Sayonara Global Economy - As Goes Japan, So Goes the World

Economics / Global Debt Crisis 2015 Jan 05, 2015 - 01:58 PM GMTBy: James_Quinn

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." - Ludwig von Mises

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." - Ludwig von Mises

The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie. The .1% party like it's 1999, central bankers not only don't take away the punch bowl - they spike it with 200% grain alcohol, the purveyors of propaganda in the mainstream media encourage the party to reach Caligula orgy levels, the captured political class and their government apparatchiks propagate manipulated and massaged economic data to convince the masses their standard of living isn't really deteriorating, and the entire facade is supposedly validated by all-time highs in the stock market. It's nothing but mass delusion perpetuated by the issuance of prodigious amounts of debt by central bankers around the globe. And nowhere has the obliteration of a currency through money printing been more flagrant than in the land of the setting sun - Japan. The leaders of this former economic juggernaut have chosen to commit hari-kari on behalf of the Japanese people, while enriching the elite, insiders, bankers, and their global banking co-conspirators.

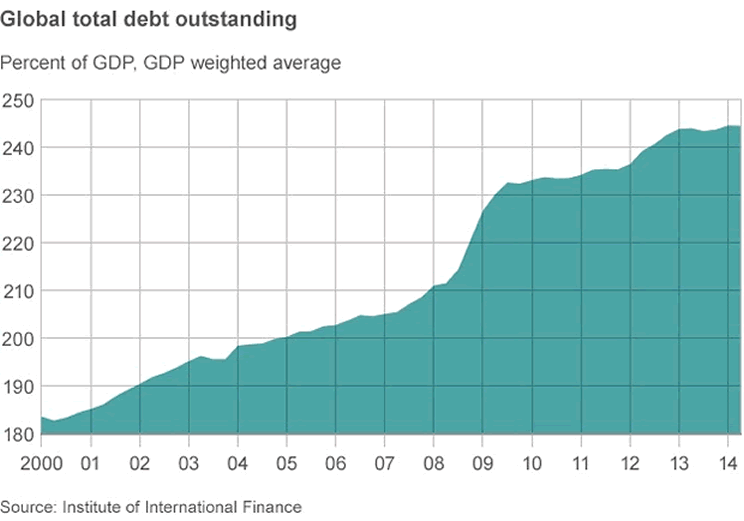

Japan is just the point of the global debt spear in a world gone mad. Total world debt, excluding financial firms, now exceeds $100 trillion. The worldwide banking syndicate has an additional $130 trillion of debt on their insolvent books. As if this wasn't enough, there are over $700 trillion of derivatives of mass destruction layered on top in this pyramid of debt. Just five Too Big To Trust Wall Street banks control 95% of the $302 trillion U.S. derivatives market. The reason Jamie Dimon and the rest of the leaders of the Wall Street criminal syndicate commanded their politician puppets in Congress to reverse the Dodd Frank rule on separating derivatives trading from normal bank lending is because these high stakes gamblers want to shift their future losses onto the backs of middle class taxpayers - again. The bankers, with the full support of their captured Washington politicians, will abscond with the deposits of the people to pay for their system destroying risk taking, just as they did in 2008 by holding taxpayers hostage for a $700 billion bailout.

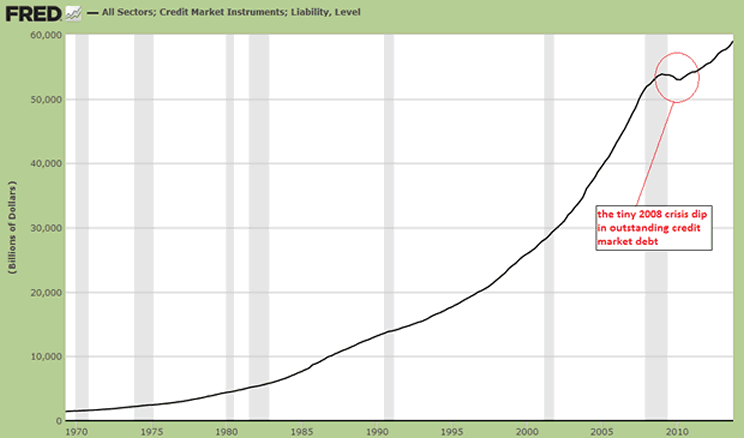

Only the ignorant, intellectually dishonest, employees of the Deep State, CNBC cheerleaders for the oligarchy, or Ivy League educated Keynesian loving economists choose to be willfully ignorant regarding the true cause of the 2008 implosion of the worldwide financial system. The immense expansion of credit in the U.S. from 2000 through 2008 was created, encouraged, supported and sustained by Alan Greenspan, Ben Bernanke and their cohorts at the Federal Reserve through their reckless lowering of interest rates and abdication of regulatory oversight, as their owner banks committed the greatest financial control fraud in world history. Total credit market debt in the U.S. grew from $25 trillion in 2000 (already up 100% from $12.5 trillion in 1990) to $53 trillion by 2008.

