US Dollar and the Gold Fairy Tale

Commodities / Gold and Silver 2015 Dec 19, 2014 - 01:06 PM GMTBy: John_Mauldin

Grant Williams writes: On Christmas Eve 1979, 27 days before I became a teenager, in a surburban street in Moseley in Britain’s West Midlands, a group of musicians put the finishing touches on their debut album.

Grant Williams writes: On Christmas Eve 1979, 27 days before I became a teenager, in a surburban street in Moseley in Britain’s West Midlands, a group of musicians put the finishing touches on their debut album.

The musicians — Brian Travers, Astro, James Brown (no, not that one), Earl Falconer, Norman Hassan, Mickey Virtue, and twins Ali and Robin Campbell — had a unique approach to the music business.

Eighteen months prior to completing their first album, Ali Campbell and Travers had plastered the streets of Birmingham with leaflets promoting the band, which had taken its name from the document issued to people claiming unemployment benefits from the UK government’s Department of Health and Social Security (DHSS). The name of the form — and thus the band — was UB40.

Having advertised themselves and with dreams of making a big splash on Britain’s reinvigorated music scene running wild in their heads, the band had just one remaining item on their to-do list — learn to play their instruments.

The members of UB40 made an agreement to spend the next year doing nothing other than learning their instruments and practising their songs until they felt they were good enough.

(I know, I know! This IS analagous to many modern-day Central Bank policy efforts, but that’s not where I’m going with this, so stop jumping ahead.)

Anyway, after about a year, the band felt competent enough to play in public; and they made their debut on the 9th of February, 1979, in an upstairs room at the Hare & Hounds, a small pub in King’s Heath. They had been “booked” by a friend to celebrate his birthday.

Following on the success of their first gig (apparently, the birthday boy was delighted), the band secured a series of similar shows, all in local pubs, at which they planned to unleash their blend of reggae and dub onto an unsuspecting public who, though they didn’t realise it, had been waiting for UB40 for years.

Remarkably, at one of these pub gigs, Chrissie Hynde just happened to be in attendance, no doubt supping a couple of pints of Throgmorton’s Dubious Explanation (a real ale so thick it’s served by the slice); and she liked what she saw so much, she offered the band a supporting slot on The Pretenders’ upcoming tour of the UK.

Simple.

Fast-forward to Christmas 1979, and the story of the recording of the band’s debut album burnishes the legend yet further:

(Wikipedia): The band approached local musician Bob Lamb as he was the only person they knew with any recording experience. Lamb had been the drummer with the Steve Gibbons Band for much of the 1970s and was a well-known figure within the Birmingham music scene.... However, as the band were unable to afford a proper recording studio, the album was recorded in Lamb’s own home at the time, a ground-floor flat in a house on Cambridge Road in Birmingham’s Moseley district....

Brian Travers recalled just how basic the recording facilities of the original Cambridge Road “studio” really were:

Because we couldn’t afford a studio and he was the only guy we knew who knew how to record music, we did the album in his bedsit. I remember he had his bed on stilts. So underneath the bed was a sofa and mixing desk. And so we recorded the album there on an eight-track machine, with the same 50p coin going through the electric meter continually because we’d booted the lock off it. And, with it being a bedsit and us being eight in the band, we’d record the saxophone in the kitchen — because there was a bit of resonance off the walls, a bit of reverb — before putting the machine effects on it. While the percussion — the tambourines, the congas, the drums — we’d do in the back yard. Which is why you can hear birds singing on some of the tracks! You know, because it was in the daytime we’d be shouting across the fences “Keep it DOWN! We’re RECORDING!”

Lamb remembered the process fondly:

Nothing was hard work about that album, it was a bit of a dream that sort of fell out of the sky... It was almost effortless to make in that they were so good at the time, and so happy at the time with the success that they got, there was no effort in it.

The title of the album, “Signing Off,” was inspired by the process of the band members ending their claim on UK unemployment benefits — and becoming pop stars.

The LP (Google it, Gen Y-ers), released on August 29, 1980, spent 71 weeks on the UK albums chart, peaking at number 2 and turning platinum (when doing such a thing used to mean something). It was greeted with rapture by Britain’s music press:

(Sounds): Five stars out of five. It is an (almost) perfect album.... It’s rare to find a debut album so detailed, so excellently played and so packed with bite — I sometimes think it hasn’t really happened since The Clash.

