Precarious Times for Stock Markets

Stock-Markets / Stock Markets 2015 Feb 02, 2015 - 06:32 PM GMTBy: Bob_Loukas

It suddenly seems as though the good times in equities might be ending. Though my perspective is based only on “gut feel”, there seems to be an underlying level of fear that has crept into the markets. If so, it’s a real problem for equities. Any market trading at all-time highs and with a valuation far above historical averages requires a continued level of irrational excitement and speculative ignorance to remain sustainable. And fear is not consistent with irrational, speculative ignorance.

It suddenly seems as though the good times in equities might be ending. Though my perspective is based only on “gut feel”, there seems to be an underlying level of fear that has crept into the markets. If so, it’s a real problem for equities. Any market trading at all-time highs and with a valuation far above historical averages requires a continued level of irrational excitement and speculative ignorance to remain sustainable. And fear is not consistent with irrational, speculative ignorance.

When equities price in Risk, it can happen quickly, and I believe the markets are in the early stages of doing just that. Though equities don’t want to believe that significant downside is possible, crashes in commodity prices and massive demand for high quality debt are harbingers of significant declines ahead. In my opinion, the early stages of an equity market decline are unfolding, and it’s only a matter of time before it erupts into a serious event.

Macroeconomic measures don’t always correlate directly with equity market performance, at least not in the immediate term. But when economic numbers begin to look as ugly as they are at present, I can assure you that an overheated and extended market will stand up and take notice. Of particular note this week are several ominous signs:

- Earning season is off to a slow start; big names are missing earnings expectations, and forward guidance is at the lowest level since 2007.

- US Q4 real GDP came in at 2.6% annualized vs 3% expected.

- Durable goods fell 3.4% month-over-month, far below expectations.

- World bond market yields are crashing, and in some cases have become negative. Negative rates extend almost to the 10 year bonds, representing an insane level of safe haven buying.

- The S&P 500 had back-to-back down months for the first time since 2012, the last time we had a major Yearly Cycle Low.

- The German economy fell 0.3%, its first negative quarter since 2009.

- Inflation rates in Europe are now negative.

- Crude oil continues to crash.

In quoting the above statistics, I’m mindful of the fact there are always both negative and positive points that an analyst can use to support a point of view. In this case, though, I honestly feel that the severity and depth of current macroeconomic developments are well outside of the norm. The extreme movements in many markets are interrelated, and seem to be a reflection of a rapidly deteriorating economic landscape.

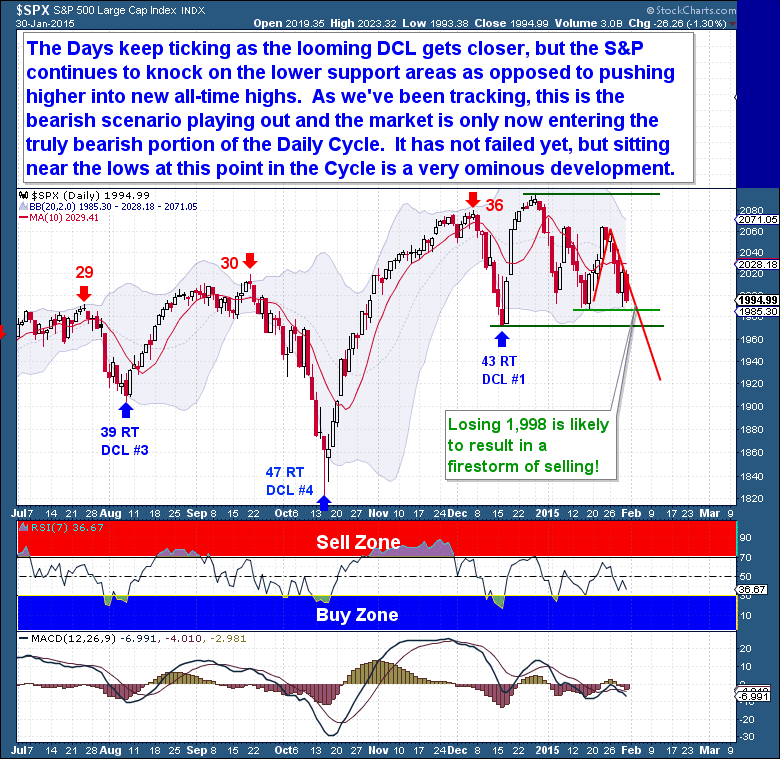

These shifts are showing up as weakness in equity markets. As days tick by, and as the Daily Cycle Low (DCL) draws closer, the S&P has continued to knock against lower support areas. Throughout the past 3 year bull advance, at this point in the Cycle the S&P has pushed higher to new all-time highs. So the current position – bumping against support – is definitely a change in character, one that is telling us that the market may be exhausted. In my opinion, it is also telling us that 2015 is going to be a difficult period for markets. The current Daily Cycle (DC) has not failed yet, but it’s sitting near the lows, and at this point, that’s a very ominous development.

