Gold Price Due for a Setback?

Commodities / Gold and Silver 2015 Jan 23, 2015 - 04:14 PM GMTBy: Dan_Norcini

Now that we have had a chance to see how the dust settled after this historic day in the markets, there are some observations I would like to make.

Now that we have had a chance to see how the dust settled after this historic day in the markets, there are some observations I would like to make.

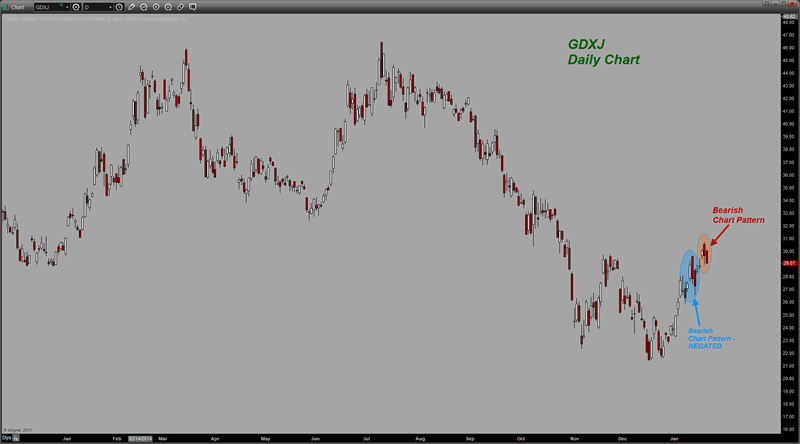

I want to start out first with the junior mining shares, as evidenced by the GDXJ. The readers know that I have expressed concern over the fact that this group has been lagging the performance of the actual metal. Typically, in a strong upside run in gold, that is not the case as this index tends to outperform the metal itself.

Yesterday, the market was on the verge of posting yet another OUTSIDE REVERSAL DAY LOWER ( like it did last Tuesday) but in the final hour of trading, it managed to bring in enough buying to take it well off the trading session low. Still, the chart pattern raised my eyebrows as it closed very near the open of the previous day; that is not bullish price action.

Today, the market opened well after the announcement from the ECB and when it did, that was essentially the high point of the day. It went lower from there. That too is NOT bullish price action. This reluctance of the junior miners to follow/lead the gold price higher as well as its lagging of the mid-tiers and the major miners, is disconcerting if one is a bull. For whatever the reason, the big buyers are not interested in chasing these stocks higher.

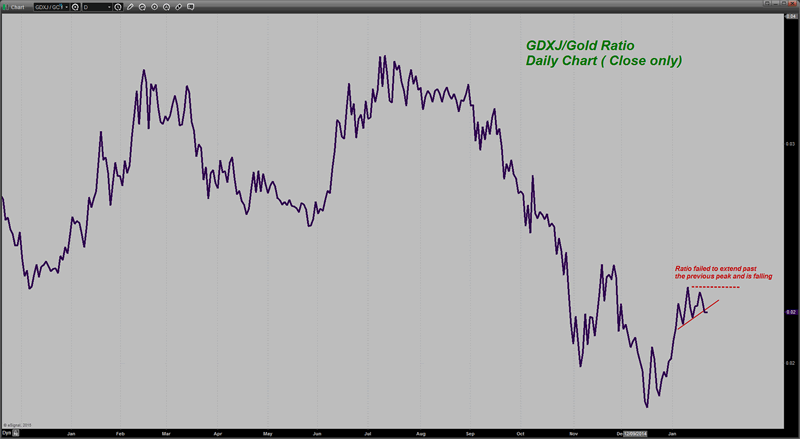

The result of this relative apathy towards the junior miners can be seen in that ratio chart which I have been posting recently. As noted with that ratio, it tends to be a leading indicator of the actual gold price itself. When the ratio declines, generally the price of gold will follow within a couple/few days later.

Note on the chart that this ratio continues to be weak ( it has been rising since the last part of December – just as the gold price has been rising ) and that becomes something to monitor very closely.

Based on what I am seeing here in this ratio, it looks to me like gold is getting a bit tired up here. Please understand that I am not saying the move higher is finished and now gold is getting ready to reassert a bearish trend. What I am saying is that one of the recent drivers behind the move higher in gold was fear/uncertainty over the slowing global economy which was resulting in negative interest rates in some cases and ultra low interest rates in others.

That however is all well-known to the gold market by now. Today’s ECB announcement also removes one more bit of that uncertainty because we now know exactly what the ECB plans are as well as the amount involved and the duration.

One can see the relief by investors evidenced in the sharp drop in the VIX and the late afternoon surge in equity markets. I would expect Japan to follow suit early this evening in that regard.

It occurs to me that the last big uncertainty we face is the outcome from this weekend’s election in Greece. That should keep gold relatively well supported on any move lower that occurs tomorrow as it would be a surprise to me if traders wanted to get too aggressive on the short side of gold heading into that unknown vote.

That being said, with a lot of the uncertainty being removed from the ECB announcement, one wonders if gold is due for a breather up here.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.