Bitcoin Price At Beginning of an Extremely Important Decline

Commodities / Bitcoin Jan 13, 2015 - 04:49 PM GMTBy: Mike_McAra

Briefly: short speculative positions, stop-loss at $257, take-profit at $153.

Briefly: short speculative positions, stop-loss at $257, take-profit at $153.

There’s been a plunge in the price of Bitcoin and this is reflected by an uptick in the (already relatively high) number of news stories covering the “Bitcoin crash” or how much the currency has lost since its peak values. On CoinDesk, we read:

The bitcoin price has plunged below $250 and appears to be falling further, as sell orders pile up at major exchanges.

The price opened the day at $267.08, but quickly fell after just two hours of trading. Soon after 3am (GMT), the price plunged through the $250 mark, which market watchers see as an important psychological barrier for the price.

The price held steady, but then plunged again about seven hours later, at around 10am. The price then fell about $14 to fall under the $230 mark (…).

(…)

Market-watchers have previously warned that if the price falls below $250, then further losses could be in the offing.

The increase in negative news on Bitcoin might actually be a contrarian sign that a bottom is close. The move below $250 seems to have spawned more negative stories than we’ve seen in the recent past. So, this might be read as a signal that the selling power is being drained.

On the other hand, the “Bitcoin crash” news hasn’t really made its way to mainstream media in a blatant way. Bitcoin still is not one of the major stories on financial websites and doesn’t really crop up in general news services. So, there’s been deterioration in the sentiment but it hasn’t been enough to suggest a long-term bottom, at least not yet.

For now, we focus on the charts.

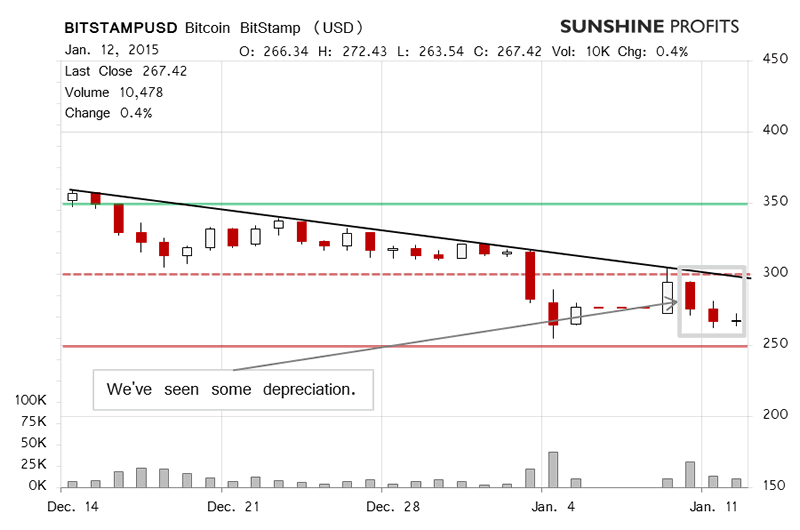

On BitStamp, we didn’t really see that much action yesterday and we analyzed the situation in the following way in yesterday’s alert:

(…) following the Friday’s appreciation, the currency took a dive on Saturday, erasing most of the previous gains. If the move on Friday was on moderate volume, the selloff on Saturday was more violent. It was followed by more depreciation on Sunday with the volume lower than on Saturday but higher than on Friday. Over the weekend, Bitcoin actually went down. Overall, these developments were not really encouraging as far as the short-term outlook is concerned.

Today (this is written around 9:00 a.m. ET), there has been a weak move up and the volume has been relatively feeble. This reads more like a breather before a more significant decline than anything else at this time.

It now turns out that this has been confirmed by a strong and volatile move down. Bitcoin has taken a significant dive, losing some 13% and the volume has ballooned to over BTC40,000, the highest level since the Jan. 4 plunge (this is written around 11:00 a.m. ET). The currency hit its lowest point today (so far) at $216. This is particularly important since we actually haven’t seen such levels in more than a year. The volume is also in the range which we have seen at important points in the past. This might suggest that there are very important times just ahead of us.

If you recall, on Jan. 6, when Bitcoin was at $270 we changed our hypothetical speculative positions to short. These hypothetical positions are already profitable. The question now remains whether it’s time to close them out.

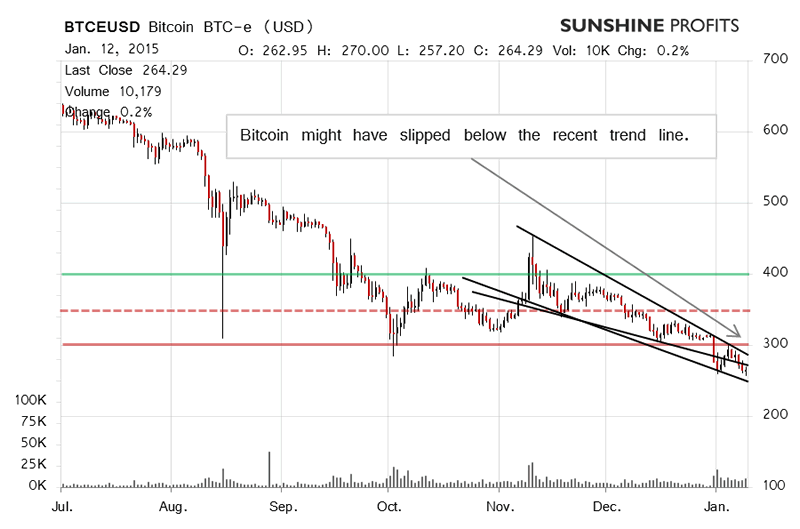

On the long-term BTC-e chart, we still don’t see the slump on the chart (it’s based on daily closes) but if it were to be included, it would suggest not only a break below the possible trend line based on the November and December local lows (the line ending around $280) but also a break below another possible declining trend line based on the November local low and the local low at the beginning of January (the line ending around $250). If you recall, yesterday we wrote:

Today, we saw depreciation to as low as $257 before the currency retraced up to over $265. The move today hasn’t been very strong just now but it might turn out being stronger than yesterday. A close below $270 could be an indication of more depreciation to come. The current situation is already bearish, but it might become even more bearish in the next couple of days, maybe even today or tomorrow.

And tomorrow it was. The slump has taken Bitcoin visibly down and it already is a sign of significant deterioration in the market, possibly a first step to $200. We have to recognize, however, that Bitcoin has actually lost much altitude in the last couple of days, from around $290 to $220 at the lowest (on BTC-e). For our readers, this has coincided with our suggested hypothetical short positions. These positions were suggested when Bitcoin was at $271.91 on BTC-e. Bitcoin is now at $234.00 which would correspond to a 13.9% gain in only 8 days on such a hypothetical position (transaction costs not included).

We still think that the gains might grow even further as we’re inclined to bet on falling Bitcoin prices. However, taking into account the magnitude of the recent depreciation, we take a precaution against a possible rebound by adjusting our stop-loss levels to $257. We also move our take-profit level to $153. In this way, we lock in some of the current gains on the hypothetical position while allowing more gains should Bitcoin in fact fall deeper. It might be the case that the action tomorrow (or even later today) will clarify the situation even further. In the current volatile environment it’s best to stay tuned to the market and we’ll keep monitoring the market.

Summing up, we think short speculative positions are still the way to go.

Trading position (short-term, our opinion): short speculative positions, stop-loss at $257, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.