The Bull Case For Gold Price 2015, and the Bear

Commodities / Gold and Silver 2015 Feb 24, 2015 - 11:30 AM GMTBy: Bob_Kirtley

There are many opposing views as to what will drive the price of gold this year and in which direction. We will discuss these views and the major factors that have contributed to their formation. Gold is a function of monetary policy just as currencies are, so we will cover on the actions and current stance of major central banks with a heavy focus on the Fed and the US economy. We currently hold the view that the Fed will hike this year and that this will drive gold to new lows before the end of 2015.

There are many opposing views as to what will drive the price of gold this year and in which direction. We will discuss these views and the major factors that have contributed to their formation. Gold is a function of monetary policy just as currencies are, so we will cover on the actions and current stance of major central banks with a heavy focus on the Fed and the US economy. We currently hold the view that the Fed will hike this year and that this will drive gold to new lows before the end of 2015.

US Economy

Since the global financial crisis in 2008 the US economy has appeared to be on the road to recovery, only for its health to decline further. These false starts show that the current growth and apparent economic health in the US may not be the beginning of another boom. If this is the case the Fed will have to delay the first rate hike, which will be extremely bullish for gold.

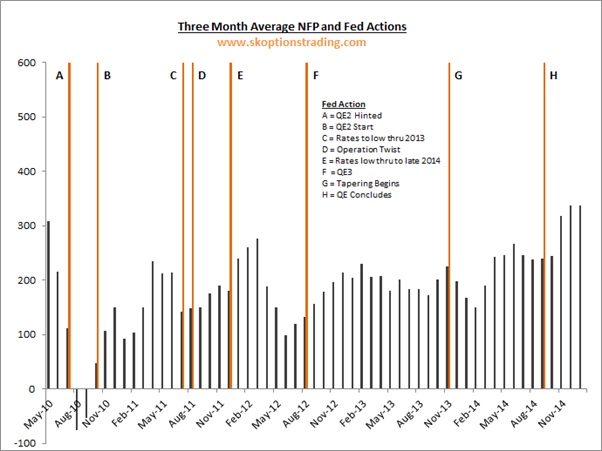

However, the signs are particularly strong at present. The employment sector has shown consistent growth with considerable gains in nonfarm payrolls. The average gain of 268,000 jobs a month over the last twelve prints has led to unemployment declining towards the Fed’s target, and has thus resulted in many holding the view that 2015 will see the beginning of a new tightening cycle.

From a trading perspective we believe the current situation is one of “the trend is your friend”. This means that we would rather react to a change in data or waning of economic momentum than to call that the economy is heading south prematurely. Moving against the tide of the US economy has been a losing battle for gold bulls in recent years.

The Fed

Gold bears and the majority of investors in the markets both believe that the Fed will hike this year. We are among these, with the June meeting being the most likely candidate for a hike being our view. Just as massive quantitative easing and accommodative monetary policy was highly bullish for gold, a rate hike and an overall tightening of policy will drive gold lower. This means that if data continues to show improvement in the economy, then the Fed will hike this year and gold will be driven to new lows.

Although if recent strength is simply another false start and the data takes a turn for the worse, then the Fed will delay the start of a new tightening cycle. In fact, if the situation becomes severe there is the possibility that the Fed may introduce new easing measures. A dovish change in stance from the Fed, by way of at least a delay in tightening, would be highly bullish for gold.

The Fed has been building towards a rate hike ever since tapering was first discussed, which means that they have now been on this course for years. The situation in the economy also appears strong enough to support higher interest rates and is likely to continue to show improvement. We therefore believe it is near certain that the Fed will hike rates before the year is out.

Monetary Policy Globally

Gold is a function of monetary policy, which is why we cover actions of central banks closely in our research. However, the Fed is not the only central bank, even if it is the most influential to the gold price. This means that we must also consider the actions of central banks globally.

