Greece Crisis Yields Ideal Market Opportunities

Stock-Markets / Financial Markets 2015 Feb 23, 2015 - 03:57 PM GMTBy: Money_Morning

Peter Krauth writes: Now that Greece has a new government, its focus on debt negotiations continue with a different front man representing the beleaguered country.

Peter Krauth writes: Now that Greece has a new government, its focus on debt negotiations continue with a different front man representing the beleaguered country.

Citizens remain skeptical at best and are rushing to get their money out of Greek banks while Prime Minister Alexis Tsipras makes overtures to Russia and China for funds to alleviate the country's fiscal crisis.

Things could go south quickly as the government and banks still face a major cash crunch, despite Friday's market-rallying announcement of a four-month reprieve from Eurozone creditors.

Amidst the chaos, some exceptionally rich opportunities borne of fear are taking shape…

Why Russia Welcomed the New Greek Government

Yanis Varoufakis, who admitted he was the finance minister of a bankrupt country, assured in the past "we will never ask for financial assistance in Moscow." Conveniently, that was worded not to rule out accepting help should it be offered. Nikos Chountis, deputy foreign minister for Greece, confirmed that both Russia and China have already made offers of financial support.

While the West may not have warm feelings for Russian President Vladimir Putin, that's not true everywhere, particularly in his home country. Recent polls in Russia indicate 85% of the populace trust Putin and 74% would vote for him if elections were held now.

Connecting the threads, when Greece's Tsipras won his own recent elections, Russian president Putin was quick to call to congratulate him and invite him to Moscow.

Renewing European sanctions on Russia depends on Greece, as unanimity is required of all EU members. This is one tool of leverage Greece has on Europe in seeking Russian aid. Consider too that Russia is Greece's largest trading partner. Moscow's "friendliness," in the region has recent precedent as Cyprus has been in talks to provide Russia with access to its ports and airstrips. Officially, that would be to meet humanitarian needs, but rumors are flying of the possibility for military access.

Ties between these nations run beyond recent history. Greece and Cyprus both are Orthodox countries, a religious heritage they share with Russia. In the early 1800s Greece benefitted from Russian help in its War of Independence from the Ottoman Empire. Today there are tens of thousands of Greeks living in Russia, and vice versa.

But the former Soviet superpower has yet another ace up its sleeve of influence.

Russia has its eyes on Greece for strategic purposes. The original South Stream pipeline, intended to cross the Black Sea to Bulgaria, was cancelled by Putin on December 1. He blamed the EU, saying they were "unconstructive" towards cooperation, as was clearly Bulgaria's decision to end development of the pipeline on its territory.

Instead, the 63 billion cubic meter gas pipeline will now cross the Black Sea into Turkey, and then on to its border with Greece, creating a gas hub for delivery to Europe. That allows Putin to bypass the hotspot of Ukraine while dangling carrots in front of Greece.

Capital Is Departing Greece En Masse

Meanwhile, there's been no lack of volatility in Europe as debt negotiations with Greece swing back and forth between encouraging and disheartening. Friday's "rally" was but one of many ahead.

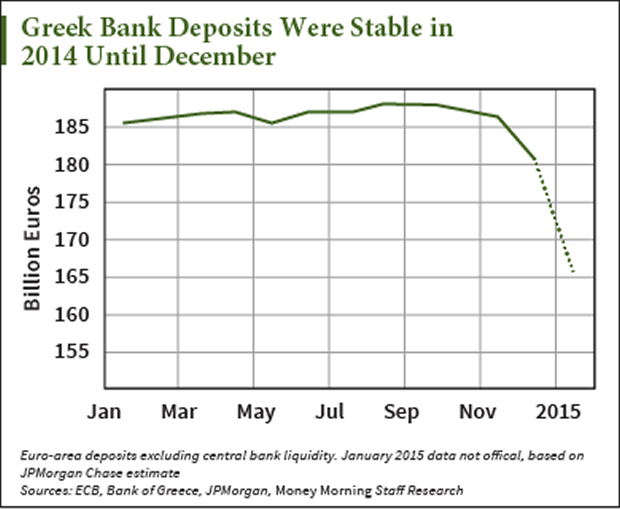

These troubling oscillations are certainly felt by Greek citizenry. It's estimated that Greek banks are bleeding up to 2 billion euros daily, with as much as 23 billion euros departing accounts over the past two months. That money is heading to perceived safe havens, often elsewhere in Europe. At current capital depletion rates, it's estimated that Greek banks could run out of collateral for new loans within three months. As a stopgap measure, they've been tapping emergency funding from the Bank of Greece, the country's central banking unit.

