Banking Crisis II - European Mega-Banks in Trouble

Companies / Credit Crisis 2014 Dec 11, 2014 - 06:14 PM GMTBy: Mike_Shedlock

I have been saying for years that European banks are in far worse shape than US banks. We can now show that in chart form thanks to Ophir Gottlieb, CEO of Capital Market Labs.

I have been saying for years that European banks are in far worse shape than US banks. We can now show that in chart form thanks to Ophir Gottlieb, CEO of Capital Market Labs.

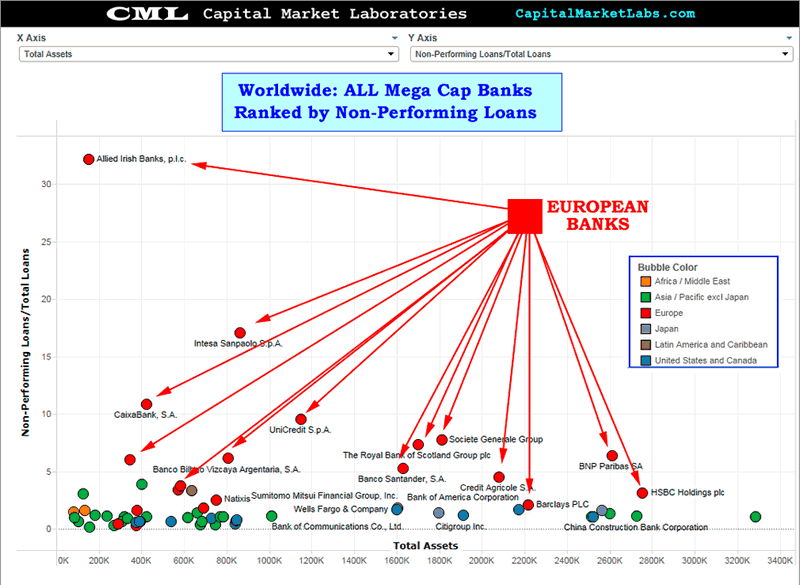

Let's start with a visualization of the day: Worldwide Mega Cap Banks: Is Europe in Crisis?

If we take all of the banks in the world with market caps larger than $25 billion USD and then plot them with total assets on the x-axis and non-performing loans as a percentage of total loans, ALL of the top eleven are in Europe.

Severe European Bank Crisis

Ophir Gottlieb expanded on the European bank crisis idea in this guest MarketWatch post yesterday: Opinion: European banks are Stuck in a Severe Crisis.

Big banks in Europe are riskier than anywhere else in the world.

They have higher non-performing loans, greater asset shrinkage, larger losses and higher debt-to-equity ratios. And European banks are bracing for even worse loan losses.

It's the combination of those characteristics that lead to a crisis, and the eurozone essentially is in one today.

Non-performing loans over total loans

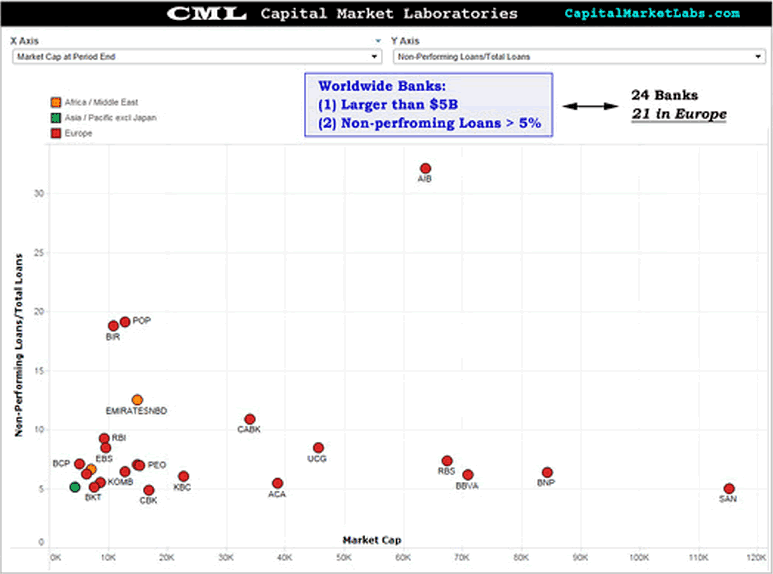

There are 200 banks in the world with market values of more than $5 billion, 48 of which are in Europe. The chart below plots non-performing loans over total loans on the y-axis and market capitalization (or value) on the x-axis for that population of banks.

