A Brief History of Inequality

Politics / Social Issues Feb 12, 2015 - 01:03 PM GMTBy: STRATFOR

At an event in Beijing last November, I had the good fortune to meet the French economist Thomas Piketty, who has sold 1.5 million copies of his book, Capital in the Twenty-First Century, since it was first published in 2013. Pacing up and down in front of a packed auditorium, Piketty explained that because the rate of return on capital is now higher than the growth rate of the global economy, the proportion of the world's wealth that is owned by a small elite will likely keep increasing; in other words, we should expect to see a divergence of wealth as the rich get much richer. As his book says, "capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based."

At an event in Beijing last November, I had the good fortune to meet the French economist Thomas Piketty, who has sold 1.5 million copies of his book, Capital in the Twenty-First Century, since it was first published in 2013. Pacing up and down in front of a packed auditorium, Piketty explained that because the rate of return on capital is now higher than the growth rate of the global economy, the proportion of the world's wealth that is owned by a small elite will likely keep increasing; in other words, we should expect to see a divergence of wealth as the rich get much richer. As his book says, "capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based."

No strategic forecaster can afford to ignore this alarming prediction — or the enthusiastic response it got from the audience in Beijing. In the 20th century, the two world wars were the only force powerful enough to reverse the concentration of wealth in the elite and the mounting class conflict; in the 21st century, we seem to be falling back into a comparable world of revolution, political extremism and mass violence.

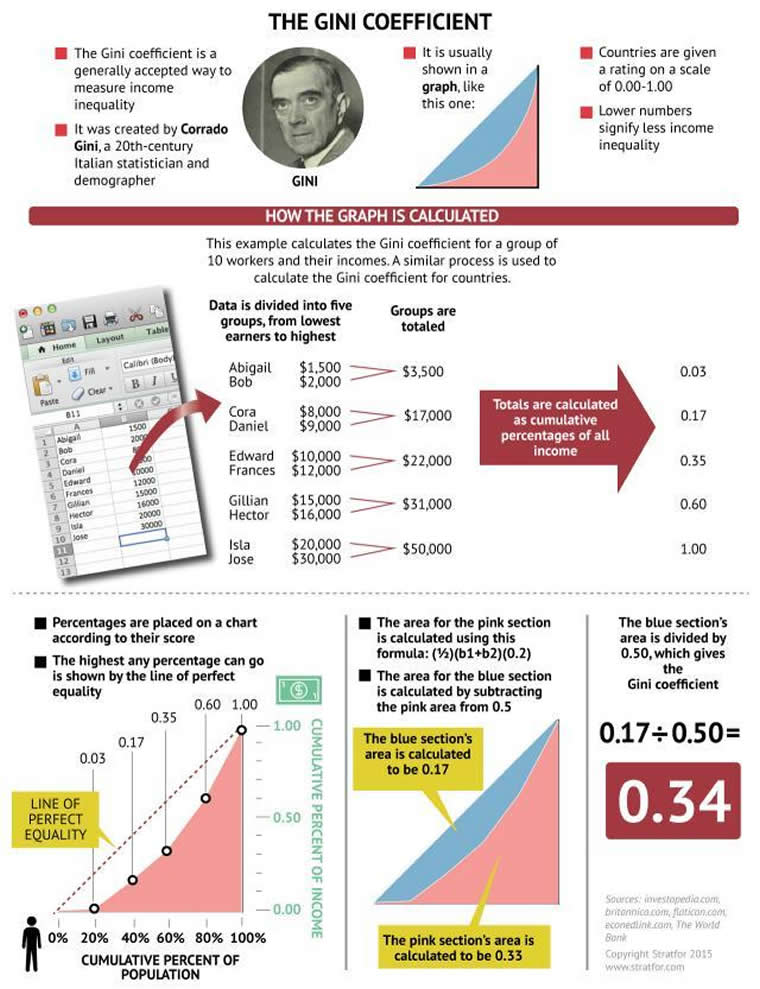

It was hard to be sure whether the members of the audience were enthusiastic because they thought Piketty was forecasting the collapse of Western democratic economies or because they thought his words applied equally well to their own society. After all, China could almost be the poster child for the process Piketty described. When Mao Zedong died in 1976, post-tax and -transfer income inequality stood at 0.31 on the Gini index. (The Gini coefficient runs from 0, meaning everyone in a country has the same income, to 1, meaning one person earns all the country's income and everyone else earns nothing.) By 2009, China's income inequality score had soared to 0.47, where it stubbornly remains after peaking at 0.51 in 2003. Though Chinese tax returns are too opaque to make reliable calculations regarding wealth inequality, or the uneven distribution of assets as opposed to income, he is almost certainly correct that this figure has risen even faster than the country's income inequality.