The album would go on to make Q Magazine’s “100 Greatest British Albums Ever” (#83, if you’re interested) and is featured in a book somewhat somberly titled 1001 Albums to Hear Before You Die.

I think it’s fair to say I played my part in the success of the band by spending the pocket money I had saved up on a copy of “Signing Off” (though the band have so far not publicly acknowledged my involvement).

Anyway, as I am now signing off from Mauldin Economics, I felt it would be appropriate to take stock of a few of the issues I have covered ad nauseum repeatedly during my two-plus years working with John and his team; and I thought I’d also take those of you unfamiliar with UB40’s debut album through a few of the tracks (and remind those of you who know the band just how spectacular that album was).

Track 2. King — 4:35

The “King” referred to in the second track on “Signing Off” was, of course, Martin Luther King, Jr. The song was short on lyrics but big on impact; however, the undoubted “King” in markets today is once again King Dollar, and the world’s reserve currency is making some serious waves right now, which threaten to cause chaos in world markets.

At this point I’ll throw things over to my friend and partner in Real Vision Television and author of The Global Macro Investor, Raoul Pal, who has been warning of the likelihood of a major move in the dollar for longer than just about anybody. In his most recent report, he explained the ramifications of a dollar bull market in the clearest, most concise way possible:

(Raoul Pal): Debt dynamics, deflation, positioning and technicals all suggest that a dollar bull market of some considerable velocity and length is underway.

When dollar bull markets occur, emerging markets get hit.

When dollar bull markets occur, carry trades get unwound.

When dollar bull markets occur, they tend to usher in disinflationary forces as commodities and goods get re-priced.

The preceding three factors lead to a self-reinforcing of the dollar bull market, creating more of the same in a cycle of liquidation and bad debts, creating more demand for US dollars.

As I said, clear and concise.

I watched Raoul present at the iCIO Summit this past week, and his presentation was compelling, to say the least. As he pointed out in a panel discussion with Mark Yusko, Dennis Gartman, David Rosenberg, and myself, “When currencies begin to trend, they can do so for decades.”

A sobering thought.

A look at the long-term charts of the DXY Index shows just how massive the potential reversal of this trend is; and based on Raoul’s roadmap, the sheer size of the reversal gives us a strong hint of the degree of carnage that will be wrought upon a world in which the dollar carry trade has reached somewhere between $5 trillion and $9 trillion.

Incidentally, one of those estimates is Raoul’s, and one belongs to the BIS, and I bet your first guess as to which is which would have been wrong.

A closer look at a shorter-term chart demonstrates the recent break clearly:

The BIS report to which I refer was published last week, and it was astounding in terms of the sheer size of the dollar carry trade it depicted.

According to the BIS, US dollar loans to China’s banks and companies have jumped to $1.1 trillion — that’s TRILLION — from virtually zero just five short years ago. The annual rate of increase of those loans is a mind-boggling 47%.

However, the fun doesn’t stop there.

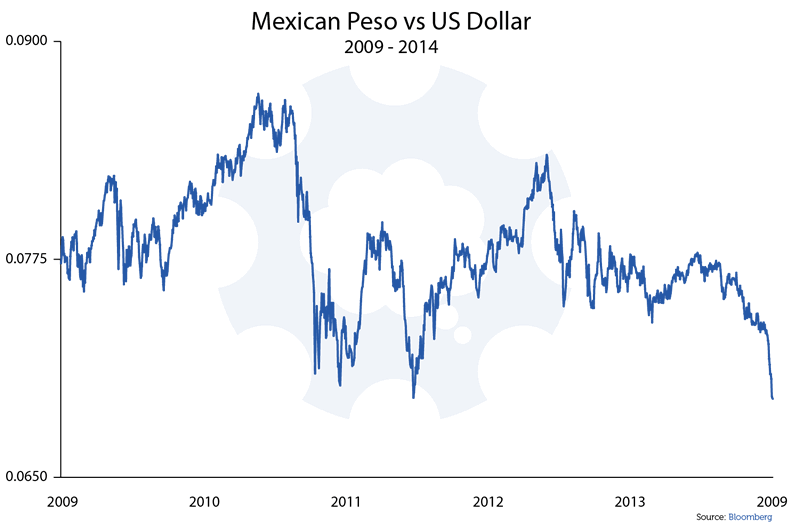

Consider Brazil, for example, where cross-border dollar credit now stands at $461 billion, or roughly 20% of GDP. For Mexico those numbers are even more eye-watering. A country with a GDP of just $1.1 trillion has outstanding cross-border dollar credit of $381 billion — or roughly 30% of GDP. Frightening.