If we take the population of world banks greater than $5 billion in market capitalization and select those with non-performing loans over total loans that are greater than 5% (worse than the Bank of America/Countrywide/Merrill Lynch combination), we are left with 24 banks. Twenty-one of those are in Europe.

To give a perspective on this, at the height of the Great Recession, after Bank of America had integrated all Countrywide loans and Merrill Lynch debt, the combined entity hit an all-time high of 4.5% non-performing loans to total loans.

Taking the same population of world banks over $5 billion in market cap and charting only those that show asset shrinkage over the past two years, we are left with 31 banks. Twenty-seven of those are in Europe. In addition, all 22 banks in the world with a 2% shrinkage in assets or worse (per year over two years) are in Europe.

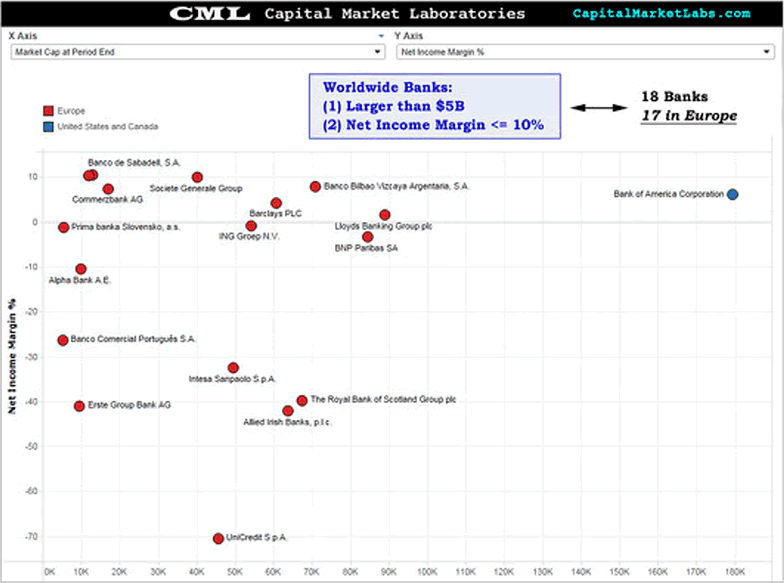

If you're wondering if any of this hits the bottom line, the answer is a resounding "yes." Below we chart net income margin on the y-axis and market cap on the x-axis.

If we take the banks worldwide over $5 billion in market cap and plot those with net income margins below 10%, we get 18 banks. Seventeen of those are in Europe. If we only look at banks with negative earnings, all 10 are in Europe.

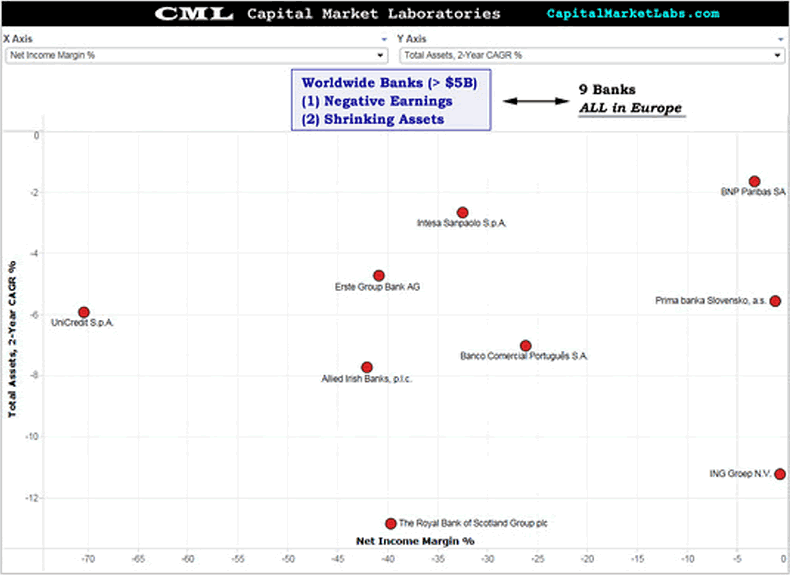

Total assets, 2-year growth rate and net income

If we dive deeper and look to combine the charts from above into one chart, we find there are nine banks in the entire world that are larger than $5 billion, have shrinking assets over two years (y-axis) and have negative net income margins (x-axis). All nine are in Europe.

Those banks aren't trivial. In fact, they average nearly $900 billion in assets. As a group, they hold over $8 trillion in assets.

ECB Bound to Fail

Thanks much to Ophir Gottlieb and Capital Market Labs!