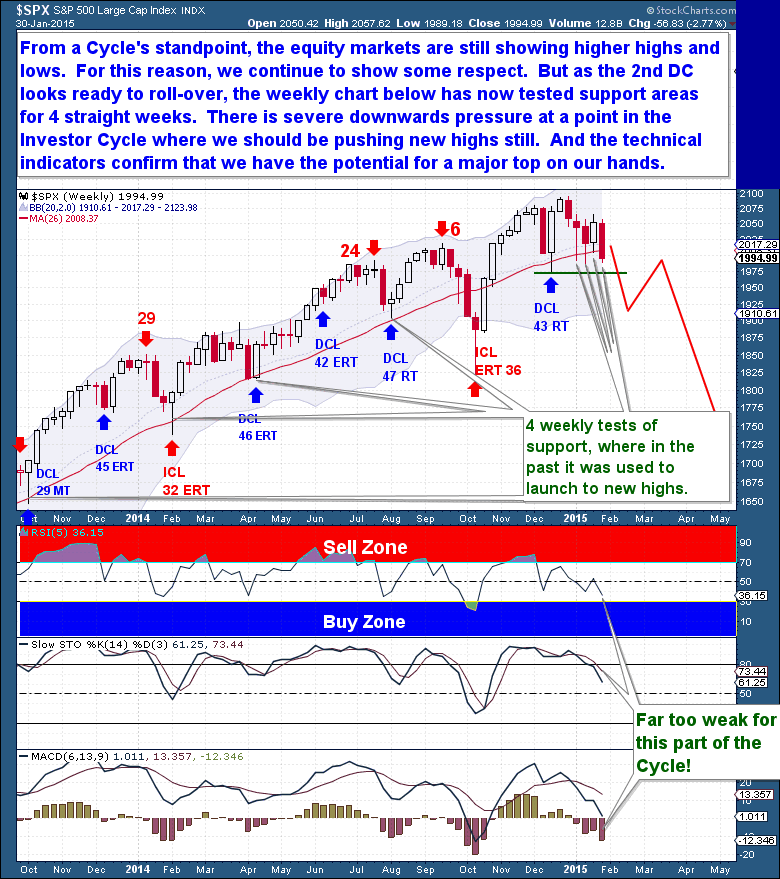

From a Cycle standpoint, the equity markets are still showing higher highs and higher lows. So, following strict Cycle discipline, I could make the argument that the bull market is alive and well. And for this reason, we are forced to show it some respect. But the most surprising development from here would be for equities to roar higher. Such a move would catch many (yet again) by surprise, but I think it’s unlikely this time.

The bull market has had its time, and the bears look like they will finally have a chance to control the action. With the 2nd DC looking ready to roll-over, and with numerous tests of the 26 week moving average in play, the market’s change in character appears ready to play out in prices.

Severe downward pressure is obviously building, and at a point in the Investor Cycle (IC) where a continuing bull market should see us pushing to new highs. The technical indicators confirm that this is an Investor Cycle in its declining phase, and it would be very rare to have the Cycle suddenly change course at this point.

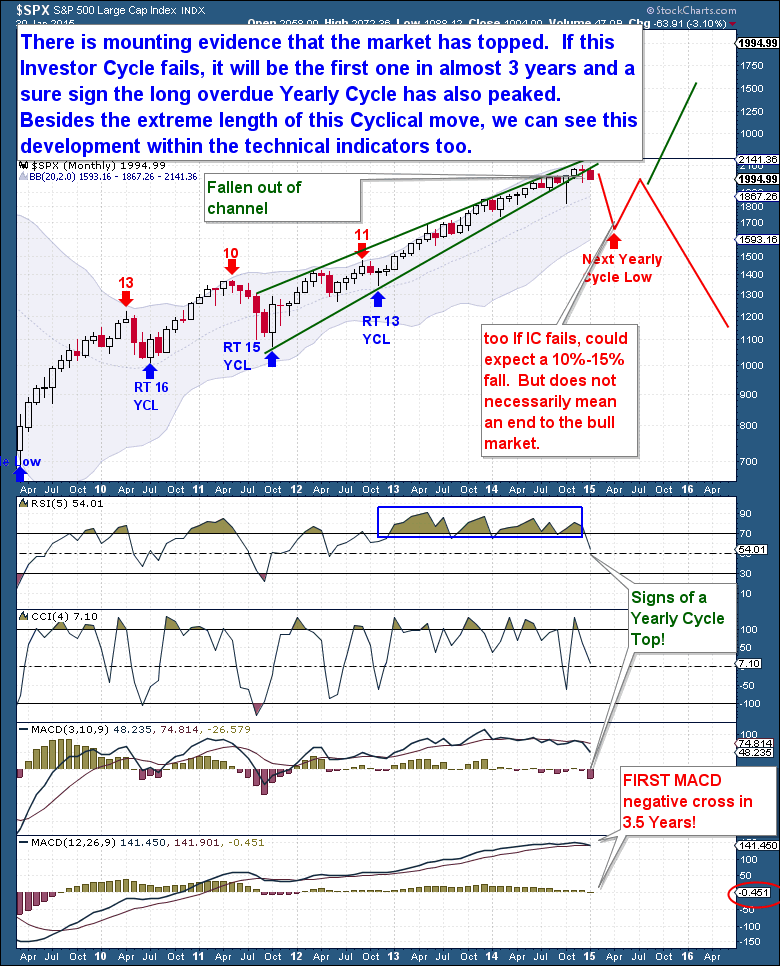

Recent developments are, perhaps, most apparent on a monthly chart. With January’s close, for the first time since the up-move began in 2011, we have a monthly candle that is entirely below the massive bull market channel. This alone is fairly strong evidence to support the idea that the market has topped.

The technical indicators paint a similar picture. The monthly RSI is showing diverging weakness, while the first negative monthly MACD cross since the 19%, 2011 decline is a serious warning sign. When we combine the negative technical indicators and macro-economic weakness with recent Daily Cycle struggles, and then consider them in the context of an overextended cyclical bull market, there’s compelling evidence that the market is on the verge of a major decline.

If the current Daily Cycle fails in the coming weeks, it will set off a domino effect of cascading Cycle failures. A DC failure would almost certainly result in an IC failure with a move below 1,816. This would be, at a minimum, a deep Yearly Cycle decline by the early spring. From there, how deep equities might fall is really anybody’s guess.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

View the Site: The Financial Tap

You’re just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try#

By Bob Loukas

© 2015 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.