Learn from My U.S. Dollar Mistake

InvestorEducation / Learn to Trade Jan 31, 2015 - 05:02 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: "Today may be the very top in the U.S. dollar," I said on Fox Business two weeks ago.

Dr. Steve Sjuggerud writes: "Today may be the very top in the U.S. dollar," I said on Fox Business two weeks ago.

I was wrong. I need to learn from my mistake...

If you want to get better at investing, you need to analyze your mistakes. That way, you don't make them again.

So let's take a look at what I did, and where I went wrong...

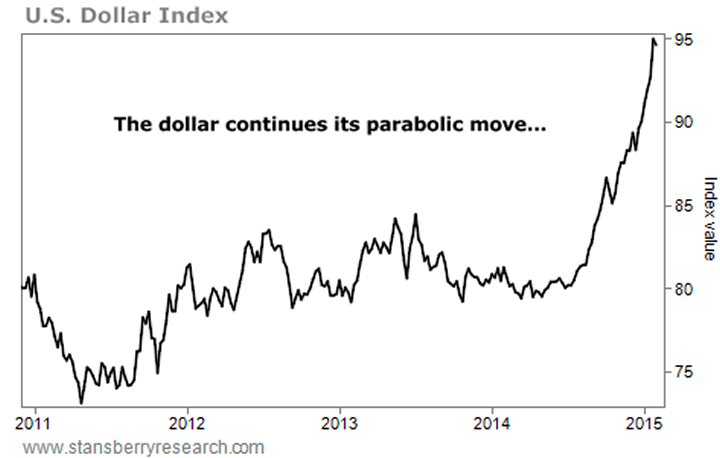

It turns out, two weeks ago was NOT the top in the dollar. Instead, the dollar has continued to "go parabolic." Take a look:

My first mistake was that you never want to fight a "parabolic" move.

Personally, I have had trouble with this one in my career... When you see an investment soar in an extreme way, the bust is often just as extreme – when it finally arrives. The trick is when that day arrives.

Parabolic moves can keep going, and going... You don't want to fight them. You can lose a lot of money, quickly, by betting against them.

My next mistake was this: You can't trade "value" or "sentiment" by themselves... Instead, you have to wait to have the trend in your favor.

Right now, sentiment on the dollar is at a record high – everyone loves the U.S. dollar. And sentiment on the euro is at record lows – everyone hates it. These sentiment extremes will change – very soon. And the way they will change will be through a stronger euro and a weaker dollar.

This should happen soon... But when? I can't know to the exact day (as I proved on Fox Business!).

It's smarter NOT to predict the exact day. Instead, you wait...

You use hindsight. When the trend has clearly changed in your favor, then you can make the trade. You might miss the first few percentage points of the move, but it is a much safer way to trade.

In the case of the dollar, I didn't have the trend yet... I just had sentiment. So I got it wrong.

As a newsletter writer, it might make for a great headline to call the top. But the reality is, you can still make plenty of money – in a much safer way – by waiting for the trend to go in your favor before making the trade.

So in summary:

1. Never fight a parabolic move

2. You can't trade value or sentiment by themselves

3. Wait for the trend to go your way before you place your trade.

Hopefully I will do these things the next time around.

I learn more from my wrong calls than I do from my right ones. I strongly suggest you analyze each trade you make, to figure out what you could have done better.

That's how you get better as an investor... so do it!

Good investing,

Steve

Editor's note: If you'd like more insight and actionable advice from Dr. Steve Sjuggerud, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the five must-read books on investing. This report will show you several of the DailyWealth team's "must read" books, which will help you become a better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.