Gottlieb concludes with "The European Central Bank (ECB) seems motivated to pursue quantitative easing, which may include an interest rate cut. When interest rates fall, demand for borrowing tends to rise. It's that demand (in part) that hypothetically could jump-start the EU's economy. Given the data above, we must ask: Are European banks willing to (or can they afford to) lend more money if their existing bad debts get even worse?"

On that I have a distinct opinion: It is virtually impossible for QE to work.

Banks do not lend because funding is cheap. One look at Japan provides sufficient proof.

I have stated that numerous times before, but in light of the above charts and Mario Draghi's hopeless plan, it's worth taking another look at when banks lend and when they don't.

When Banks Lend

From my August 22 post: German Two-Year Bonds Have Negative Yield, Demand High; Euro Bond Bubble Guaranteed to Burst

Central bank money madness continues, with market participants expecting QE to begin in Europe.

Would QE by the ECB spur European bank lending? Of course not. Banks do not lend from excess reserves. Banks lend (provided they are not capital impaired), when credit-worthy borrowers want credit and banks perceive risks worth lending.

The ECB tried to induce banks to lend by charging, rather than paying interest on excess reserves. The results are in: Yield on Two-Year German Bonds is Negative.

There is no demand for loans and/or willingness of banks to lend. Credit-worthy customers simply do not want loans in this environment. And no fundamental flaws with the euro have been fixed after all these can-kicking years.

Meanwhile, Spanish banks gorge on low-yielding Spanish bonds, Italian banks on low-yielding Italian bonds, Portuguese banks on low-yielding Portuguese bonds, etc., all with massive leverage.

The ECB's expectation was to spur lending, instead it created a bond bubble. It's a bubble guaranteed to burst.

Capital Impairment to the Forefront

Also consider snips from Spotlight on European Bank Lending: Capital Impairment to the Forefront.

Banks lend (provided they are not capital impaired), when credit-worthy borrowers want credit and banks perceive risks worth lending.

So which is it, lack of credit-worthy borrowers or capital impairment? The answer is likely both, but the spotlight goes on capital impairment and Texas Ratios, the latter a ratio of bad loans to equity.

Whether or not banks pass stress tests, and whether or not reports say they are not capital impaired, one can look at actual lending and easily come to another conclusion.

Occam's Razor and Bank Lending

I discuss bank lending again in response to a reader question regarding the above bank lending posts: Occam's Razor and Bank Lending. This was my explanation ...

Occam's Razor suggests the simplest explanation is likely to be the correct one. In this case, central banks clearly want to spur lending. So why aren't banks lending?

Two Possible Reasons Banks Aren't Lending

- Banks are capital impaired (even if they deny they are not)

- Banks have no credit-worthy borrowers who want loans

I suggest both

That is the simplest explanation that fits the bill, and it also fits in with sound economic theory.

Thus, that is precisely what Occam's Razor would suggest. Whether or not central banks talk to, or understand banks or bank lending is irrelevant.

Moreover, I stick with my assertion that central banks are generally clueless about the state of the economy. This has been proven time and time again.

Thus, it should not at all be surprising to find that central banks are surprised to discover their attempts to spur lending have failed.

Necessary Conditions for Bank Lending

- Banks are not capital impaired.

- Banks believe they have credit-worthy customers (or that asset prices will rise enough to cover the risk).

- Creditworthy borrowers want loans.

If all three conditions are not met, banks don't lend.

Notice the word "believe". Banks do not actually have to have creditworthy borrowers (they didn't in the housing bubbles). Rather they have to believe they do (or that rising asset prices will bail them out). Banks were horribly wrong but that is what they believed.

The charts from Capital Market Labs show my overall thesis on the state of European banks was indeed the correct one.

Counterproductive Central Bank Efforts

Attempts to force banks to lend when they do not want to (or can't due to capital impairment), will do nothing but create asset bubbles while pushing real interest rates negative (in the case of German bonds, nominal rates are actually negative).

Asset bubbles by definition burst. And when bubbles burst, they unleash extreme deflationary forces that central banks hoped to stop.

Challenge to Keynesians

I discussed the absurdity of central bank deflation fighting in Challenge to Keynesians "Prove Rising Prices Provide an Overall Economic Benefit".

Please take a look.

Here is the key construct: "Central bankers should not fear falling consumer prices. What central bankers should fear is falling asset prices, more specifically, loans made on assets in an asset bubble. The irony is central banks create asset inflation by fighting something everyone on the planet should welcome [consumer price deflation]."

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2014 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.