The bankers, politicians, mainstream media corporations, and mega-corporations that run the show lured Americans into increasing their credit card, auto loan, and student loan debt from $1.6 trillion in 2000 to $2.7 trillion in 2008, while extracting over $600 billion of phantom home equity from their McMansions. And it was all spent on things they didn't need, produced in Chinese slave labor factories. The mal-investment boom was epic and the collapse in 2008 would have purged the bad debt, punished the risk takers, bankrupted the criminal banks, reset the financial system, and taught generations a lesson they needed to learn - excess debt kills. Instead of voluntarily abandoning the madness of never ending credit expansion and accepting the consequences of their folly, the world's central bankers and captured politician hacks chose to save bankers, billionaires, and the ruling elite at the expense of the common people.

The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses, while the criminals continue to manufacture debt out of thin air, pillage the wealth of the working class, gamble recklessly knowing it's with taxpayer funds, debase their currencies in an effort to make their debts easier to service, and enrich themselves and their cohorts, while impoverishing the little people. Consumer credit card debt peaked at $1.02 trillion in mid-2008. After hundreds of billions in bad debt write-offs by the Wall Street banks and shifted to the taxpayer, the American consumer has purposefully avoided running up credit card debt on Chinese produced crap, despite the urging of bankers, the mainstream media and politicians to revive our warped, debt laden, consumption dependent economy. Credit card debt is currently $140 billion BELOW levels in 2008, despite the never ending propaganda about an economic and jobs recovery. The fake Wall Street created housing recovery is confirmed by the fact mortgage debt outstanding is $1.4 trillion LOWER than 2008 heights and mortgage applications are hovering at 1999 levels.

Where Americans were in control and understood the consequences of their actions, they willingly reduced their debt based consumption. This was unacceptable to the powers that be at the Federal Reserve, in the banking sector, consumption dependent mega-corporations, and their government puppets on a string. The government took complete control of the student loan market and used their ownership of the largest auto lender - Ally Financial (aka GMAC, aka Ditech, aka Rescap) to dole out subprime auto loans and subprime student loans at a prodigious rate. The Wall Street banks joined the party, with assurance from Yellen and the Obama administration their future losses would be covered.

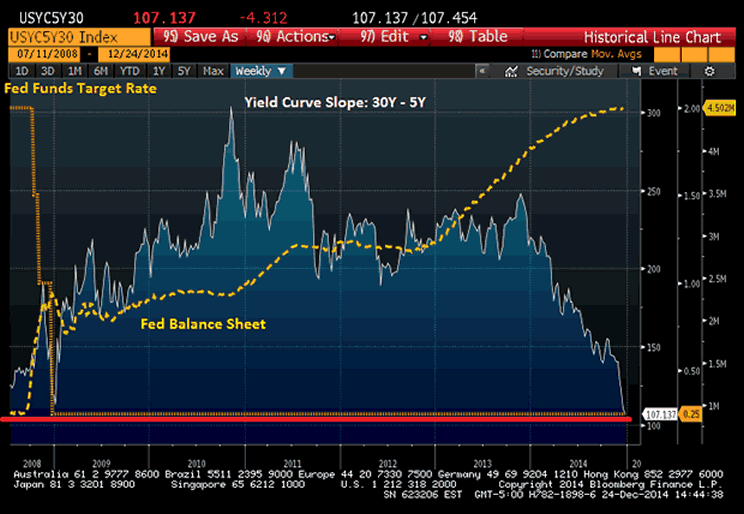

The Greenspan/Bernanke/Yellen Put lives on. So, while credit card debt is 14% below 2008 levels, student loan and auto loan debt has soared by 47%, up $769 billion from its early 2010 lows. The Fed and their government minions have desperately accelerated their credit expansion in a futile effort to revive our moribund, debt saturated, welfare/warfare empire of delusion. After temporarily plateauing at $52 trillion in 2010, the acceleration of consumer credit, issuance of corporate debt to fund stock buybacks, and of course the $5 trillion added to the National Debt by Obama, have driven total credit market debt to an all-time high of $58 trillion. In addition, the Fed expanded their balance sheet by $3.6 trillion through their various QE schemes, funneling the interest free funds to their Wall Street owners to create the illusion of economic recovery through a stock market surge. The .1% never had it so good.

