Bail-In Normalization

Politics / Credit Crisis Bailouts Dec 31, 2014 - 03:29 PM GMTBy: Andy_Sutton

When the bail-in first ripped through Cyprus in the first part of 2013, I wrote a series of articles about the topic and examined some documents from the Bank for International Settlements, the FDIC and Bank of England regarding treatment of depositors and their funds. To sum it up as we begin the latest chapter in what will no doubt morph into the biggest swindle ever to impact humankind, let’s recap what exactly the bail-in is.

When the bail-in first ripped through Cyprus in the first part of 2013, I wrote a series of articles about the topic and examined some documents from the Bank for International Settlements, the FDIC and Bank of England regarding treatment of depositors and their funds. To sum it up as we begin the latest chapter in what will no doubt morph into the biggest swindle ever to impact humankind, let’s recap what exactly the bail-in is.

It was determined in late 2012 that there are certain banks that simply cannot be allowed to fail – at any cost. They were quickly labeled ‘Too big to fail’. I and others added that they were too big to jail too since this select group pretty much received carte blanche to do whatever it wanted, regardless of the risk, impact, or consequences. In the whitepapers, these banks were referred to as ‘G-SIFIs’ or Global Systemically Important Financial Institutions. Under the FDIC/Bank of England model of resolving the failure of such an institution, it was made very clear that unsecured creditors like bondholders would get their heads handed to them. What was even more disturbing was that, unlike previously, depositors were now lumped into the same category as bondholders.

Bondholders, by nature, assume a risk when they invest. This risk is well-understood. Concomitant with taking on such risk is a return on investment. Depositors, on the other hand, don’t have the same expectation of risk, and since 2008, they certainly don’t get much of a return – if any at all. Depositors, in fact, think that their paycheck is safe when it goes into the bank. They don’t consider their paycheck to be invested in that bank. Furthermore, they expect that when they write a check against the money in their account that the check will be paid. They also expect that if they go to the ATM that they’ll be able to access their money. They expect to be able to show up at the bank and withdraw their money if they so choose. All of these assumptions were being challenged prior to any talk of the bail-in with banks requiring waiting periods for withdrawing more than x dollars. I have received many emails from people stating waiting periods of up to a week to take out as little as $2,000 in cash.

So maybe one might argue that it is on the depositors for not reading the fine print or that they should be clairvoyant and realize that those gold FDIC guarantee stickers plastered all over every bank window aren’t worth the stuff they’re printed on. Normally I’d say some of the responsibility falls on consumers and maybe it still does; there certainly have been lots of articles and videos about all of this stuff. Nothing on the mainstream media though, as usual, and unfortunately, the public still hasn’t learned in that regard. From that perspective this is all on the public because you’d think after being lied to time and time again by the government and the media that people might become just a tad skeptical. Evidently not; especially when it is time to shop until you drop, spend money you don’t have on things you don’t need, then hope to pay it all off in the new year with stagnant wages. Yep, sounds like a winner.

The Latest Chapter

So why write more about this now, when everyone is firmly ensconced in holiday mode? Unfortunately, I don’t get to dictate when the establishment makes its moves and yes it has made another one. The G20 recently adopted the FDIC/BOE bail-in resolution mechanism at its last meeting. What this means is that all member nations are now urged to codify the bail-in into their laws. Many, including the United States, have already done so. Nothing has been taken yet. This is just another step towards the normalization of stealing depositor money to cover bank losses.

There is a lot of psychology at work here. At first, the idea of stealing bank deposits to cover losses seems like theft – which it is. But the public is so against using taxpayer money after 2008 because it saw how crooked that was that anything, ANYTHING, is better than taxpayer funded bailouts. So let’s introduce the idea of a bail-in. After all, if you deposit your money in an institution and it fails, shouldn’t you share the risk? It never was supposed to be that way, but ok. So then we’ll write up a bunch of whitepapers, try it all out on some poor people on an island nobody has ever heard of (meanwhile warning the big money that the ax is about to fall), then cause absolute chaos over the course of a two week period. The sad thing is that test was a success. The sheep took their shearing with little in the way of resistance – what could they do really – and even more importantly, the rest of the sheep around the world were too busy wrapped up in Snapchat and Twitter to even notice what had just taken place. But ignorance is bliss, right?

Let’s take a few lines from the latest Financial Stability Board document – presented on 10-November-2014:

“Resolution strategies and the resolution plans which operationalize them should set out how firms may be resolved without severe systemic disruption, without exposing public funds to loss, and while ensuring continuity of systemically important (or “critical”) functions. Losses should be absorbed in the first place by shareholders and then by unsecured and uninsured creditors consistent with the statutory hierarchy of creditor claims.

The Key Attributes describe the powers and tools that authorities should have to achieve this objective. These include the bail-in power, i.e., the power to write down and convert into equity all or parts of the firm’s unsecured and uninsured liabilities of the firm under resolution or any successor in a manner that respects the creditor hierarchy and to the extent necessary to absorb the losses.”

