Bitcoin Price Moving to Below $350?

Commodities / Bitcoin Nov 22, 2014 - 09:57 AM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Mozilla has started accepting Bitcoin donations, we read on CoinDesk:

Mozilla, the open-source development community behind the popular Firefox web browser, is now accepting bitcoin donations.

The Mozilla Foundation, the non-profit entity that provides support for the community's broad open-source development, will be partnering with Coinbase to accept bitcoin contributions. The California-based bitcoin services provider announced the deal on its blog, where it reinforced that, per its policies toward charities, it will not charge fees for the donations it processes.

With the news, Mozilla joins the growing number of non-profit organizations that support open-source and free Web-focused initiatives, including the Wikimedia Foundation, that are accepting bitcoin. In recent months, charitable organizations around the world have slowly begun to turn to digital currency to facilitate donations while removing costs associated with legacy payment methods.

This is not something that will make an enormous impact on the market. On the other hand, another popular name is open to Bitcoin transfers. While Mozilla is not a retailer or a payment processor, it is an initiative that people not familiar with cryptocurrencies recognize. By putting the "donate bitcoins button" on their webpage, they are likely to make users wonder what Bitcoin is and why they haven't heard about it (of course this might only be true for those of them who actually don't have any knowledge of Bitcoin).

So, it seems that even if Mozilla's move won't change the Bitcoin landscape, it might familiarize some of the Firefox's users with cryptocurrencies.

For now, we focus on the charts.

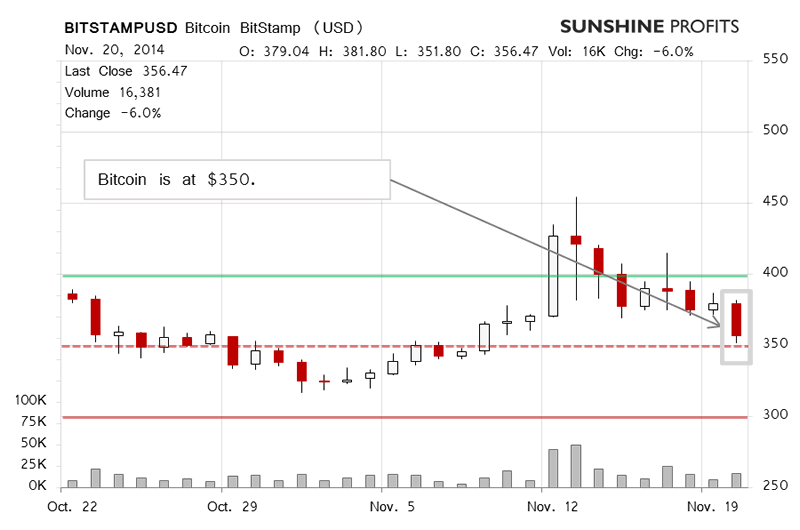

On BitStamp, we saw a significant move down yesterday. The move brought Bitcoin down to $350 (dashed red line in the chart above). The volume was up and so the depreciation seemed quite important. Quite possibly it was, but it would appear that we might just need additional confirmation before accepting this as the case.

Right now, a move below $400 (solid green line) is confirmed. As such, the current environment is relatively bearish. On the other hand, from a longer perspective, we recently saw a first higher high in months. Based on that, the current situation might have implications for the medium or long term.

Today, the currency has gone down further (this is written after 10:30 a.m. ET). The volume is pretty much the same it was yesterday. Bitcoin went down almost to $340 before rebounding to $350. Is this a meaningful rebound? At the moment of writing we don't have enough signs to point to that. It seems that if we see more depreciation and Bitcoin goes below $350, we might see a more violent continuation of the downtrend.

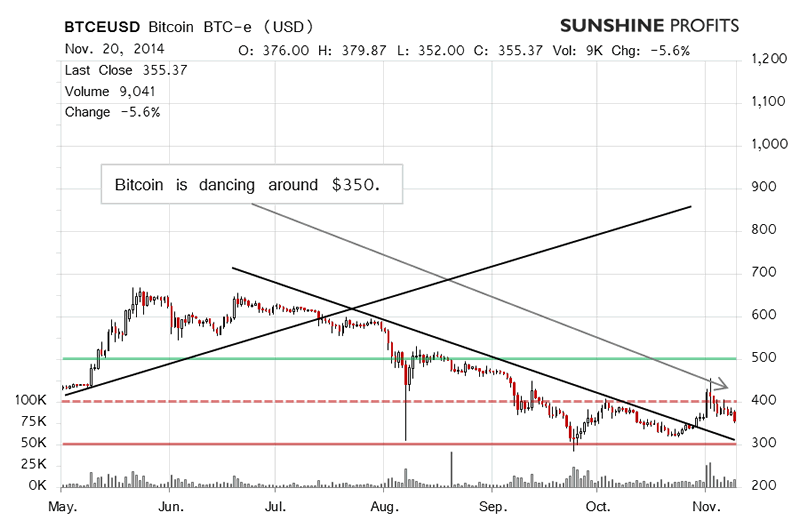

On the long-term BTC-e chart, yesterday’s move is clearly visible. Right now, $350 seems to be the level to observe. Yesterday, we wrote:

Now, we're at $350 which means that a move to $300 might be underway. If we see additional confirmation of that, we will consider going short and betting on a move down to $300. On the other hand, a move above $400 at this time could herald an attempt to form another higher high.

At the moment of writing, down looks like the direction for the short term but this is far from certain and the fact that we're still at $350, should make traders cautious before going long just now. If we in fact see the currency staying below $350, we might be inclined to bet on lower prices then. This is not the case at the moment.

Summing up, we don't support any short-term positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.