Savage Murder In Paris Shows Freedom, Western Societies and Economies Vulnerable

Politics / Social Issues Jan 08, 2015 - 03:44 PM GMTBy: GoldCore

The savage attacks on the satirical magazine, Charlie Hebdo, in Paris leaving 12 dead yesterday shows how vulnerable western societies and economies are to the twin threats of terrorism and war.

The savage attacks on the satirical magazine, Charlie Hebdo, in Paris leaving 12 dead yesterday shows how vulnerable western societies and economies are to the twin threats of terrorism and war.

The attacks pose threats to our already under attack freedoms – freedom of the press, freedom of privacy, freedom of religion, freedom of conscience, freedom of speech, expression and thought.

It poses risks to the open societies that have been regained in recent years – in terms of freedom of movement of goods, services and people in the EU and internationally. This in itself poses real risks to already fragile economies in France, the EU and internationally.

The concern is that this may be the opening salvo in a new wave of conflict between NATO states and supra-national and radicalised Islamic groups across the Middle East.

Eyewitnesses say and photos and videos show the hooded attackers brandishing AK-47’s operated with the clinical coolness of professional assassins or battled hardened military men. Although they have not been captured at this point French authorities have identified them as French men, possibly of Algerian extraction and they are being linked to Al Queda in Yemen.

As the attack began, it is alleged that they shouted to bystanders, “Tell the media that this is al-Qaeda in the Yemen.” Other reports say that they said this to a female employee as she left the building with her child, as they entered the building.

For the five million Muslims living in France, over 7.7% of the population, and for Muslims across Europe it promises to be an uncomfortable few months as a wave of distrust, hatred and anger sweeps through the wider society and intelligence agencies, the far right and governments seek to exploit the attack for their own purposes.

The attacks have brought more attention than could possibly have been expected on the book “Submission” by Michel Houellebecq which was featured on the cover of yesterday’s Charlie Hebdo magazine and the apparent motivation for the violence.

The book is reminiscent of the horrible 1930’s anti-Semitic propaganda or the alarmist Cold War slogans such as “The Russians are coming.” It fear mongers and portrays a France in 2022 which has become an Islamic theocracy when a fringe Islamic party seizes control of the state through the democratic process in similar fashion to the Nazi party in 1933.

It is silly and will never happen but worse, it is prejudiced, Islamophobic and anti-Muslim and designed to create fear of Muslims – the majority of whom are normal, peace loving human beings.

It is particularly tragic that France should have been targeted by terrorists given that they voted in favour of Palestine taking a seat at the International Criminal Court only in December.

France has been an ambiguous NATO member in recent years. They are in the process of finishing the production of two battleships which were ordered by Russia before the Ukraine crisis began.

There is a risk of refraining to the simplistic and dangerous narrative of the fabled “Clash of Civilisations” that arms companies, militarists and terrorists globally are intent on provoking.

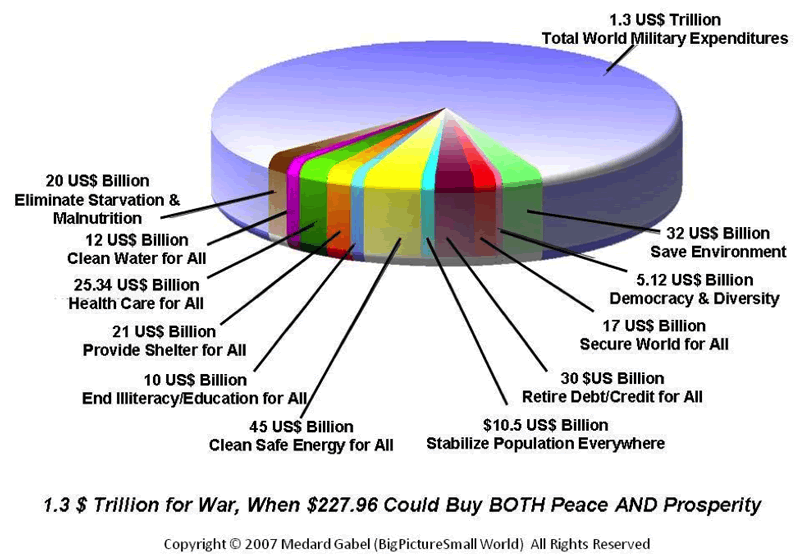

We must break the vicious loop – militarists use terrorism to justify war and terrorists use war to justify terrorism. We are slow learners that violence does not work and only breeds more violence.

Some would use terrorism to close borders, others to promote war and a further erosion of our civil liberties and civil rights. Instead, we should seek to address the root causes of terrorism which is poverty and injustice.

Nearly four years of war in Syria has created a staggering humanitarian crisis, with a huge one-third of the country’s original 23 million inhabitants displaced and more than three million of those registered as refugees in other countries.

“It is like the seven plagues of the Bible falling on these poor people,” Jan Egeland, the secretary general of the Norwegian Refugee Council, said yesterday.

Perpetual war in the Middle East and North Africa will lead to even more suffering in the region. Potential war with Russia does not bear thinking about.

The consequences of war are innocent victims, poverty and injustice. This is a breeding ground for the terrorists of today and tomorrow.

Unless as a race we change direction and there are always alternatives – the prospect for greater instability in the form of terrorism and war in the near future is very high.

Get Breaking News and Updates Here

MARKET UPDATE

Today’s AM fix was USD 1,206.50, EUR 1,025.06 and GBP 800.97 per ounce.

Yesterday’s AM fix was USD 1,213.75, EUR 1,023.83 and GBP 802.37 per ounce.

Spot gold fell $6.60 or 0.54% to $1,212.30 per ounce yesterday and silver rose $0.01 or 0.06% to $16.54 per ounce.

Gold in GBP – 5 Days (Thomson Reuters)

Further weakness in the euro today has lifted gold priced in the single currency by 0.2 percent to over 1,025 euros an ounce. Gold in euros is has risen risen 4.4% this year after the 11% gain in 2014 as gold seeks to price in the twin risks of Grexit and or Draghi’s money printing ‘bazooka’.

Euro-denominated gold has consolidated after breaking above EUR 1,000/oz for the first time since last March on Monday, to reach a 15-1/2 month high at EUR 1,029.81/oz yesterday.

Gold in pounds has been an even stronger performer since the start of the year and has risen from GBP 760 to over GBP 800 per ounce today or 5.2%, compared to a 1.9% rise in dollar terms.

Gold has fallen two days in a row as global equities rebounded and as traders took profits after gains in recent days.

Gold in GBP – 5 Days (Thomson Reuters)

Tomorrow’s closely watched U.S. non farm payrolls report, a key barometer of the U.S. economy, is estimated to show an increase of 240,000 and the unemployment rate dropping to 5.7 percent.

World stocks rose as signs of sluggish global economies increase speculation that central banks will support stimulus efforts.

Silver slipped by 0.7 percent at $16.35 an ounce, while platinum was up 0.1 percent at $1,215.10 an ounce and palladium was down 0.3 percent at $785.72 an ounce

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.