Energy and Resources in High Demand

Commodities / Gold & Silver May 28, 2008 - 03:05 PM GMTBy: Aden_Forecast

There seems to be no stopping the high flying oil price as it leaps above $130, a price that seemed unlikely just last December. The growth in oil demand will continue to be driven by China and Asia , in spite of the U.S. economic slowdown.

There seems to be no stopping the high flying oil price as it leaps above $130, a price that seemed unlikely just last December. The growth in oil demand will continue to be driven by China and Asia , in spite of the U.S. economic slowdown.

In fact, according to the International Energy Agency, China, India , Russia and the Middle East will consume more crude than the U.S. , for the first time. Oil use worldwide will increase 2% this year because of the emerging markets. So with demand as robust as it is, any possible supply disruption will simply push oil up further.

This has already been happening, for instance, with the ongoing supply threats in Nigeria , Africa 's biggest oil producer. And it's been another main factor keeping upward pressure on the oil price over the past few months.

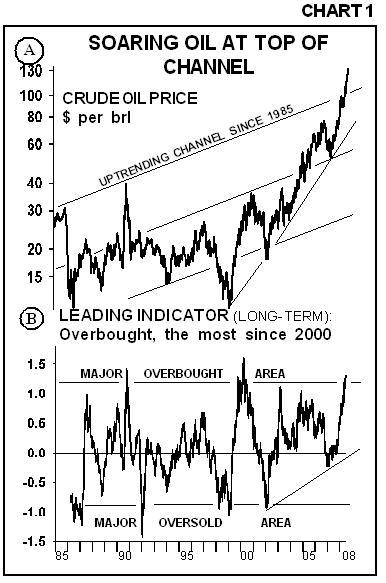

Chart 1A shows the incredible run up in oil. It's now overshooting the top side of a 23 year channel, while its leading indicator (B) is at an overbought area, the most since 2000. This is saying that oil is near, or at a high area for now. Keep an eye on $112 as oil will remain very strong even if it declines to this level. Major support is at $85 and as long as the oil price stays above $85, this bull market will continue to march onward and upward.

Chart 1A shows the incredible run up in oil. It's now overshooting the top side of a 23 year channel, while its leading indicator (B) is at an overbought area, the most since 2000. This is saying that oil is near, or at a high area for now. Keep an eye on $112 as oil will remain very strong even if it declines to this level. Major support is at $85 and as long as the oil price stays above $85, this bull market will continue to march onward and upward.

Meanwhile, an enormous transfer of wealth is going to the countries with energy reserves. And with the recent oil discovery in Brazil , the world's biggest since 2000, you can understand why the Brazilian stock market is hitting new record highs. The global transfer of wealth, and the gap between rich and poor is widening, in large part due to oil, and this too will likely continue.

GOLD: Which way next?

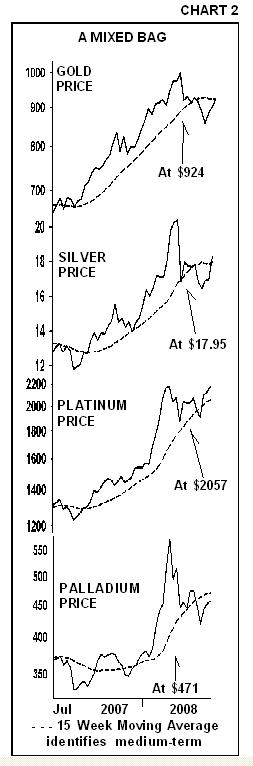

As for the metals, gold and the other precious metals remain bullish. But following their steep rises, they declined in the past couple of months in downward corrections, which started in March (see Chart 2 ). In recent weeks, the metals have been rising again, but it's too soon to tell if this is simply a rebound or the beginning of a renewed, sustained upmove.

The 15-week moving averages have captured the intermediate rises in the metals best, and with all four metals now giving mixed signals, this is saying that the intermediate trends are still to be determined.

For now, here's what we're watching…

As you can see, platinum is well above its moving average, which is at $2057, and platinum is often a leader. So if platinum now stays above $2057, it'll be a bullish sign, not only for platinum but for the other metals too.

Silver is also looking good. That'll be reinforced if it can hold above the $17.95 level.

Gold and palladium are lagging. But if they can rise and stay above $924 and $471, respectively, it'll be an impressive signal that the metals are again in synch. In other words, they'll all be poised to head higher within their major bull markets. That is, the intermediate declines from March to May will clearly be over.

As we've said so many times before, the major trends are the most important, regardless of near term ups and downs. So with that in mind, we thought this would be a good time to answer some of the questions we hear most…

FREQUENTLY ASKED QUESTIONS

Q. Would you buy new gold positions now?

A. It's always a good strategy to average into any market. That is, buy a certain amount on a monthly basis knowing that you will likely hold this position for years because gold's major bull market is still evolving.

Buying at intermediate lows is ideal, which is why we follow the intermediate trend. To give you an example, last Summer was an ideal buying time and so was the Summer of 2006. If you would've bought then, you would have obtained the best price of the last two years on an intermediate basis. But if you'd averaged into the market since the Summer of 2006, you would have also done very well.

Q. Would you ever sell gold?

A. As special as gold is, we're not married to it. Our devotion is to the major trend and when it's up, like it is now, we will stay invested. Gold has been in a confirmed uptrend since August, 2001, and as long as this uptrend stays intact, we'll stay with it. This trend is truly your friend.

Q. So what's better to buy, gold or silver?

A. Gold led silver when the bull market started in 2001. Silver didn't take off until 2003, but once it did, it made up for lost time and it clearly outperformed gold. Overall, we recommend buying and holding both metals, but it looks like silver will soon be outperforming gold again.

Q. What's the best way to buy?

A. We like the coins in both metals. You can buy the metals at Kitco.com

For ease in buying, we also like the Exchange Traded funds (ETFs) in gold (GLD) and silver (SLV).

--

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.