Crude Oil and the War Cycle 2015 and Beyond

Commodities / Crude Oil Dec 10, 2014 - 10:54 AM GMTBy: Clif_Droke

This year witnessed the bottom of one of several components of the 120-year cycle of inflation and deflation. The cycle to which I'm referring is the 24-year cycle. Of particular relevance is that this cycle answers to the cycle of war.

This year witnessed the bottom of one of several components of the 120-year cycle of inflation and deflation. The cycle to which I'm referring is the 24-year cycle. Of particular relevance is that this cycle answers to the cycle of war.

Since 1894 when the previous 120-year Grand Super Cycle bottomed and a new one began, there have been four military conflagrations at each subsequent bottom of the 24-year cycle. Most of these wars have been major in scope. The first such instance of war occurred in the years leading up to 1918, which saw the first 24-year cycle bottom of the current 120-year cycle. The 24-year cycle that bottomed that year saw the ending to the First World War. Remembering that the final "hard down" phase of the 24-year cycle approximates to almost two-and-a-half years, this represented roughly the second half of that major war, a war that involved the United States.

The next 24-year cycle bottom occurred in 1942. This year represented the United States' entry into the Second World War against Japan and the Axis Powers. Both the 1918 and the 1942 cycle bottom years proved vicious in terms of military conflicts on the global scale.

Following the 1942 bottom, the next 24-year cycle bottom occurred in 1966. This was a particularly harsh year in the Vietnam War in terms of the United States' involvement. Following the 1965 National Liberation Front attack on two American military installations, President Lyndon Johnson ordered the continuous bombing of North Vietnam.

The year 1990 saw the most recent 24-year cycle bottom in the current 120-year Grand Super Cycle. This year saw the start of the first Persian Gulf War involving the United States and its allies against Iraq. This period also saw a rather conspicuous jump in the price of crude oil as it related to the war and its anticipated supply disruptions.

The waning years of the 120-year cycle witnessed a winding down of the militarism which typified the years 2002-2010. A two-front war in Iraq and Afghanistan, which dragged on for some eight years, was waged in part to revive an economy rendered sluggish by the "tech wreck" and recession of 2001-2.

Although much was made over China's industrial demand during those years, without the billions in war spending between 2002 and 2010 the boom in commodities prices would almost certainly have been less pronounced. Not coincidentally, the decline in commodities prices began with the winding down of both wars.

War has long been used as a panacea to fight the ravages of inflation as well as deflation. Viewed from this context, war is as much a policy response to economic malaise as it is a political response to a threatening foreign power. Most recently, Russia's president, Vladimir Putin, has shown aggression against Ukraine. Some observers, including Mohamed El-Erian, view Putin's militant threatening as a distraction effort designed at taking his people's attention away from the increasingly weak state of the Russian economy. Since Russia's economic prospects are closely aligned with the oil market, continued weakness in the oil price will only give the country more incentive to find ways of reversing its woes. In the short term, a military response may be Russia's only recourse.

The last six years have seen economic policy governed almost exclusively by the Federal Reserve. The executive and legislative branches of the U.S. government have done amazingly little and were content to cede their authority to the Fed. The pendulum swings both ways, though, and the Rule of Alternation suggests that the years immediately ahead will witness a greater authoritative response from government. Now that the Fed's QE program has ended, look for Washington to craft its own policy response to the threat of a global economic slowdown.

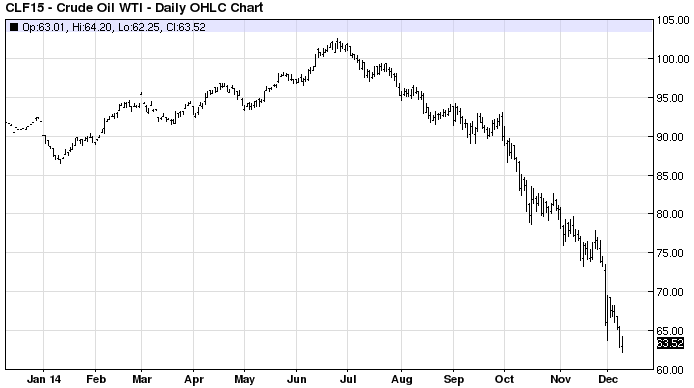

One such response would be of a military nature. The dramatic plunge in oil and copper prices is a troubling sign that global industrial demand for these key commodities is contracting. What's more, both commodities are considered by many economists to be barometers for the global economy. Indeed, the stunning drop in the prices of many commodities is reminiscent of the prelude to the 1998 global mini-crisis which threatened to plunge the developed world into outright deflation. A policy response from the Fed in late '98 was sufficient to restore investors' confidence, however, and the malaise was quickly reversed. With interest rates currently hovering near long-term lows in many countries, a monetary policy response today would carry decidedly less weight than it did then. The only alternative might be a military response.

CLF15 - Crude Oil WTI - Daily OHLC Chart

The initiation of a fresh war campaign in the coming years would provide an emphatic cure for persistently low commodity prices as war spending always leads to higher prices. It would also fix the reduced industrial output of many countries whose economies heavily depends no industry. History shows that war is often the last resort of desperate governments whose economies are wracked by diminished demand. Even the rumor of war can have a short-term impact in boosting prices. Don't be surprised then if war rhetoric finds its way back into the headlines in 2015.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, "Mastering Moving Averages," I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, "The Best Strategies For Momentum Traders." Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.