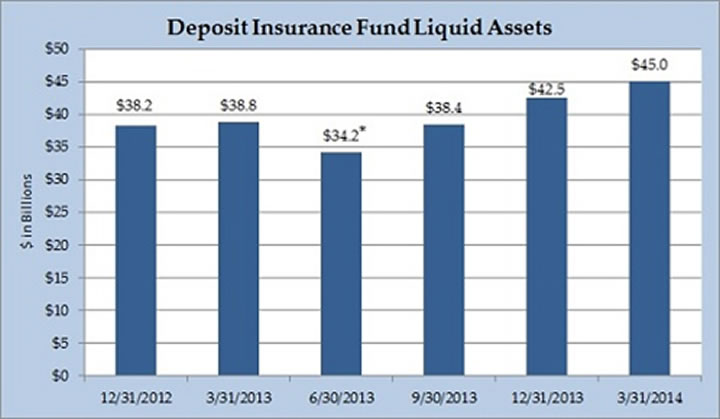

Since it has already been established that your bank account falls into the unsecured category, it is pretty clear how you can go from having cash to pay your bills to being a shareholder in a worthless bank without having any time to make an adjustment. But wait you say, the FDIC insures all my deposits up to $250,000 in each account – the sticker says so! At present time, the FDIC’s reserves for insuring deposits (please note that your money in the bank is no longer considered a deposit) is well under 5% of total bank ‘deposits’. Meaning, it would not take a total, or even significant blow up and, even if the FDIC were inclined, it couldn’t back up the near $1.64 trillion (as of 12/8/2014) in checkable deposits. The derivatives market is far worse - several hundred times the size of all bank deposits. A mere single digit percent blowout in interest rate swap derivatives would turn the world upside down.

The clowns at the G20 know this. They know there isn’t enough money on the planet to put this Humpty Dumpty back together again, but instead of putting a stop to it, they merely apply lipstick to the pig and sell the fairytale that somehow they’re in control and that don’t worry it won’t get out of hand. They won’t stop it because the G20 puppets are put in power by the same people who are gathering insane amounts of power to themselves by enslaving the world through phony currency systems, usury, and other predatory financial and economic practices.

Security for the Insecure?

What is even worse is that the aforementioned derivatives (think of them as bets basically) have been declared by the financial establishment to be secured, meaning that they must be made good on. It is like you walking into a casino and being approached by a guard and being told to hand over all your money. Why you ask? Because the high roller over there at the roulette wheel just lost a bunch of money. Ok, what does that have to do with me you say? Well, he bet 1000 times what he actually had to bet with in the first place. Ok, how’s that my problem you ask. Well, the casino has a rule that if this happens, everyone else in the casino has to give over all of their money to the house to make good on his bad bet.

Your deposits, on the other hand, are no longer secured, meaning they can (and will) be used as the Dutch boy to plug holes in the dam the next time one of these bad boys goes too far and tips things over. And it will happen too. I have no idea when, just that it will. 2008 was bound to happen and all the lessons that should have been learned never were and once the bailout money was in place, it was back to business as usual. The ‘reform’ of 2010, otherwise known as Dodd-Frankas crafted to make you feel secure, but actually laid the groundwork for what we’re seeing today.

This is no exaggeration either. The way the system is set up today, these G-SIFIs are able to leverage not only themselves and their shareholders, but the economies of the world when they play their twisted games. And of course they want protection when it all goes bad so they put in some puppets who come up with the idea of stealing your bank account, and likely your retirement assets too, in a vain attempt to fill the gap should things go sour.

Of course things will never go sour, right? JPMorgan brags about consecutive quarters where it goes 90 days straight without losing a dime on any given day. Everyone wins, all the time, right? Someone has to be losing for all these guys to be doing all this winning. The financial casino is a zero-sum game after all.

One must ask that if this mountain of risk called derivatives is analogous to nuclear weapon stockpiles in that it can wipe out the world several times over, then why exactly is anyone concerned with pilfering checking accounts? Remember, these guys can create ALL the money they need. Even if they had to make good on the whole pile of derivatives, they could, with a few keystrokes, create enough Dollars, Euros, Yen, etc. to do it. Sure it would cause other problems, but the crisis could be averted in the short term and isn’t that all these clowns are interested in anyway? No, the true answer is they want control. If they can swipe your checking account, they control you. It’s not about money per se; it is money being used as a tool to power.

What’s the take-home message in all this? It is not one of despair, but you’d better get your head out of the Telescreen, off Twitter and Shapchat, and into some of these matters. Nobody is looking out for you so you’d best do it for yourself. There are a bunch of us who are willing to help, but ultimately the responsibility is yours. I know that is not a popular concept in America today, but it is one you’d better embrace – and quickly.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.