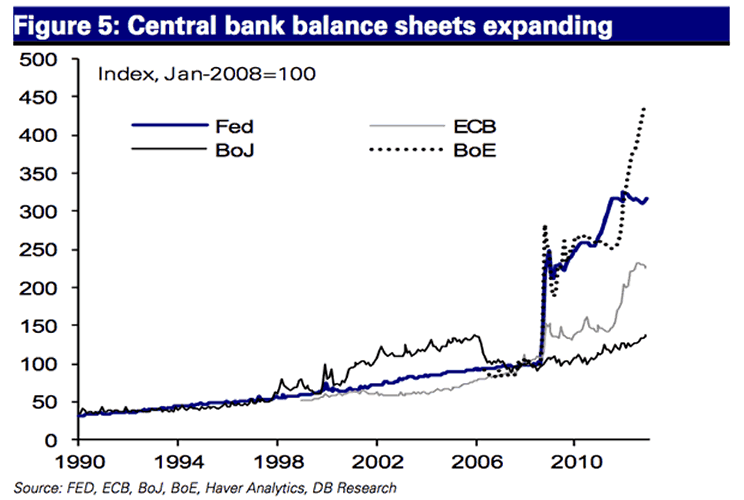

Of course, the U.S. has not been alone in attempting to cure a disease caused by excessive debt by issuing trillions in new debt. It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction, chaos and retribution for the guilty. The Federal Reserve used every means at their disposal to hide the fact they bought over $400 billion of mortgage backed securities from European banks and in excess of $1.5 trillion of their QE benefited foreign banks. It was no coincidence that one day after the Fed ended QE3, the Bank of Japan announced a massive "surprise" increase in purchases of bonds and stocks. It wasn't a surprise to Janet Yellen, as this was the plan to keep stock markets rising, record Wall Street bonuses being paid, and further enrichment of the .1% global elite. The Japanese stock market has surged 18% since the October 31 announcement, with the U.S. market up 10%. Now it is time for Draghi to pick up the baton and create another trillion or two to support the lifestyles of the rich and famous. Central bankers know who they really work for, and it's not you.

With global worldwide debt now exceeding $230 trillion we have far surpassed the point of no return. There is no mathematical possibility this debt will ever be repaid. And this doesn't even include the hundreds of trillions of unfunded liability promises made by corrupt politicians around the world. The level of total global debt to global GDP, at nosebleed levels of 210% in 2008, has escalated past 240% as central bankers push the world towards a final and total catastrophe. With U.S. credit market debt of $58 trillion and GDP of $17.6 trillion, the U.S. is a basket case at 330%. The UK, Sweden and Canada are on par with the U.S.

But Japan takes the cake with total debt to GDP exceeding 500% and headed higher by the second. Their 25 year Keynesian experiment by mad central bankers and politicians enters its final phase of currency failure. Negative real interest rates, trillions wasted on worthless stimulus programs, and currency debasement have failed miserably, so Abe's solution has been to double down and accelerate failed solutions. Only an Austrian economist can appreciate the foolishness of such a reckless act.

"Credit expansion is the governments' foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. - Ludwig von Mises

Madness in the Land of the Setting Sun

"The Japanese economy is burdened with an unusually bad demographic problem, made much worse by the burdens of insider dealing, crony capitalism, and zombie banks and their corporations. And its greatest burden of all is an elite that serves itself and its friends first and foremost, and that finds a greater kinship with its global counterparts than with the people whose interests it purports to represent." - Jesse

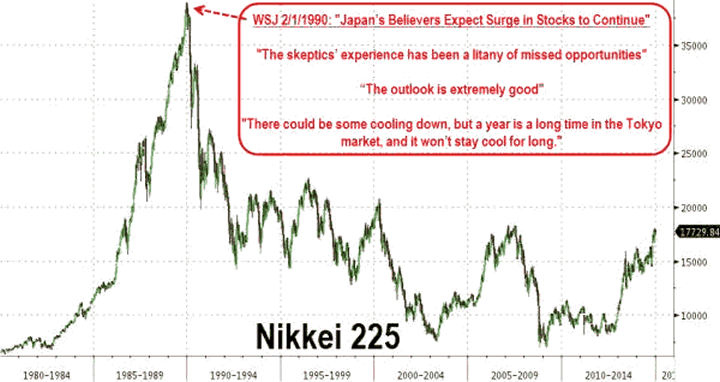

Despite all of the hot air spewed by the financial media about Abe's dramatic actions to "revive" the Japanese economy and the liftoff of the Nikkei from its lows, the Japanese stock market was only up 7% in 2014. Of course, if you were a U.S. foreign investor you would have lost 7%, as the Yen fell 14% versus the USD in 2014. It has now fallen by 36% versus the USD since 2012. The 26% stock market gain since early 2013 has been achieved through a 22% debasement in the currency. The German stock market soared in 1923 at the same rate the governmental authorities debased their currency. The utter and complete failure of Keynesianism can be seen in the chart above and the economic data 25 years after the 1990 Japanese stock market crash. They have experienced a 25 year recession because they chose to cover-up the bad debt of their zombie banks, wasted the nation's wealth on bridge to nowhere projects, and propped up the wealth of the elite ruling class of corporate titans.