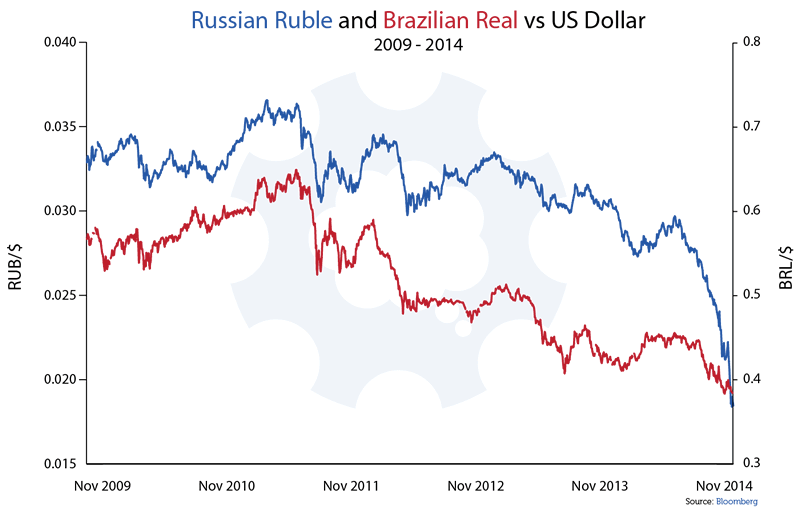

Meanwhile, in Russia the same metric has reached $751 billion. Why does this matter? Well, the charts below, which show the appreciation of the US dollar against those three currencies in the last five years, highlight the danger to countries that have been able to borrow seemingly endless amounts of (relatively) stable dollars to finance business operations and expansion.

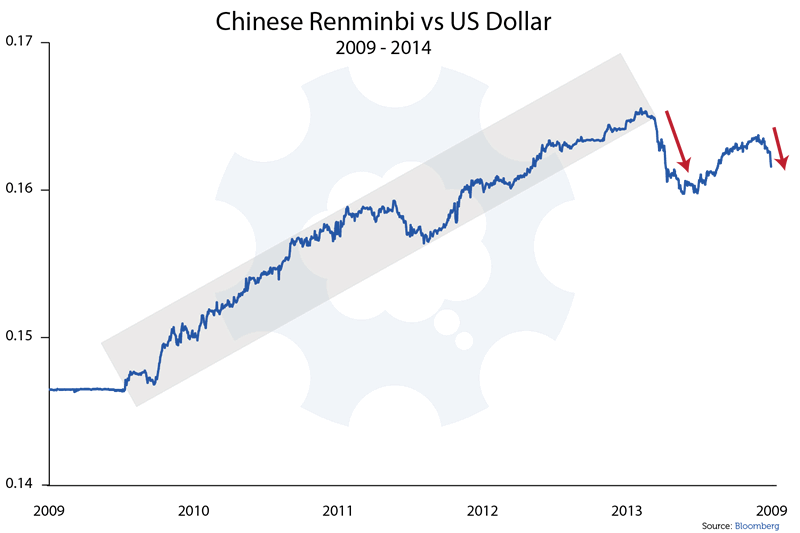

Lastly — and perhaps most importantly — witness the change in direction of the Chinese renminbi which, after trending higher against the dollar for many years (and, in the process, moving virtually everybody to the same side of the boat in the belief that a stronger Chinese currency was a given), has suddenly started to look as if it may also succumb to the renewed strength of the dollar. The only difference here being that the Chinese may actively be looking now to devalue their currency in light of the ongoing attempt by the Japanese to devaluetheir way back to competitiveness. Few thought this a likely scenario until very recently; consequently, few are positioned accordingly; and when things like that happen in the macro world, you can get some REALLY funky moves.

When currency wars break out, they can get very nasty very quickly.

Under no circumstances should you take your eyes off the US dollar, folks. The sheer number of places where you will witness the knock-on effects of a soaring dollar — chief amongst them emerging markets and the commodity space — will be breathtaking.

