Gold Consolidating Gains

Commodities / Gold and Silver 2015 Feb 02, 2015 - 06:44 PM GMTBy: Alasdair_Macleod

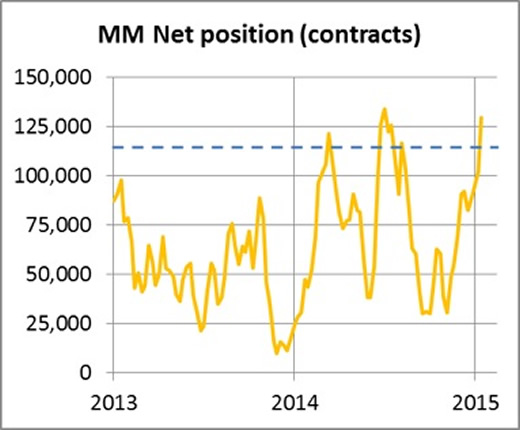

Gold and silver prices consolidated recent gains this week, both having become overbought short-term, and they now appear to be building a base before an attempt to convincingly attack higher ground, though yesterday’s price reaction was quite sharp. The recent slightly overbought situation for gold is shown in the chart below, which is of the Comex Managed Money category net position:

Gold and silver prices consolidated recent gains this week, both having become overbought short-term, and they now appear to be building a base before an attempt to convincingly attack higher ground, though yesterday’s price reaction was quite sharp. The recent slightly overbought situation for gold is shown in the chart below, which is of the Comex Managed Money category net position:

The dotted line is the average net long position (since 2006), so we can see that net longs are slightly higher than that average. This tells us that fund and hedge fund managers have undergone a huge shift in sentiment over the last two months.

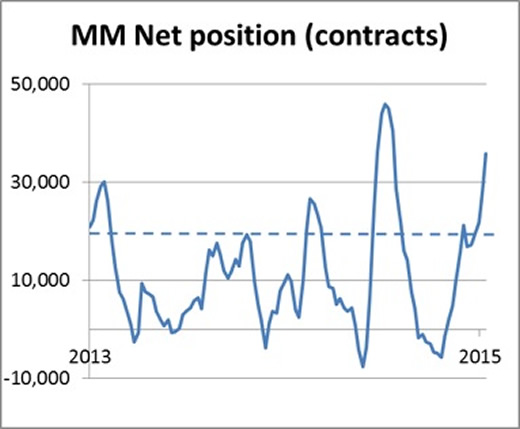

Silver tells a similar story:

Again, the dotted line is the long-term average net position, indicating that silver’s strong rally needs some consolidating. Any pause in the news flow is an opportunity for the bullion banks to mark the price down in the hope they can close some of their short positions, and that is what happened yesterday, with gold driven down over 2% and silver by nearly 6%.

Last time the Managed Money category was as bullish was in July last year, when gold ran up to $1330 and silver to $21. Gold and silver then fell back to new lows, so will this happen again?

Time will tell, and there is no doubt some of the large trading banks have a vested interest in seeing lower prices. But in mid-2014 markets were coming to terms with the end of the Fed’s quantitative easing programme; this time we have the ECB’s QE about to be implemented.

So background monetary fundamentals for gold and silver appear to be improving, with the ECB having announced this month quantitative easing of €60bn per month from March onwards. Ahead of this announcement the Swiss National Bank decided to abandon its peg to the euro, injecting a high degree of currency instability into European markets. These developments are more likely than not to produce European buyers for gold over time, and it is worth noting that, priced in euros, gold is already some 25-30% up from its recent lows.

Also in Europe there have been significant losses from the Swiss franc reaction, and the Greek banking system is suffering depositor withdrawals. It would, however, be wrong to expect too much impact on gold and silver from these events, until there is firmer evidence they could be systemically destabilising.

The bigger news is currencies. With both the Bank of Japan and the ECB determined to weaken their currencies against the US dollar, we have the makings of a return to deliberate devaluations, which is more likely to encourage Japanese and European buyers for bullion.

In other news, the Shanghai Gold Exchange has been delivering large quantities of gold into the wholesale markets, with a further 70.63 tonnes last week, making a total of 201.67 tonnes for the first three weeks of January. Note how rising prices have not deterred Chinese demand.

Next week

Monday. Eurozone: Manufacturing PMI. UK: CIPS/Markit Manufacturing PMI. US: Core PCE Price Index, Personal Income, Personal Spending, Manufacturing PMI, Construction Spending, ISM Manufacturing.

Tuesday. UK: CIPS/Markit Construction PMI. Eurozone: PPI. US: Factory Orders, IBD Consumer Optimism, Vehicle Sales.

Wednesday. Eurozone: Composite PMI, Services PMI, Retail Trade. UK:CIPS/Markit Services PMI. US: ADP Employment Survey, ISM Non-Manufacturing

Thursday. UK: Halifax House Price Index, BoE MPC Base Rate. US: Initial Claims, Non-Farm Productivity, Trade Balance, Unit Labour Costs.

Friday. Japan: Leading Indicator. UK: Visible Trade Balance. US: Non-Farm Payrolls, Private payrolls, Unemployment, Consumer Credit.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.