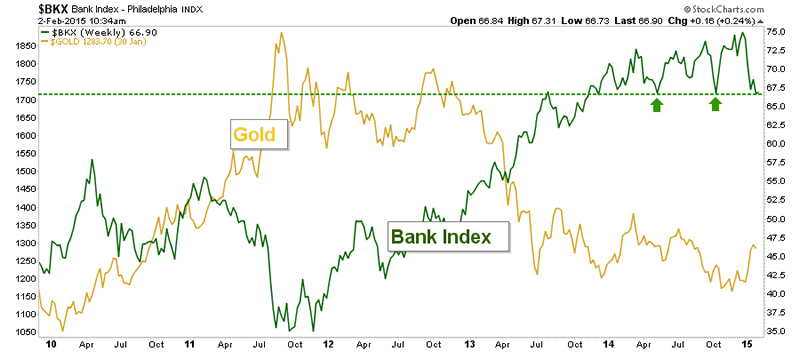

Gold & US Banks; a Critical Juncture

Commodities / Gold and Silver 2015 Feb 02, 2015 - 06:28 PM GMTBy: Gary_Tanashian

It’s all about confidence, right? Right.

In 2011, when the commodity and ‘inflation’ trades blew out, the Federal Reserve was completely discredited, with gold bugs out front poking them in the eye with taunts of “Helicopter Ben”. Markets rebelled against the Fed by sending silver to $50 and commodities in general to an all-time high.

Today, we have come 180° as market participants the world over have been conditioned to revere policy made from on high. Herds being what they are, every utterance from the jawbones of these former buffoons is respected in the form of instantaneous market movement. It’s as if everyone believes the Fed is in total control.

One indicator that this confidence is coming unwound would be a breakdown in the banks. They are right at key… as in critical… as in bull market… support. Not surprisingly, gold has taken on an inverse stance to the Pigs. This should be interesting.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.