The Nikkei closed at 38,916 on December 29, 1989. Twenty five years later it stands at 17,451, still down 55% from its high after a quarter of a century of Keynesian "solutions". In 1990 the government had about 60 trillion Yen in tax revenues and 69 trillion Yen in general account total expenditures. Now, the government estimates 52 trillion Yen in tax revenues for fiscal 2014 but has more than 95 trillion Yen in expenditures. It wasn't that long ago when the term "trillion" was an unknown and unnecessary concept. Japanese governmental debt now exceeds 1.2 quadrillion Yen, or $10 trillion at current currency rates. At last year's currency rates the debt would be $12 trillion. Now you understand the beauty of currency debasement. It theoretically makes your debt less burdensome, until the collapse of your currency system. When confidence dissipates in the ability of Japanese leaders to manage their fiscal affairs, a tipping point will be reached and it will be game over for Japan and their mad Keynesian experiment.

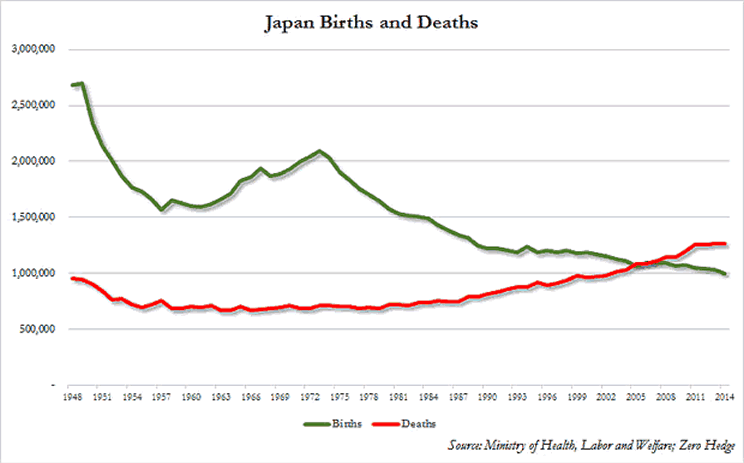

The Japanese society and economy is dying a slow suffocating death. The Ministry of Health, Labor and Welfare reported earlier this week, while Japan recorded 1.0 million births in 2014, or the lowest number in recorded history; this was offset by 1.27 million deaths: also the highest on record.

Japan is in the throes of a demographic death and debt spiral. The politicians add debt at ever increasing levels and because no investor in their right mind would buy debt with negative real yields while the government devalues the currency, the Japanese central bank buys the debt - along with domestic and foreign stocks for good measure. The debt will never be repaid because it can't. Even a miniscule increase in interest rates would ignite a conflagration of epic proportions, as the interest on the debt would blow the Japanese deficit sky high. Japan has a population of 127 million and at the current fertility rate of 1.4, will be below 100 million by 2045 and below 85 million by 2060. Old people can't have babies, so this is a virtual certainty. Social programs, debt, and unfunded liabilities need a growing population and positive economic growth in order to be paid and honored. This is an impossibility in Japan. It's just a matter of time before default and collapse sweep over this once proud empire like the tsunami that struck their shores a few years ago.

The Japanese people get it and are not cooperating with the authorities by spending money they don't have, while the ruling class reaps the benefits of free money and stock market gains and they are left with declining real wages and high inflation for food and energy which must be imported. The debt can only be paid through real tax increases or stealth tax increases through inflation. The Japanese people realize Abenomics is a farce and continue to hoard their remaining wealth, preparing for the cataclysm which beckons. They know how bankers and politicians treat their constituents. The little people will be thrown under the bus with welfare and social benefit cuts, while the ruling class will be left unscathed and further enriched. The nation will have gone full cycle, from extreme poverty after World War II to a global economic powerhouse by 1990 and back to a broken nation when this charade of debt collapses.

The Abe government's latest plan is the same plan used for twenty five years. I guess they never read Einstein's quote about insanity. They have delayed their sales tax increase, are cutting corporate tax rates with the hope the corporations will pay their workers more money. How has that worked out in the U.S.? Japanese corporations will build cash reserves, buy back their own stock, pay corporate executives bonuses, and leave their workers to fend for themselves. The government will spend tens of billions on more shovel ready projects benefiting the connected corporations. The banks will pretend they aren't insolvent. And the Bank of Japan will just buy all the debt, debase the currency, and prop up the Japanese and U.S. stock market. That's what they've been instructed to do by their authoritarian American oligarch masters. If they can just drive the Japanese Yen down to 140, the Wall Street banking cabal can drive the S&P 500 up another 20%.

Booms brought about by credit expansion ALWAYS end in a contractionary bust. It's just a matter of when. The level of mal-investment in Japan, Europe, China and the U.S. during the boom created by central bankers is almost incomprehensible in its scale of absurdity. The only beneficiaries have been bankers, corporate insiders, politicians, and shadowy billionaires hiding in plain sight. The illusory boom has already impoverished the working class and the coming bust will invoke civil unrest, social chaos and war.

"Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump. The boom squanders through mal-investment scarce factors of production and reduces the stock available through overconsumption; its alleged blessings are paid for by impoverishment." - Ludwig von Mises

Live by the Debt, Die by the Debt

"Credit expansion is the governments' foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous." - Ludwig von Mises

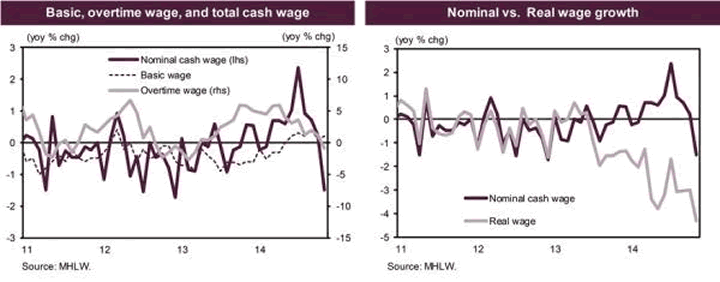

Abenomics may be benefitting corporate insiders, bankers and politicians, but not the working class or senior citizen savers. Real wages declined by 4.8% in December, the largest decline since 1998. As the Keynesians have implemented every Krugman recommendation for the last five years, real wages have relentlessly declined for 30 months in a row. But at least they have created double digit inflation in everyday living expenses like food and energy. The Japanese Misery Index (unemployment plus inflation) now stands at levels last seen in 1981. Mission accomplished Abe.

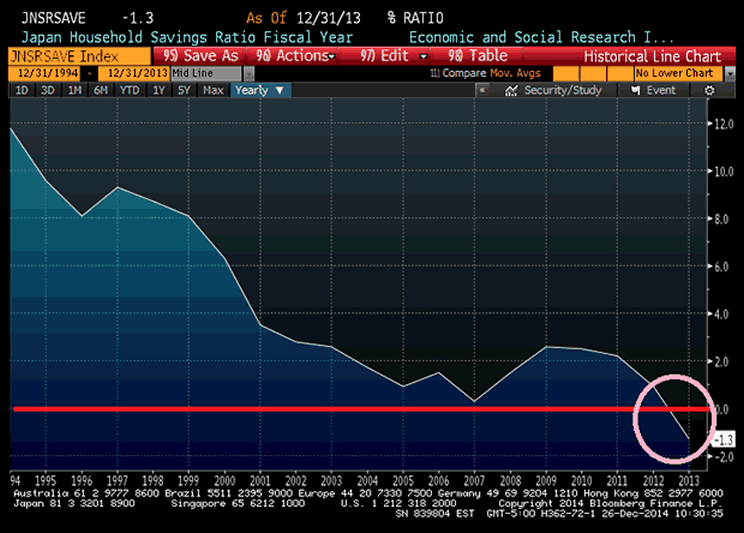

The common Japanese folks have been so enraptured with the Abenomics, they drove the national savings rate negative for the first time since 1955. The savings rate is now negative 1.3%. Krugman sees this as a huge success as the peasants have to draw down their savings to pay for sushi and heat. At least the government got a greater cut with the increased sales tax. Imported inflation is curing that excessive saving "problem" which Krugman and his Keynesian cohorts believe is holding the Japanese economy back. They ignore the fact that Japan experienced its phenomenal economic growth in the 1970's and 1980's when the national savings rate was between 15% and 25%.

Those not polluted by Ivy League business school dogma realize savings leads to capital investment and healthy economic growth. Low savings and rising debt are a symptom of a diseased consumption based economy which cannot be sustained. The elderly are being forced to use their savings to survive and the workers can't save when their real wages continue to decline. With huge labor slack (1.12 jobs available for every person seeking a position) and the government stopping at nothing to "achieve" inflation, real wages will continue to fall, exacerbating the downward spiral and portending the final ruin.

