Gold Market Manipulation, US Resorts to Illegality to Protect Failed Financial Policies

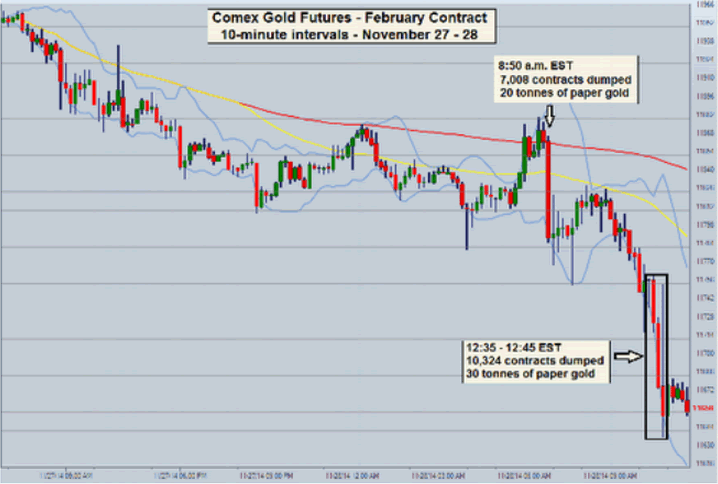

Commodities / Gold and Silver 2014 Dec 05, 2014 - 10:43 AM GMT In a blatant and massive market intervention, the price of gold was smashed on Friday. Right after the Comex opened on Friday morning 7,008 paper gold contracts representing 20 tonnes of gold were dumped in the New York Comex futures market at 8:50 a.m. EST. At 12:35 a.m. EST 10,324 contracts representing 30 tonnes of gold were dropped on the Comex futures market:

In a blatant and massive market intervention, the price of gold was smashed on Friday. Right after the Comex opened on Friday morning 7,008 paper gold contracts representing 20 tonnes of gold were dumped in the New York Comex futures market at 8:50 a.m. EST. At 12:35 a.m. EST 10,324 contracts representing 30 tonnes of gold were dropped on the Comex futures market:

No relevant news or events occurred that would have triggered this sudden sell-off in gold. Furthermore, none of the other markets experienced any unusual movement (stocks, bonds, currencies).

The intervention in the gold market occurred on the Friday after the U.S. had observed its Thanksgiving Day holiday. It is one of the lowest volume trading days of the year on the Comex.

A rational person who wants to short gold because he believes the price will fall wants to obtain the highest price for the contracts he sells in order to maximize his profits when he settles the contracts. If his sale of contracts drives down the price of gold, he reduces the spread between the amount he receives for his contracts and the price at settlement, thus minimizing his profits, or if the price goes against him maximizing his losses. A bona fide seller speculating on the direction of the gold price would choose a more liquid market period and dribble out his contract sales so as not to cause a significant impact on the price.

As you can see from the price-action on the graph, massive sales concentrated within a few minutes minimize sales proceeds and are at odds with profit maximization. A rational seller would not behave in this way. What we are witnessing in the bullion futures market are short sales designed to drive down the price of bullion. This is price manipulation.

Here is the Security and Exchange Commission’s definition of manipulation:

Manipulation is intentional conduct designed to deceive investors by controlling or artificially affecting the market for a security…[this includes] rigging quotes, prices or trades to create a false or deceptive picture of the demand for a security. Those who engage in manipulation are subject to various civil and criminal sanctions.

Why is manipulation of the price of gold in the futures market not investigated and prosecuted?

The manipulation has been blatant and repetitious since 2011.

The answer to the question is that suppressing the price of gold helps to protect the U.S. dollar’s value from the excessive debt and money creation of the past six years. The attacks on gold also enable the bullion banks to purchase large blocks of shares in the GLD gold trust that can be redeemed in gold with which to supply Asian purchasers. Whether or not the Federal Reserve and the U.S. Treasury are instigators of the price manipulation, government authorities tolerate it as it supports the dollar’s value in the face of an enormous creation of new dollars and new federal debt.

In other words, the illegal rigging of the price of gold in the futures market is deemed by the US government to be essential to the success of its economic policy, just as illegal torture, illegal military invasions and attacks on sovereign countries, unconstitutional violation of habeas corpus, unconstitutional spying on U.S. citizens, and illegal and unconstitutional murder of U.S. citizens by the executive branch are essential to the U.S. government’s “war on terror.”

The U.S. government resorts to massive illegality across the board in order to protect its failed policies. The rule of law and accountable government have been sacrificed to failed policies.

Dr. Paul Craig Roberts and Dave Kranzler

http://www.paulcraigroberts.org/

Paul Craig Roberts [ email him ] was Assistant Secretary of the Treasury during President Reagan's first term. He was Associate Editor of the Wall Street Journal . He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University. He was awarded the Legion of Honor by French President Francois Mitterrand. He is the author of Supply-Side Revolution : An Insider's Account of Policymaking in Washington ; Alienation and the Soviet Economy and Meltdown: Inside the Soviet Economy , and is the co-author with Lawrence M. Stratton of The Tyranny of Good Intentions : How Prosecutors and Bureaucrats Are Trampling the Constitution in the Name of Justice . Click here for Peter Brimelow's Forbes Magazine interview with Roberts about the recent epidemic of prosecutorial misconduct.

© 2014 Copyright Paul Craig Roberts - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.