I will write at greater length on the likely effects of the dollar’s move on gold in a few weeks, as it warrants a piece all its own; so stay tuned for that one.

In a series of conversations I’ve been fortunate to have had with some of the best macro traders in the world in recent months through Real Vision Television, there has been one overarching takeaway from every one of them: macro is back, and 2015 is shaping up to be an epic year for the guys who trade these fundamental shifts. To a man, after several years of little action in the macro world, they are positively licking their lips at the potential opportunities that are headed their way next year.

One person’s opportunity is another person’s crisis. You have been warned.

Track 3 was an instrumental number called “12 Bar,” a reggae reimagining of the 12-bar blues that highlighted Brian Travers’ remarkably good saxophony skills (given his lack of attention to learning to play the instrument before forming the band).

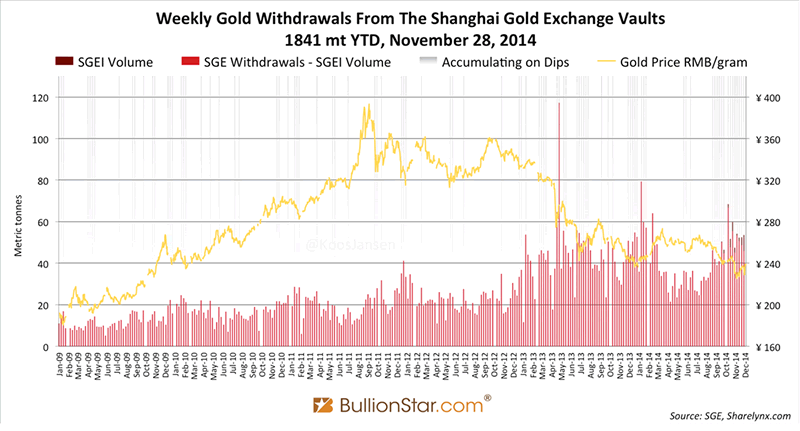

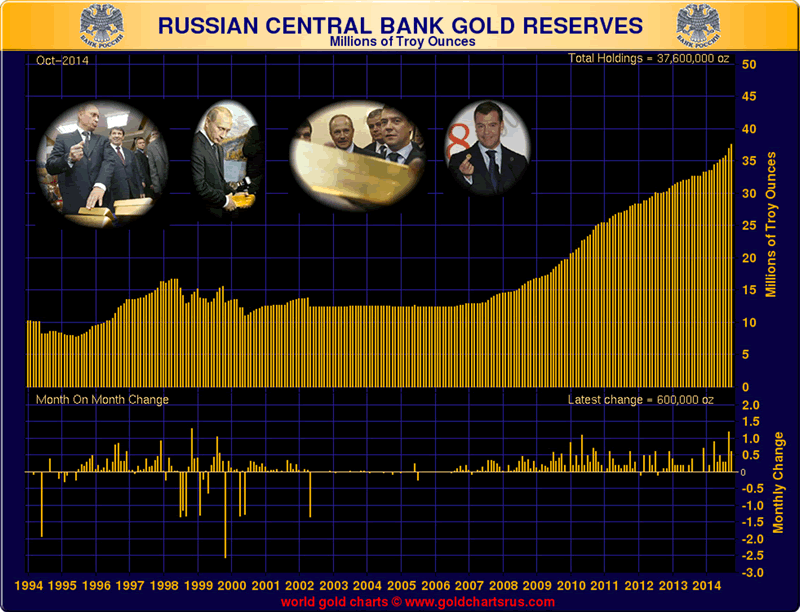

Obviously, during my time with Mauldin Economics, the “bars” which have preoccupied me have been those of the gold variety — and for the most part, their constant movement in an easterly direction.