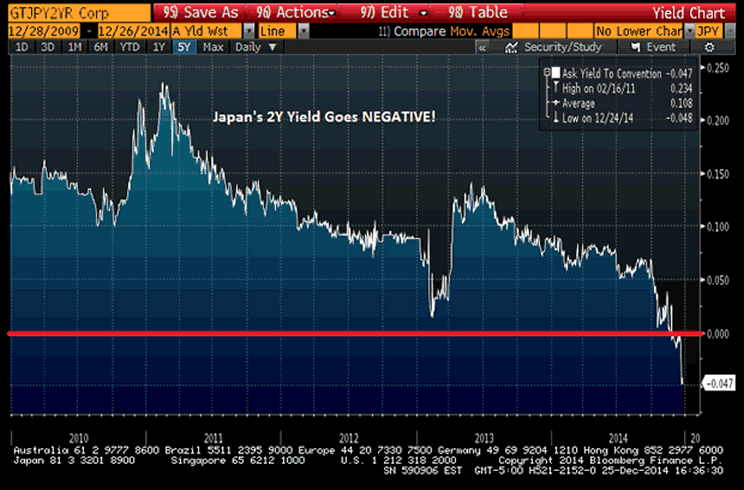

Yields on Japanese debt with maturities less than four years are now negative. And that is before taking into account inflation that has averaged 2.7% over the last year. An investment in Japanese short term debt is guaranteed to produce a negative 3% return. And if you are a foreign investor you get the benefit of losing more money due to the plunging Yen. There will be no one other than the Bank of Japan foolish enough to buy Japanese debt from this point forward. The warped thought process of Japanese leaders and financial journalists is summed up in this quote from Bloomberg last week:

The Bank of Japan this month maintained its unprecedented stimulus as Governor Haruhiko Kuroda's battle to stoke inflation faces challenges from tumbling oil prices. The central bank plans to boost the monetary base at an annual pace of 80 trillion yen ($666 billion), it said in a statement.

Only a central banker could see a huge drop in oil prices as a negative for the people of Japan who import all of their oil. Keynesians actually believe a consumer spending less for energy is an undesirable outcome. This is why common folk hate central bankers.

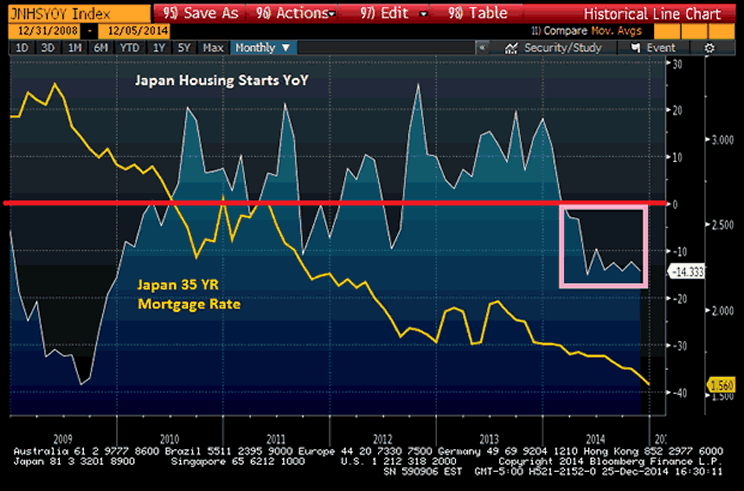

The Japanese housing market has plunged to 2009 levels despite 35 year mortgage rates being cut in half since 2009. If borrowing at 1.56% for 35 years can't revive their housing market, maybe they should just give the houses away. With a rapidly aging population, middle aged workers seeing their real wages falling, and less young people entering the workforce, the Japanese housing market is DOA at any interest rate.

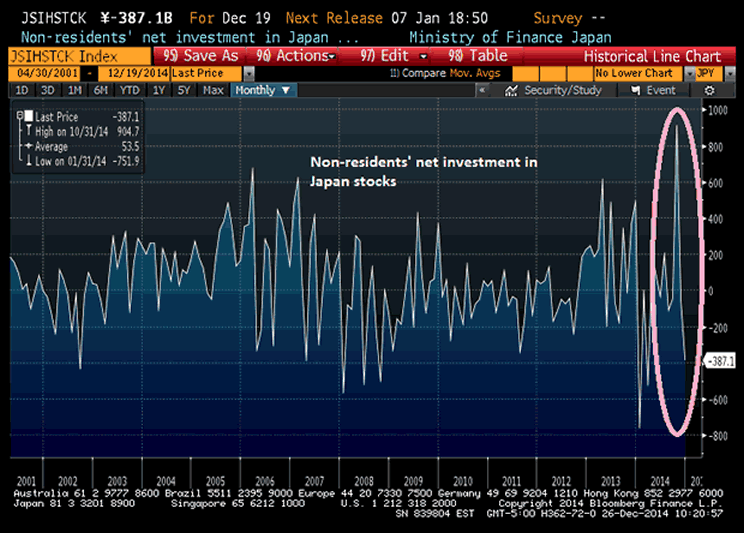

One of the main purposes of devaluing your currency is to spur exports of products produced by your manufacturers. Japan ran trade surpluses for decades, but has now run trade deficits for 29 consecutive months. Their trade deficits have averaged more than $8 billion per month in 2014 - another feather in the cap of Abenomics. Foreign investors have lost faith in Abenomics and the Keynesian dogma which has plagued Japan for twenty five years. Abe has no strategy other than to roll out more stimulus plans, hand more money to Japanese banks and corporations, and have the BOJ buy all of the debt supporting these plans, while buying stocks in Japan and the U.S. for good measure. Foreign investors are fleeing. Inflows were down 94% in 2014. Foreign investors ran for the exit in November selling 387 billion Yen worth of stocks.