When a group of us withdrew for lunch, though, our Chinese hosts pushed back against Piketty's thesis: Hadn't Deng Xiaoping taught us that getting rich is no sin? Isn't rising inequality just the price China must pay to escape from poverty? Though Piketty would agree that there is nothing inherently wrong in accumulating a lot of wealth, he would also insist that it is very bad indeed if that accumulation results in too much inequality. The big issue in our discussion — what I have come to think of as "the lunch question" — is whether the world is now crossing into an era of too much inequality.

We failed to reach a consensus as we ate, but after thinking about the question for a few more months, I would like to use this column to make some suggestions. I suspect that our biggest mistake during that lunch was that we failed to analyze the question from a sufficiently long-term perspective. Piketty's research looks back nearly 250 years, but to see the whole picture we need to consider the last 15,000 years, going back to the age before agriculture was invented. When we do, we begin to see that each age seems to get the inequality it needs. To put it more precisely, different economic systems function best with different levels of inequality, creating selective pressures that reward groups moving toward the most effective level and punish those moving away from it. It is also clear that transitions between systems can be particularly traumatic, and it is possible that we are on the verge of such a transition now.

A Brief History of Inequality

Let me take a moment to sketch what inequality has looked like over the past 15,000 years. Before the dawn of agriculture, mankind was made up of hunter-gatherers who captured the energy they needed to survive from wild plants and animals. This economic system rewarded those who lived in tiny bands and moved around constantly, and punished those who tried to live in large groups and stay in one place (they simply starved). It was very difficult to create permanent inequality because foraging bands had no room for kings and aristocrats and little more for accumulated wealth. Consequently, foragers tended to be desperately poor, but equally so. (Though the comparison is rather misleading, British economist Angus Maddison suggested that the typical hunter-gatherer had a daily income equivalent to $1.10 in 1990 U.S. values.) Anthropological studies of today's few remaining foraging societies suggest that their Gini coefficients for both income and wealth inequality averaged around 0.25 — well below Maoist China's score — and archaeological evidence for prehistoric foragers seems consistent with this figure.

Farming began around 9600 B.C. in what we now call the Middle East, appearing some 2,000 years later in Pakistan and China, another 1,000 years later in Mexico and Peru, and later still in several other parts of the world. Living off domesticated plants and animals changed man's way of life and provided far more energy than foraging had. Bigger stores of food were able to sustain more people, for longer amounts of time, and the global population shot up from 6 million in 10,000 B.C. to 250 million in 1 B.C. Large social collectives that stayed in one place working their fields now flourished at the expense of smaller and less sedentary groups. (The Roman Empire had about 60 million subjects, 1 million of whom lived in the city of Rome itself.) Between 9600 B.C. and 1750 A.D., nearly all of the world's foraging societies went extinct.

Although average incomes rose in agricultural communities (reaching an average of about $1.50-$2.20 per day, by Maddison's calculations), the economic structure also rewarded societies that became less equal. The age of farming required much more complex divisions of labor than the foraging world, and while free markets did make a certain amount of specialization possible, laws backed by state violence played an even larger role. Some people became aristocrats or godlike kings, while others became peasants or slaves, and economic inequality surged. The average Gini coefficient for income inequality in agricultural societies was around 0.45, nearly twice as high as in foraging societies. The Roman Empire's score probably lay between 0.42 and 0.44; in 1688 England, it reached 0.47; and in France on the eve of the revolution, it was an agonizing 0.59. Wealth inequality leaped higher still: Gini scores regularly topped 0.80, and one Roman plutocrat who died in 8 B.C. left in his will 7,200 oxen, 257,000 other animals, 4,116 slaves and enough cash to feed half a million people for a year.

The Industrial Revolution changed everything once again. The awesome power of fossil fuels released a new flood of energy as steam and electricity drove machines that vastly augmented human and animal labor. New factories churned out previously unimaginable quantities of goods and liberated people from much of the manual drudgery that characterized the agricultural age. As when farming displaced foraging, our ancestors converted part of their newfound energy into more people and part into higher incomes. (In A.D. 1800 there were fewer than 1 billion people in the world; now there are more than 7 billion. The global average income also rose roughly tenfold over that period, reaching around $25 per day in 1990 U.S. values.)

Exploiting fossil fuels effectively requires even more complex divisions of labor than farming, and the failures of fascism and communism suggest that societies in which the free market takes the lead rather than the state tend to perform better. But this economic system produces its own tension: On the one hand, specialists providing crucial services can convert their expertise into political and economic power, which drives up inequality; on the other hand, wealth in a market society depends on the existence of an affluent middle class that can buy an abundance of goods and services. Too much inequality carries the risk of killing the goose that laid the golden egg.

Like the farming and foraging civilizations before it, our fossil fuel world has an equilibrium point — a "right" level of inequality — and societies that move toward this optimum balance will flourish while those that move away from it will not. The most successful governments often recognize this, using progressive taxation and other fiscal transfers to push economic inequality toward what they hope is the sweet spot. For example, the member states of the Organization for Economic Cooperation and Development drove post-tax income inequality down into hunter-gatherer territory by 1970, reaching an average Gini coefficient of 0.26, but economic difficulties and voters' rightward shift in the following decades suggest that this may have been too low. By 2012, the bloc's average post-tax income inequality had drifted back up to 0.31, and new waves of economic difficulty and public anger are now suggesting that this level is too high.

