, from May through December 1993, from May until November 2005, and at the turn of the 2008 and 2009.

Graph 1: Gold (green line) and US Dollar Index (red line) from 2004 to 2009

Trends of the U.S. dollar and gold do not always align inversely, and even when they do, the percentage moves are not very well matched. Just think of the important rally in gold from 2008 to 2013, when the dollar was back where it was in late 2008. Also, peaks and troughs do not always align. Gold was rising when the dollar hit its peak in mid-2010.

Interestingly, those periods did not last long. What are the possible causes for such temporary aberrations? Capie, Mills and Wood's in their paper "Gold as a hedge against the dollar" claim there may be some supply shocks or central bank's (optionally government's) intervention in the market. The other possible reasons are expectations among foreign investors that the U.S. dollar exchange-rate changes are only temporary. Such opinion could make them endure fluctuations rather than change their portfolios in favor of gold (think about transactions costs).

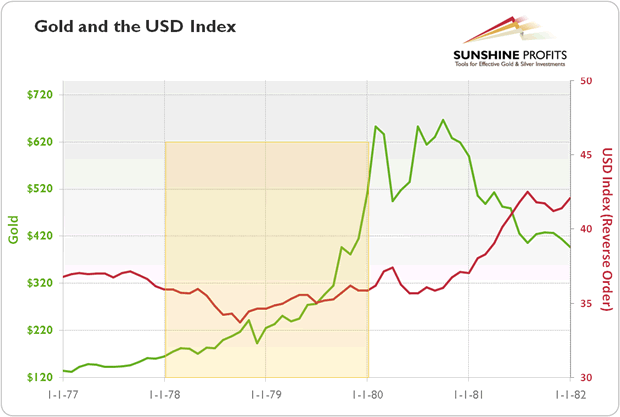

However, medium or long-term trends were also affected: the traditional inverse relationship broke down during the two year period of 1978-1980. Such a long period calls for a more detailed analysis of the reasons behind disruptions in the negative correlation between gold and U.S. dollar in the medium or long term (but also in the short ones).

Graph 2: Gold (green line) and US Dollar Index (red line) from 1977 to 1981

First, changes in gold are sometimes driven upward not by relative weakness in the U.S. dollar to other fiat currencies, but, instead, by flight from all paper currencies. This was probably the case of 1978-1980, when investors feared global recession following the oil crises or the collapse of the world's monetary system (plus, gold was in the speculative buying mania stage at that time). Eventually they switched from all paper currencies to gold - the traditional store of wealth, historically chosen by the market to play the role of money. It should be clear now why the U.S. dollar was traded sideways to other currencies (all currencies were depreciating), while gold skyrocketed from $200 per ounce to $800 per ounce. It would be difficult to find a better argument why gold should be considered more like an international traded currency than just a simple commodity whose price is expressed in dollars.

The second reason even further strengthens the role of gold as the global currency. Gold can be an insurance policy against financial crashes or even collapse of the monetary system. However, the U.S. dollar exhibits similar tail risk properties. Greenbacks are also seen as the world's safe haven currency. The U.S. dollar is still the main reserve currency- over half of the total amount of greenbacks stock is held outside the USA and U.S. Treasuries are eagerly bought during crises. It should be clear now why the U.S. dollar and gold can move up or down together. Investors may choose both as safe havens: greenback and gold during global catastrophes or crises in another currency. The best example may be the period from November 2008 to February 2009, when both gold and the U.S. dollar were generally rising due to the financial crisis. Such a co-movement proved that gold behaves sometimes as a hedge against a dollar-denominated-system rather than the dollar itself. This is why gold is not only a hedge against stocks on average, but also a safe haven in extreme stock market conditions. Similar movement occurred in November 2010, when gold and the U.S. dollar rose together due to growing concerns about Ireland and the Euro zone's situation.

To sum up, a rally in gold while the U.S. dollar remains flat means that investors are concerned about the condition of the global economy and the international monetary system, while a simultaneous rally in the U.S. dollar and gold indicates that investors worry about the global economic stability outside of the USA and thus shift capital to the two most important safe havens. Although U.S. dollar is a fiat money, which systematically loses its purchasing power, it is still one of the best of the worst paper currencies, especially since capping the Swiss franc at 1.20 per euro in September 2011.

In order to stay updated on the latest developments in the gold market and US economy we encourage either joining our gold newsletter (it's free and you can unsubscribe in just a few clicks) or subscribing to our premium Market Overview reports (on which the above articles is based).

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.