Purchases of the nation's shares through mid-December by investors outside Japan were less than a tenth of the 15.1 trillion yen they bought last year. Japanese Trust banks, which trade on behalf of pension funds, have added 2.7 trillion yen, after being bullied into buying stocks by Abe and his central banker cronies. These same Trust banks had rationally dumped about 4 trillion yen of equities in 2013. Japanese individuals, who see the writing on the wall, were net sellers for a fourth straight year. The surprise (not to Yellen) easing on October 31 temporarily brought the Wall Street traders into the market for its initial surge, but they have since exited stage left. The only entity stupid enough to invest in Japanese bonds or stocks is the Japanese government.

With a Shiller PE ratio exceeding 30 and future stock losses virtually guaranteed, the Government Pension Investment Fund, the world's largest manager of retirement savings with 130.9 trillion yen in assets, pledged on Oct. 31 to more than double its target allocation for domestic shares. That means they will be buying another 9.8 trillion Yen of Japanese stocks. Not to be outdone, the Bank of Japan unveiled an expansion of its asset-purchasing program, including tripling investments in exchange-traded funds to about 3 trillion yen a year. The announcement on October 31 had one purpose and one purpose only - to create a stock market rally. It worked.

The Japanese market soared by 18% in a matter of days. The Japanese .1%, bankers, corporate insiders, government apparatchiks, and Wall Streeters in the know were the only beneficiaries. Only 6% of households in Japan own any stocks. The ruling elite continue to reap the rewards, while the average person sinks further into despair and impoverishment. The Japanese boom ended twenty five years ago. The boom was illusory. The rapidly aging Japanese populace will not do the bidding of their masters. After a 25 year recession they are despondent and dispirited. They don't trust or believe their government and banking leaders. Death by Keynsian hari kari will finish off this once great economic powerhouse.

"The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration." - Ludwig von Mises

As Goes Japan, So Goes the World

Japan just happens to be ahead of the curve on the path to collapse. Europe isn't far behind. In a shocking turn of events, it seems a bad debt problem cannot be solved by issuing more bad debt. The country which kicked off the EU financial crisis and their round of credit expansion - Greece - is imploding again. Greece, with a 26% unemployment rate, government debt to GDP of 175%, a budget deficit equal to 12% of GDP, and incapable of making their debt payments, had 3 year bonds yielding just over 3% in September. Today they yield 12%. I wonder who invested in Greek bonds at 3%. The Greek stock market had gone up by 170% since mid-2012 because their future was so bright. It has now fallen by 60% in the last nine months. Greece was a basket case bankrupt country in 2012. It is more bankrupt today. The mal-investment in Greece, aided and abetted by Goldman Sachs, created a false boom that is going bust. When it inevitably collapses it will take down many European banks and plunge Europe into depression.

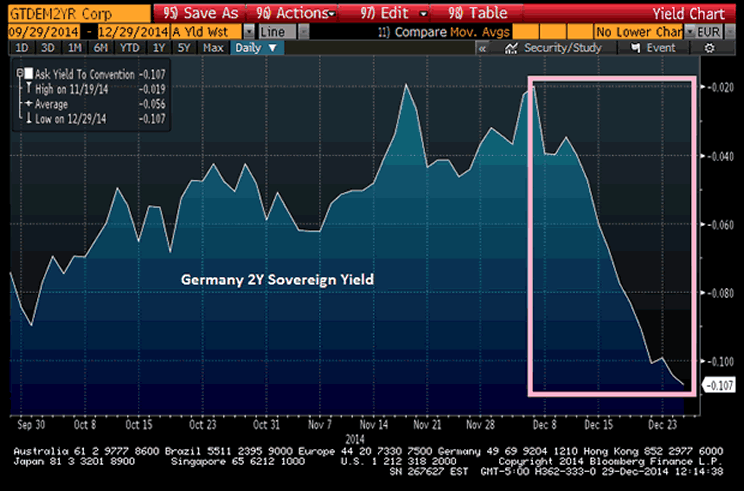

Maybe that is why German 2 year bond yields have plunged into negative territory.