Outside of the US monetary policy is still highly accommodative. The BOJ and ECB have both embarked upon new, major quantitative easing programs in the last six months while other countries are cutting rates or at least holding back in increasing them. This provides a positive back drop for the gold as an alternative monetary asset that cannot be simply “printed” to ease economic conditions.

Yet in spite of this accommodative policy, the fact of the matter is that gold still remains very close to the lows made last November.

The argument that we as gold bears hold as to why ECB QE has failed to drive gold higher is based on the nature of the QE, which targets credit rather than simply being broad based. This means that it will stimulate growth in a similar way to QE3 in the US, which history shows was highly bearish for gold.

The action from the BOJ has not sparked any major movement higher either, but for a different reason. This is that markets and come to expect accommodative policy from Japan after years of deflation and the efforts to combat it. This has lessened the impact on the gold price to effectively nil, which means that future action is unlikely to spark a rally either.

This means that although the actions of central banks globally may provide a positive back drop for gold, it does not make sense to be holding the metal. There are other strategies, such as selling downside equity protection and being long stocks, that are much better suited to taking advantage of accommodative monetary policy.

Currency

Monetary easing across most of the world means that the currencies of these economies, such as the Euro and the Yen, are likely to weaken. This is bullish for gold since the metal makes a good investment as an alternate currency for those in the Eurozone and countries with an accommodative stance.

However, there are also bearish currency implications that arise from the Fed moving towards a tightening cycle while policy is still dovish across the rest of the world. The US dollar has strengthened significantly with a rate hike has been priced in while other currencies are being weakened.

This strength has slowed upward movement in the gold price and is likely to continue to do so. A strengthening US dollar also means that even if gold stays at its current level in other currencies, it has the potential to decline in US dollars.

We believe that the currency implications are on the whole bearish for gold. It is unlikely that increased demand for gold as an alternative monetary asset will counteract the strengthening of the US dollar and the bearish effects of the Fed moving towards a tightening cycle.

Oil

Oil has more than halved since June last year and has lost a third of its value in the last three months alone. This decline and the resultant low energy costs are arguably yet to flow through to effect inflation in full. This means that disinflationary risks are still present with the potential to delay a rate hike and push gold higher.

There is also the risk that oil breaks lower again and declines significantly form here. This leads to the possibility of disinflation and new QE programs in the US to combat it. The effect of which would be massively bullish for gold.

Oil prices have stabilised somewhat around the $50 level, which means that there is the potential for an increase from here. Given that this is the case, we believe the Fed will look through the drop in energy costs as “transitory”, just as they did when oil prices rose post GFC. Policy is about much more than the price of oil and as such linking Fed policy with such high leverage to energy costs is a misconception.

Inflation

The key risk to a bearish stance on gold is a change in the trend of economic data in the US. At present this data is showing improvement in the US economy, particularly in the employment sector as we have covered, but there should be at least some concern around prices. There has been a lack of wage push inflation and the overall inflation rate has slowed since reaching 2.1% in June last year, with the last print showing only a 0.8% rise in prices. If this continues, then the Fed will be under less pressure to increase rates and therefore may delay the first rate hike and lead to a rally in gold.

Although lower inflation does pose a risk to gold shorts, it is unlikely that this risk will become a reality. We are beginning to see wage inflation that is likely to increase as the unemployment rate declines further. Oil prices have also begun to stabilise and have the potential to rebound from here. This means that the current situation in inflation is likely to be transitory and not indicative of the overall economic health in the US. Therefore, it is likely that inflation will provide sufficient pressure for the Fed to hike this year.

Conclusion

Considering the factors and dynamics discussed we are bearish on gold. We respect the risks in play and believe that the extent of the Fed’s hiking cycle will be less than the market currently anticipates, but that ultimately the effect will be bearish. We hold the view that the Fed will hike in June and that ahead of this gold will suffer significantly. Specifically, we believe that gold will make a new low and trade beneath the $1130.40 level seen last November and are offering a money back special to new subscribers until March if we are wrong. To find out how exactly we will take advantage of the decline in gold, please subscribe below.

Go gently.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.