Why Corporate Earnings Reports Are Overrated

Companies / Corporate Earnings Feb 06, 2015 - 03:41 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: What I am about to share with you today won’t win me any friends on Wall Street. But, that’s how it goes.

Keith Fitz-Gerald writes: What I am about to share with you today won’t win me any friends on Wall Street. But, that’s how it goes.

This is important information to you as an investor and that’s why you need to know what it’s telling you. So I’m happy to take my lumps and show it to you anyway…

Right now we’re in the midst of the first “earnings season” in 2015, with publicly traded companies reporting their latest quarterly results – in this case from Q4/2014.

Millions of investors are understandably anxious and confused. Companies take off like a rocket on good numbers or get a multi-billion-dollar haircut on bad ones.

Thing is… Wall Street likes it that way. The more confused you are, the more profitable they are because investors who chase innuendo tend to trade more (and generate bigger commissions).

That said, it’s NOT a waste of time if you know how to sort out the information that actually matters and what it says about your money.

Here’s what you need to know.

Why Earnings Reports Are Overrated

Earnings season is a lot like going to the circus… a whole lot of “oohing and aahing,” bright lights, and noise. It’s entertaining but next to irrelevant for anyone interested in building real wealth over the longer term.

First, there’s a tremendous mismatch between the business cycles of most publicly traded companies and the quarterly reporting system. So the information being presented really doesn’t give you anything more than a snapshot of a company’s performance – and a badly focused one at that.

Take Boeing, for instance. The company has a multi-year lead time on any aircraft or weapons system order. So the notion that they’ve got to report numbers every 90 days is fundamentally flawed, especially when you’re talking about billion-dollar sales cycles.

Or how about Alibaba? The company has terrific numbers and unprecedented growth that it will capitalize on for years to come. Yet the street gave it an 8.8% haircut after gross profit margins fell to only 71.3%. Yet, the same market pushed Amazon shares up 8% after the closing bell with a comparable gross margin of 22.77% and a quarterly profit margin of 0.73%? Gimme a break!

Second, investing based on earnings expectations is like betting on a horse race after you know the results. That’s because most public companies provide guidance which is, of course, duly managed by competent CFOs to ensure the numbers are hit. Right now the forward-looking numbers have been guided steadily downward for several years, making any “beat” suspect. But the markets fall for it anyway.

Third, analysts are terrible stock pickers, generally speaking. Their job is to analyze data, gain insight, and assess value. Not trade. Institutional managers, on the other hand, are tasked with making money. There’s a big difference.

You can see that very clearly in a survey back in 2006 by Institutional Investor magazine, the most prominent professional publication of its kind, which actually showed that stock selection was ranked 11th out of 12 possible criteria prioritizing analyst capabilities.

That was made pretty clear in two of the biggest stock market routs in recent history, the Dot.bomb crash and the 43% fall from July 2008 to March 2009 that catapulted the world into the ongoing Financial Crisis. 10 months into the tech meltdown in 2001, for instance, Solomon Smith Barney analysts tracked almost 1,200 stocks. Yet, the firm had no “sell” ratings and only one “underperform” on the books. Is it any wonder the public is annoyed?

This era of careless optimism with other people’s money is changing, of course, but upside bias is still a tremendous problem on Wall Street because of the incestuous relationship between investment bankers, analysts, and brokerage houses.

Fourth, analysts are compensated for clout, knowledge, and data. Accuracy isn’t part of the equation. Given that some analysts make millions a year, I’ve got a problem with just how subjective most of Wall Street’s research really is, especially when huge conflicts of interest are normal operating procedure. Chances are you do too, or you wouldn’t be here.

But again, there is ONE thing you can learn from earnings season – the bigger picture still matters.

We’ve talked about this a lot because it’s where the notion of a globally unstoppable trend comes from. Why track a stock or two worth a few hundred million when trillions are on the move? To me this is a lot like trying to fight an individual wave at the beach when the tide’s changing – not very productive.