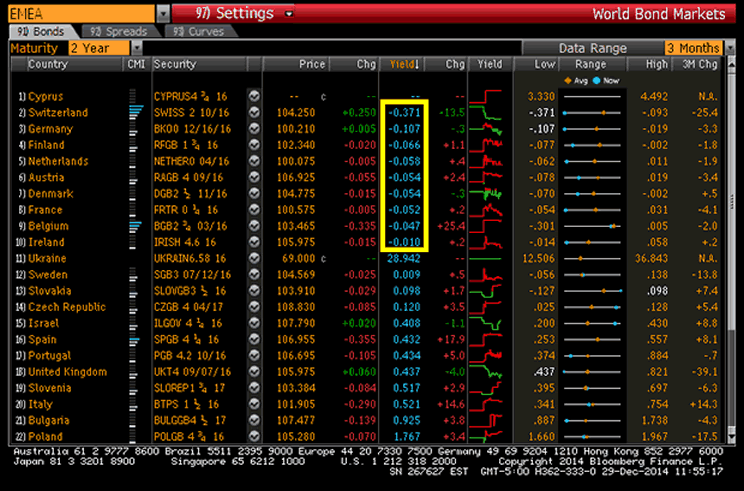

Maybe that is why 2 year bond yields in Switzerland, Finland, Netherlands, Austria, Denmark, France, Belgium, and Ireland have all gone negative in the last month. Those 2 year Ukrainian bonds sure look tempting at a 29% yield. What could possibly go wrong?

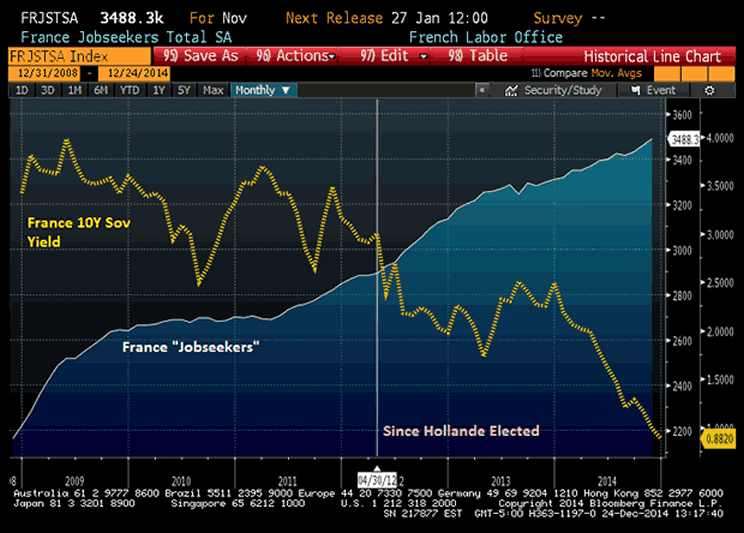

European country GDP rates are barely above 0%. Germany is headed into recession as Obama's Russian sanctions have no impact on the U.S., but destroy economies in Europe. France, the 2nd biggest economy in Europe, has seen their 10 year yields plunge from 2.5% to 0.9% over the course of 2014, while their jobless rises unrelentingly to new highs. These are sure signs of a Keynesian inspired economic recovery.

With Japan in a depression, Europe in a recession, China experiencing a slow motion real estate collapse, Russia headed into recession, Brazil in recession, and all Middle East oil producing countries ($500 billion decrease in oil revenues in 2015) headed south, the U.S. is the prettiest horse in the glue factory. You can ignore the dramatic flattening of the yield curve and the plunge in 10 year treasury yields from 3% to 2.1% over the course of 2014. We've got Obamacare spending and military spending to pump up our GDP and the Federal Reserve to pump up our stock market. Mortgage applications at 15 year lows, new home sales at previous recession lows, real median household income 9% lower than 2008, 19% of all households on food stamps, real unemployment exceeding 15%, and the real nasty aspects of Obamacare about to hammer businesses and individuals, all add up to a fantastic year ahead for our welfare/warfare empire of debt.

The global economy is imploding. Stock markets do not reflect the economic circumstances of the average person in Asia, Europe or the U.S. Governments across the globe have been captured by banking, corporate and military interests. They have used their power to subsidize rich elite oligarchs at the expense of the common people. Their weapons have been debt, control of interest rates, ability to rig stock, bond and currency markets, and media propaganda to convince the masses these criminal actions have actually benefited them. The people are beginning to realize government is not their friend. Trusting the government to solve the problems they created which led to the 2008 worldwide financial collapse, is insane. They have saved their .1% benefactors, while impoverishing billions. Now that their "solutions" are failing again, they will use real weapons wielded by soldiers, police and prison guards to enforce their decrees and self-serving laws. The year of consequences may have finally arrived. The people versus their governments is crystallizing as the impending chaotic clash which will turn violent, bloody and vicious. Your freedom will depend upon the outcome.

"It is important to remember that government interference always means either violent action or the threat of such action. The funds that a government spends for whatever purposes are levied by taxation. And taxes are paid because the taxpayers are afraid of offering resistance to the tax gatherers. They know that any disobedience or resistance is hopeless. As long as this is the state of affairs, the government is able to collect the money that it wants to spend. Government is in the last resort the employment of armed men, of policemen, gendarmes, soldiers, prison guards, and hangmen. The essential feature of government is the enforcement of its decrees by beating, killing, and imprisoning. Those who are asking for more government interference are asking ultimately for more compulsion and less freedom." - Ludwig von Mises

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2014 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.