I have written article after article and given presentation after presentation about the dichotomy between paper and physical gold and have regularly highlighted the magnitude of the flow of gold out of the West and into strong Eastern hands. In the previous edition of this publication (“How Could It Happen?”), I imagined a future in which this stunning relocation of physical gold had finally mattered; and between publishing that piece and penning this one, a couple of interesting things have happened. Firstly, my friend Barry Ritholtz took a big, fat shot at me in a Bloomberg column entitled “The Gold Fairy Tale Fails Again.” Barry’s article (which was entirely consistent with his very public and oft-stated thinking and was, as is always the case with Barry, very well-written) took apart what he sees as the various failed narratives in the gold markets. He began with gold’s link to QE:

(Barry Ritholtz): [T]he most popular gold narrative was that the Federal Reserve’s program of quantitative easing would lead to the collapse of the dollar and hyperinflation. “The problem with all of this was that even as the narrative was failing, the storytellers never changed their tale. The dollar hit three-year highs, despite QE. Inflation was nowhere to be found,” I wrote at the time...

... moved on to the recent SGI:

Switzerland was going to save gold based on a ballot proposal stipulating that the Swiss National Bank hold at least 20 percent of its 520-billion-franc ($538 billion) balance sheet in gold, repatriate overseas gold holdings and never sell bullion in the future. This was going to be the driver of the next leg up in gold. Except for the small fact that the “Save Our Swiss Gold” proposal was voted down, 77 percent to 23 percent, by the electorate....

... then hit upon the recent Indian import restrictions and reports of gold shortages, which Barry clearly feels are spurious, before eventually finding his way to yours truly:

Perhaps the most egregious narrative failure came from Grant Williams of Mauldin Economics. He imagined a conversation 30 years from now about China’s secret three-decade-long gold-buying spree, dating to November 2014. Well, we only need to wait 30 years to see if this prediction is correct.

Now, in response to the lighting up of my Twitter feed after Barry’s article was posted (and my thanks to all those who kindly pointed it out to me), I would say this: Barry is right on all counts.

For now.

I am delighted to be able to call Barry a friend and have absolutely no problem with his calling me out on what I said. Those of us who possess sufficient hubris to deem our thoughts worthy of distribution wider than the inside of our own heads are absolutely there to be taken to task should others disagree with us. We make ourselves fair game the second we hit the wires.

Sadly, none of us actually KNOW anything. How could we? We all take whatever inputs we find and then use them to reach our own conclusions based mostly on probability, and more often than not those conclusions are wrong.

HOWEVER... if your logic is sound and your thought processes rigorous, being wrong is often a temporary state — something that can also be said about being right, of course. In my humble opinion, the issue with gold today is not one of narrative, as Barry suggests, but rather that the extent of the current interference in markets by our friends at the various central banks around the world has meant that being wrong (no matter which part of the financial jigsaw puzzle you may be concerned with) has never been easier — even though being right has never, in my own mind at least, been more assured in the long term, certainly as far as gold is concerned.

As I slumped against the literary ropes, Barry threw one more punch when he suggested that the reader would “only need to wait 30 years to see if this prediction is correct,” but this is where I stop covering up and finally flick a jab or two of my own.

I think the chances of having to wait 30 years to see the gold conundrum resolve itself (in materially higher prices, I might add) lie close to those of Barry’s being invited to give the opening address at the next GATA conference. The evidence is crystal clear that significant quantities of physical gold have been pouring into Eastern vaults (due to both private- and public-sector activity); and gold is, after all, a finite resource. Not only that, but the “weakness” in gold (which remains roughly 500% above its turn-of-the-century low, despite the recent 30% correction) is confined to the paper market.

Whilst this distinction between paper and real gold hasn’t mattered up until now, there will come a day when it absolutely does — to everybody — and at that point, anyone not positioned correctly will be in a world of hurt.

(Charts above and below courtesy of Nick Laird at Sharelynx and Koos Jansen)

Tightness in the physical market has increased consistently as the likes of Russia continue to stockpile ever-increasing amounts of gold and as Chinese imports as well as withdrawals from the Shanghai Gold Exchange maintain a torrid pace. The only missing piece of the puzzle is the lack of any official acknowledgement that the Chinese have been doing the same thing to a far greater degree; and, as I wrote in “How Could It Happen?”, there is a curious demand for absolute proof from those who dispute official figures, whilst the principle of reasonable doubt continues to hold sway on the other side of the argument.

I suspect that imbalance will right itself — possibly very soon — and when it does there will be absolutely no putting the genie back into the bottle.

In the meantime, as Barry so confidently predicted, the Swiss Gold Initiative failed, but that was overshadowed (in my mind at least) by a couple of very interesting developments that were covered beautifully by two of my buddies, Willem Middelkoop (author of The Big Reset — a phenomenal read) and Koos Jansen.