Greece crisisWho can blame the exiting depositors? A recent Bloomberg piece reported on a drastic measure that Greece may be poised to institute, which is likely only exacerbating the exodus. Daniel Gros, director of the Centre for European Policy Studies said the outflows from Greek banks could prompt the government to resort to Cyprus-style solutions: imposing capital controls.

In some cases, worried Greeks are stashing physical cash underneath floor tiles, or burying it in the garden. According the U.K. Royal Mint, Greek demand for gold coins is up as they seek out another safe haven from political chaos.

The Opportunities You Can Seize

Clearly Greek citizens and investors are scared, with good reason. Ironically, that's opened up some opportunities that may simply not have existed otherwise.

If you're an investor with exposure to the region, you can mimic the Greeks and add to your cash and gold holdings. Both are sound options in the short-term.

But there's a better alternative.

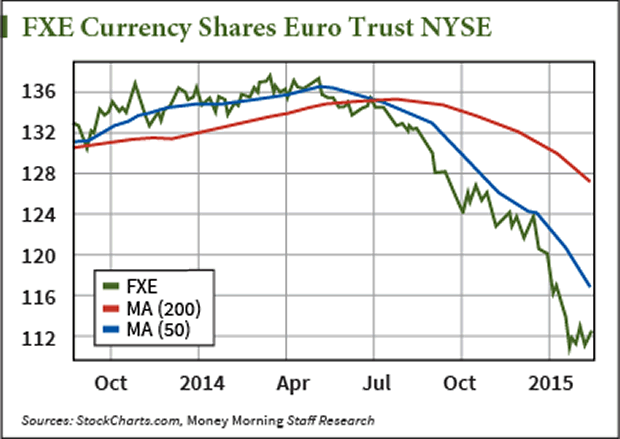

As you can see from the chart at right, the euro's been falling pretty rapidly for nearly the past year. Odds are good that most of the concern and negative sentiment (near all-time lows) have already been priced in. All of this should sound familiar: Europe faced its last sovereign debt crisis, with Greece in the fore, in late 2011 to early 2012. It was also the last time euro currency sentiment was so negative.

The euro bottomed against the U.S. dollar in mid-2012 around 1.22, then climbed to 1.38 by early 2014.

I think we could be looking at a similar setup right now. Consider buying the Guggenheim CurrencyShares Euro Trust (NYSE: FXE) to go long the currency. But I'd suggest using a very tight hard stop loss at the recent low of $110.33.

If you're willing to take on more risk, Greece is offering a tremendous opportunity in shipping right now. Have a look at Navios Maritime Inc. (NYSE: NM). With the Baltic Dry Index currently at 5-year lows, it seems everyone "knows" global growth is slowing and there's nowhere to go but down.

Yet contrarians realize those are typically the best setups to invest in. Navios, headquartered in Athens, was incorporated in 1954 as a subsidiary of U.S. Steel. Its focus is the shipping of dry bulk commodities, like iron ore, coal, fertilizers, and grains. Vessels are chartered to trading houses, producers, and government entities. The company's logistics business operates ports and handles vessels, and operates Capesize, Panamax, Ultra-Handymax, and Handy size bulk carriers.

Navios' share price has already corrected considerably from highs above $12 over the past year, to trade in the $4 range currently (it was at $4.25 in mid-afternoon trading on Friday), where it appears to have stabilized and started building a base. The company continues to pay a hefty 5.8% dividend which management has committed to uphold at least until the end of next year.

So you get to collect a generous yield while waiting for the crowd to settle down and come to the same conclusion you've already reached, only at higher share prices.

Here too, I suggest using a hard trailing stop at the recent low of $3.61, which is roughly 15% below its current price.

Source :http://moneymorning.com/2015/02/23/greece-crisis-yields-ideal-opportunities/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.