Here’s how you sort things out:

Earnings Season “Tell” No. 1:

The overall earnings scorecard is most important for the present

The number you’re looking for to put earnings into the bigger context is the aggregate percentage of companies reporting that have turned in earnings and sales numbers above mean estimates. Earnings will tell you what’s going to the bottom line (so named because they are typically found at the bottom of a company’s income statement), while sales numbers clearly highlight the top line, or gross sales revenue.

As of January 30, for example, there were 227 companies that had reported Q4/2014 data. Approximately 80% reflected earnings above mean estimates, and 58% turned in sales above the mean estimates.

What this tells you is that, generally speaking, things are still pretty good in corporate America. As low as the earnings are and as suspect as the numbers remain, there’s still plenty of money moving through the system.

You can also learn a lot from the balance between the figures. For example, here we’re talking about 80% versus 58%. This ~20% gap between the number of companies beating earnings estimates and companies beating sales estimates tells me most companies are still benefiting from increasing efficiency rather than raw top-line growth. It also suggests that the recovery really isn’t what politicians think it is. Real growth typically reflects a more even distribution.

It’s important to note that this number changes almost daily as more companies report. So you don’t want to get hung up on the initial picture. The earnings scorecard actually gets more accurate as earnings season progresses and more companies report.

Earnings Season “Tell” No. 2:

The estimated earnings growth rate is your guide to the future

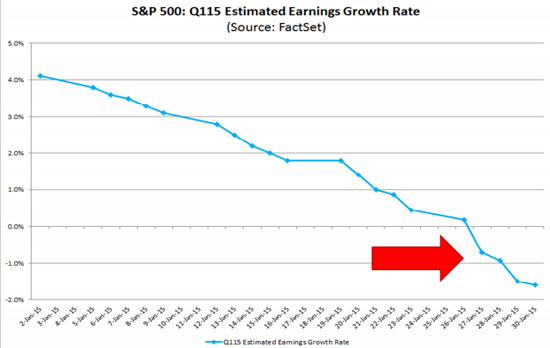

When a company reports earnings, it typically also gives a projected year-over-year earnings growth rate that can be used to compare anticipated future performance with where a company stands today.

Again, I’m not so concerned with the individual results here, but the aggregate.

Right now, for example, the blended estimated earnings rate approximately halfway through earnings season is a mere 2.1%. That’s the eighth consecutive quarter of decline, and down significantly from the 9.9% that was expected last autumn on September 30, according to FactSet.

There are a couple of key takeaways here, just like there were for the earnings scorecard, not the least of which is that 2016 may be a dicey year for markets. So you’ll want to begin preparing now by limiting new money to only the highest quality stocks with rock-solid balance sheets, tons of free cash flow, and expanding margins that are aligned with our Unstoppable Trends – the stuff we talk about all the time.

Of course, the slide also suggests that you’ll want to think about harvesting profits using trailing stops or profit targets, too. But not for reasons most people think.

Raising cash is not merely going to the sidelines to get out of the way. No, it’s about taking steps that ensure you’ll be flush with cash when stocks are “on sale.”

Buy low and sell high… that’s how the game works.

Earnings Season “Tell” No. 3:

Group things into what’s moving and what’s not

Many investors get wrapped up in the minutia associated with individual companies and wind up playing a magnificent game of “coulda, woulda, shoulda.” Let’em.

Instead, take a more detached look at what’s working and what isn’t. That way you can make any portfolio adjustments needed to rebalance or even add to existing positions.

For example, this earnings season has been a tale of two markets so far. Anything with a strong domestic footing has done well while companies with huge dollar exposure and inadequate hedging abroad are underperforming. McDonald’s is a classic example, as is Microsoft.

Generally speaking, one quarter’s trash is another’s cash, so you want to buy into the fray, especially when the fundamental business case driving a company you’re considering remains intact. That’s the case for many energy and defense stocks at present.

In closing, I’ve obviously just scratched the surface. There are literally thousands of data points you can consider depending on how complicated you want to get.

But I think earnings season is one of those cases where simple really is best.

Until next time,

Keith

Source :http://totalwealthresearch.com/2015/02/three-quarterly-market-tells-need-see-say-now/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.