The ECB Will Be Big Factor in 2015’s First Half Stock Markets

Stock-Markets / Stock Markets 2015 Jan 10, 2015 - 06:47 AM GMTBy: Sy_Harding

The European Central Bank has provided assurances for months that it is ‘monitoring’ economic conditions in the 18-nation euro-zone, and will take aggressive stimulus measures ‘if necessary’.

The European Central Bank has provided assurances for months that it is ‘monitoring’ economic conditions in the 18-nation euro-zone, and will take aggressive stimulus measures ‘if necessary’.

However, even as those economic conditions worsen, increasingly indicating the euro-zone is sliding into recession, and pressure mounts for the ECB to take action, it has done nothing except periodically re-affirm its assurances that it will do so if necessary.

Meanwhile, pressure for it to take action continues to build. The latest pressure came from the minutes of the U.S. Fed’s December FOMC meeting, released this week. The minutes showed Fed governors concerned about the euro-zone’s slide toward recession, and the impact it could have on the U.S. economy. They expect policy makers in Europe will do the right thing and respond with aggressive stimulus measures. However, in a not so subtle warning, they noted that global economies and markets could respond negatively if the ECB does not follow through on expectations.

In a letter to a European Union lawmaker on Thursday, ECB President Mario Draghi said, “The ECB Governing Council is unanimous in its commitment to using additional unconventional instruments within its mandate.”

Bloomberg News reported Thursday that the ECB’s staff has presented ECB officials with several alternative QE stimulus plans, including buying as much as 500 billion euros ($591 billion) of investment grade assets.

The increased hopes that the ECB will act at its January 22 meeting created a big two-day rally in European stock markets on Wednesday and Thursday. However, that rally reversed to the downside on Friday when additional disappointing economic reports were released.

Those reports and the reaction of markets may still put more pressure on the ECB to act.

We know what happened in the U.S. market when the Fed announced QE3 ($40 billion a month of asset purchases) in 2012, and then doubled it to $85 billion in December 2012.

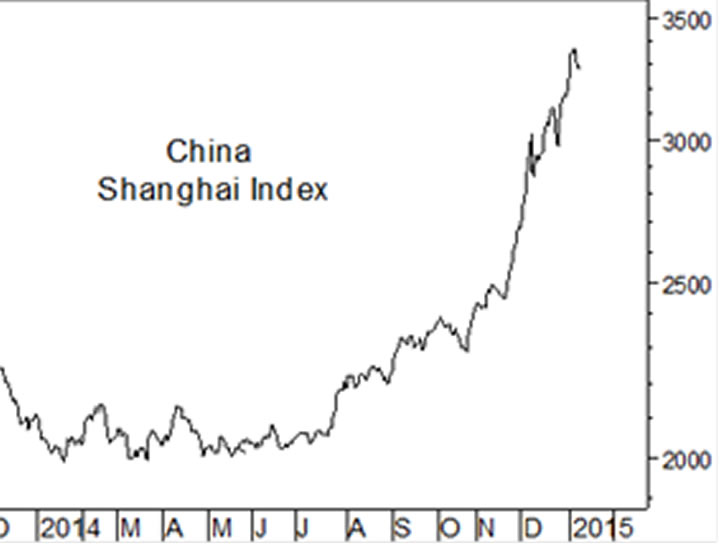

We also know what happened to China’s market when its central bank announced last October that it would inject up to $32.8 billion into 20 large national and regional banks, and take other steps to increase the stimulus measures it had initiated in April.

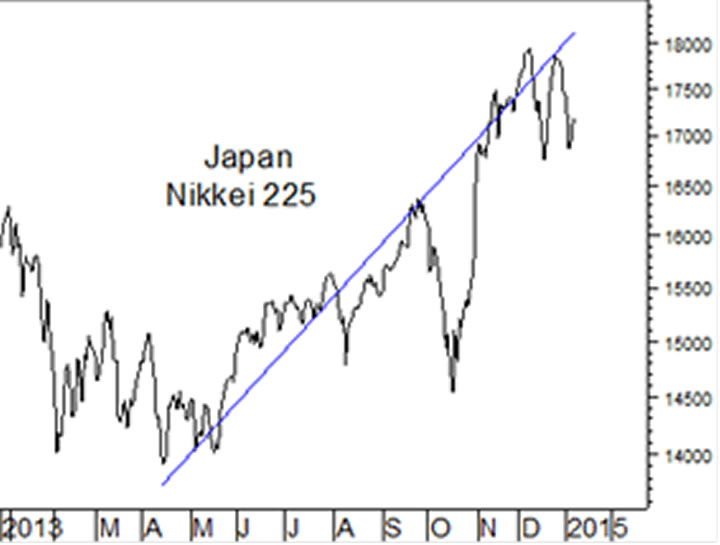

We know what happened in Japan’s market in 2013 after new Prime Minister Shinzo Abe initiated his massive fiscal and monetary stimulus plan dubbed Abenomics. Although its effect on the economy has been disappointing, its effect on the Japanese stock market is obvious.

So, it’s no wonder that global markets await action by the ECB with great expectations, but also with considerable apprehension as it continues to drag its feet.

A widely hoped for positive decision at the ECB’s January 22 meeting could well have a result similar to stimulus announcements in the U.S., China, and Japan. However, another meeting ending with no action, only more of the familiar promises of action ‘if necessary’, could well be devastating as markets lose patience.

The minutes of the Fed’s December FOMC meeting indicate the ECB’s decision one way or the other may even have a big influence on when the Fed will feel confident enough to begin raising interest rates in the U.S.

Therefore, the ECB meeting on January 22 may well be a defining factor for global markets, including that of the U.S., for at least the first half of 2015.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.