A Question With No Easy Answer

It is tempting to conclude from our historical overview that we are in a position to answer the lunch question. It seems clear that the governments of modern fossil fuel economies should aim to keep post-tax income inequality between 0.25 and 0.35, and to keep wealth inequalities between 0.70 and 0.80. Today, many countries are at or above the upper bounds of these ranges, suggesting that Piketty is right to see trouble ahead.

Still, long-term history also suggests that there is more to the story. At least four additional forces will help shape the direction our current society takes.

The first is increasing scale. Between the foraging and the farming ages, the typical size of economically integrated populations grew from a few dozen people to a few million, and integrated territories grew from a few hundred square kilometers to a few hundred thousand. Since the Industrial Revolution, integrated populations have expanded into the billions and integrated territory is beginning to encompass the entire planet. This means that within-nation inequality, which has long drawn economists' attention, is no longer the main story. Now we must pay at least as much attention to global inequality, where the picture looks very different.

Between 1820 and 1950, a handful of nations in Europe and North America transitioned from farming to fossil fuel economies, pulling far ahead of the rest of the world. According to economist Branko Milanovic, global income inequality nearly quadrupled during this period to reach a Gini score of 0.55. After 1945, as the Industrial Revolution spread to the rest of the world, the global Gini coefficient leveled off and has even dropped since 2000 as Brazil, Russia, India and China have taken off. The rich are getting richer, but the poor are getting richer faster. Piketty is clearly correct that within-nation inequality has risen since the 1970s, but if present trends continue, by 2050 the Gini score for between-nation income inequality will be heading back toward the 0.25-0.35 range, where fossil fuel economies work best.

The second force is effective demand. Fossil fuel economies depend on having affluent middle classes that are able to pay for vast amounts of goods and services, and rising inequality threatens that. Although rich countries have seen only sluggish GDP growth and their populations' richest 1 percent has captured the bulk of the profits over the past four decades, their citizens have generally seen stagnating rather than declining incomes. European and U.S. demand remain enormous, and 2 billion Asians are quickly joining the global market. Inequality is uncomfortably high, but if effective demand grows rapidly enough to absorb the world's output, we can reasonably hope that the 21st century will escape some of Piketty's darker predictions.

The third force involves new class structures. Since the rise of the first states 5,000 years ago, small political and economic units have been constantly absorbed into larger ones, creating dramatic consequences for local elites. When a tribe was taken over by a larger empire, its chief might find himself impaled or perhaps just marginalized, unable to compete in a bigger, more sophisticated and often more vicious struggle. Then again, he also might suddenly find a larger stage for his ambitions, on which he could rise to become the governor of a rich province, or perhaps a senator at the imperial capital, or even an adviser to the emperor himself. Similarly, a poor man might find himself ground down into debt bondage or slavery, or he might find new options as a merchant, mercenary or migrant in a wider world. There have always been winners and losers.

In the 21st century, we are working from the same script. For some, the globalization of the fossil fuel economy has presented extraordinary opportunities to join an international, Anglophone, tech-savvy elite, or at least to move from rural poverty to a better-paid factory job. For others, downward mobility has become a danger (at times, even a reality) as the number of qualified applicants for slots in the global elite and middle class expands at a faster rate than the number of available positions. As Jay Ogilvy put it in his recent Global Affairs column, alarming numbers of people are being "left behind."

The fourth force — and potentially the most important of all — is the possibility that we could be on the verge of leaving the age of fossil fuels altogether. New energy sources, technologies that erode the boundaries between mind and machine, and shifts toward living in virtual rather than physical spaces may all threaten — or promise — to make the 21st century the biggest rupture in human history, dwarfing the agricultural and industrial revolutions. A century from now, trying to find the right level of inequality for a fossil fuel society might seem as irrelevant as determining the right level of inequality for Neanderthals does today.

All things considered, long-term history suggests that answering "the lunch question" will not be as easy as I initially thought. Each economic system of energy capture has an ideal level of inequality, and perhaps we can even specify that in the fossil fuel world it is a Gini coefficient of 0.25-0.35 for income and 0.70-0.80 for wealth. However, running the numbers and looking for ways to stay in the right range is only the beginning. The real problem, as history shows, is that everything is connected to everything else. Tensions between those who are making it and those being left behind could easily exacerbate the "arbitrary and unsustainable inequalities" that Piketty identifies. Then again, a shift from regional economies to a global market coupled with the ongoing expansion of effective demand could soothe them. Or perhaps in a post-fossil fuel and partly post-human world, inequalities far beyond those Piketty imagined might start to seem entirely reasonable.

"The Lunch Question is republished with permission of Stratfor."

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2015 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.