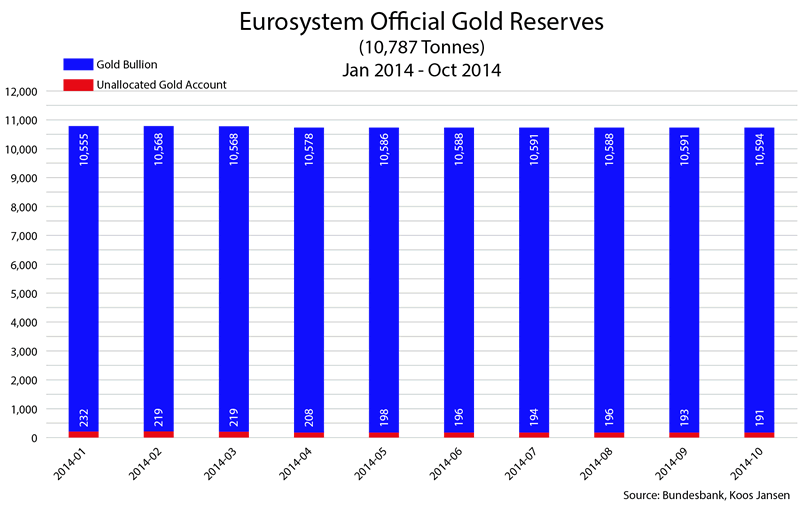

Firstly, Koos reported on the increasing drive to allocate the gold held within the Eurosystem:

(Koos Jansen): [M]ost of the Eurosystem official gold reserves are allocated, and since January 2014 (which is as far as the more detailed data goes back) the unallocated gold reserves are declining, as we can see in the next chart.

Unfortunately we do not know what happened prior to 2014.

Note, allocated does not mean the gold is located on own soil, but it does mean the gold is assigned to specific gold holdings, including bar numbers, whether stored on own soil or stored abroad. Unallocated gold relates to gold held without a claim on specified bar numbers; often these unallocated accounts are used for easy trading... The fact the Eurosystem discloses the ratio between its allocated and unallocated gold and, more important, the fact that the portion of allocated gold is far greater and increasing, tells me the Eurosystem is allocating as much gold as they can.

Secondly, another repatriation request was unearthed — this time made by perhaps the least likely source imaginable:

(Koos Jansen): In Europe, so far, Germany has been repatriating gold since 2012 from the US and France, The Netherlands has repatriated 122.5 tonnes a few weeks ago from the US, soon after Marine Le Pen, leader of the Front National party of France, penned an open letter to Christian Noyer, governor of the Bank of France, requesting that the country’s gold holdings be repatriated back to France; and now Belgium is making a move. Who’s next? And why are all these countries seemingly so nervous to get their gold ASAP on own soil?

Funnily enough, the answer to Koos’ rhetorical question about who’s next was answered just a few days later:

(Bloomberg): The Austrian state audit court says central bank should address concentration risk of storing 80% of its gold reserves with the Bank of England, Standard reports, citing draft audit report. Court advises central bank to diversify storage locations, contract partners.

Austrian central bank reviewing gold storage concept, doesn’t rule out relocating some of its gold from London to Austria: Standard cites unidentified central bank officials. Austria has 280 tons gold reserves, according to 2013 annual report. Austrian Audit Court Will Review Nation’s Gold Reserves in U.K.

Say what you want about the gold price languishing below $1200 (or not, as the case may be, after this week), and say what you want about the technical picture or the “6,000-year bubble,” as Citi’s Willem Buiter recently termed it; but know this: gold is an insurance policy — not a trading vehicle — and the time to assess gold is when people have a sudden need for insurance. When that day comes — and believe me, it’s coming — the price will be the very last thing that matters. It will be purely and simply a matter of securing possession — bubble or not — and at any price.

That price will NOT be $1200.

A “run” on the gold “bank” (something I predicted would happen when I wrote about Hugo Chavez’s original repatriation request back in 2011) would undoubtedly lead to one of those Warren Buffett moments when a bunch of people are left standing naked on the shore.

It is also a phenomenon which will begin quietly before suddenly exploding into life.

If you listen very carefully, you can hear something happening...

Click here to continue reading this article from Things That Make You Go Hmmm… – a free newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.