Is Fracking the Cause of Slumping Commodities?

Commodities / Commodities Trading Dec 11, 2014 - 02:47 PM GMTBy: Harry_Dent

What is fracking? Fracking is the process of injecting liquid at high pressure into subterranean rocks, fissures, etc., in order to force them open and allow more oil and gas to flow out of the formation, allowing it to be extracted at greater volumes.

What is fracking? Fracking is the process of injecting liquid at high pressure into subterranean rocks, fissures, etc., in order to force them open and allow more oil and gas to flow out of the formation, allowing it to be extracted at greater volumes.

Are you aware that fracking stocks are down 40% in just over 5 months? If that doesn’t sound like a bubble about to burst, I don’t know what does.

On Monday, December 8, I wrote an article detailing the downside of falling oil and commodity prices for our economy despite obvious benefits to consumers and businesses.

Why?

Because it’ll burst the great fracking bubble and because falling commodity prices just add to the deflationary environment against which central banks are fighting so hard in the first winter season we’ve seen since the Great Depression.

I just read an article by David Stockman that talked about how the Fed has created yet another bubble, and this time it’s the fracking bubble.

Fracking is very interesting technology, but it’s not as new as everyone would lead you to believe. The process has been around since 1949 when the first natural gas fracking field was created in Hugoton, Kansas.

Today, 65% of oil rigs are horizontal (rather than the traditional vertical style) and almost all of them need some degree of fracking stimulation to work.

Fracking began taking off back in 2005 and the debt to finance it began its acceleration in 2009… and what is driving this “boy wonder” industry that seemingly came out of nowhere, began leading us toward energy independence and has now inflated into a bubble about to burst?

It’s simple: cheap money.

Money Flood

Free or very cheap money will always cause excess and mal-advised investments… like the overbuilding and speculation in housing from 2000 to 2005, the student loan bubble since 2009 and the current ever-growing subprime auto loan bubble.

This is what happens when you flood free money into the economy. Consider now how Freddie Mac and Fannie Mae are back issuing 3% down mortgages guaranteed by the government and tax payers, of course. Where could that possibly be headed?

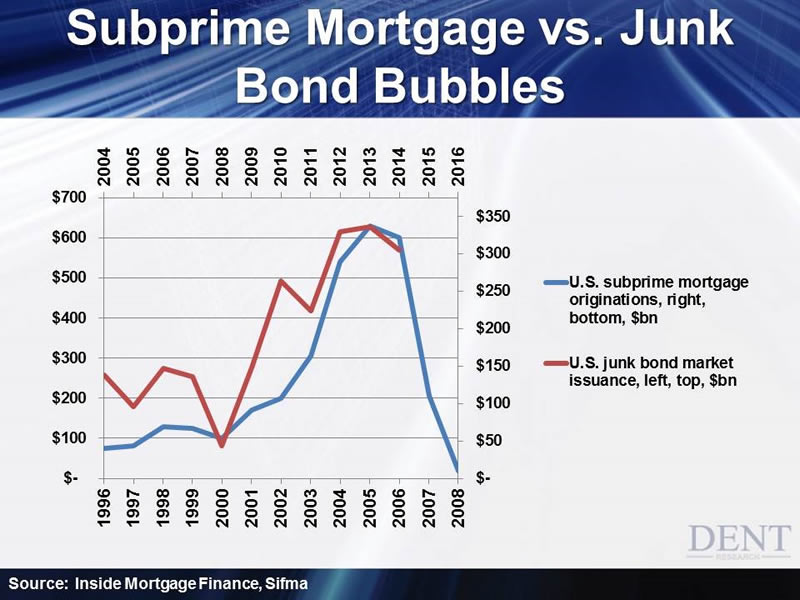

Let’s look at the subprime mortgage bubble that peaked in 2005 to 2006. The chart below shows the parallels between that bubble and the high-yield debt bubble that seems to have been peaking on a similar trajectory in 2013 to 2014.

The subprime mortgage originations were between $100 billion and $280 billion from 1996 into 2000. Then from 2000 to 2005 subprime accelerated from $100 billion to $620 billion… that’s an increase of 6.2 times in just 5 years. Similarly, high-yield corporate debt issuances accelerated from $40 billion in 2008 to $340 billion in 2013, growing 8.5 times.

The subprime bubble was a bit larger, but there are other bubbles such as the student loan one which is at $1 trillion. We also have the rising subprime auto loans that make the overall picture even worse this time around.

Like all bubbles, there’s a point where they tend to accelerate for about 5 years before they burst. That’s where we are in the fracking bubble today.

Corporations have been borrowing at very low interest rates with the primary objective being buying back their own stock and artificially inflating their earnings per share. That’s not a productive use of money. In fact, that is a sign that we are in a speculative phase with declining money velocity.

What happened to borrowing to expand your capacity and hire more workers? Instead, we find ourselves in a casino economy where speculation is the primary avenue for investment, driven by near-zero interest rates.

When More Is Less

Most don’t realize that these frackers and energy companies are a fast-growing part of the high-yield debt bubble, and now it seems likely that they will be the ones to cause it to burst, just like the mortgage security bubble did.

In 2005, energy companies were 4.4% of high-yield (junk) bonds. Now they’re 15.4% by one estimate, and I’ve seen estimates that claim 18% or even 20%.

Since 2012, fracking companies have seen an average $120 billion a year in total expenditures (including capital expenditures) vs. their operating profits. They’re simply funding that with cheap junk bond debt. It takes a lot of money to fund a rig and then it only has an average production life of just two years.

You can now see how incredibly cheap and easy it is to raise money in this industry — these factors accelerate the making and growth of a bubble… far faster than would otherwise be warranted. That has mal-investment written all over it.

The only fracking ETF started up in early 2012. Its price went from $19.50 in June of 2012 to $35 in late June of 2014 before plummeting 40% to $21 — wiping out nearly all those gains of 79.5% in just two years.

Sound like a bubble?

Continental Resources, the now infamous company in North Dakota owned by Harold Hamm, is down 60%. It had $140 million in debt in 2005, which has skyrocketed to $6 trillion today — an increase of 43 times in 9 years!

This industry has grown primarily from fracking in two states. Since 2005, production in Texas has doubled and North Dakota has tripled. Pumping out close to 2 million extra barrels a day, these fracking companies have become contributing factors in creating the excess capacity problem that’s causing oil prices to tank 40% since August. What that shows us is… bubbles always burst of their own excesses.

This industry alone has $200 billion in high-yield debt and $300 billion in leveraged loans — $500 billion in total. That may not sound exceedingly large when compared to the $40 trillion in total private debt in the U.S., but the reality is that all it takes is a trigger to expose a larger debt bubble.

Think back to the subprime crisis in 2008.

The fracking crisis is already here and it will begin ramping up even more when oil prices drop again. That may be a few months out as oil prices look to be bottoming here between $60 and $63… but it could happen at any time.

I’ve been predicting for years that oil prices will hit $10 to $20 by 2020 to 2023. I think $32 is likely within the next two years, as I commented in my article of December 8.

This is one of many triggers that could potentially burst this unprecedented debt and financial asset bubble… but it may be the most explosive!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2014 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.