Home Equity Loan Valuations In Stratosphere

Housing-Market / Credit Crisis 2008 Jun 05, 2008 - 12:09 PM GMTBy: Mike_Shedlock

Minyan Peter had some interesting comments yesterday about home equity loans. I happen to have some charts to put his comments in perspective.

Minyan Peter had some interesting comments yesterday about home equity loans. I happen to have some charts to put his comments in perspective.

First let's hear from Minyan Peter .

Lower Home Prices Impact Loan Portfolios

While Kevin's " Five Things " from earlier today discusses the impact of lower existing home prices on Fannie Mae (FNM) and Freddie Mac (FRE), to me an as large, if not larger issue, is the impact of these lower prices on existing home equity loan portfolios. With the vast majority of current home equity loan balances created during 2003-2007, most of those loans are now effectively unsecured. In addition to being woefully mispriced for the risk, these loan portfolios are likely to experience unprecedented loss rates which are far in excess of current loss levels.

Further, it's also highly unlikely that we will see again in my lifetime the availability of home equity credit that we just experienced. As a significant amount of US consumer living was funded through "cash out" loans over the past five years, the implications for the next are worth seriously considering. Loan To Value Ratios In Stratosphere

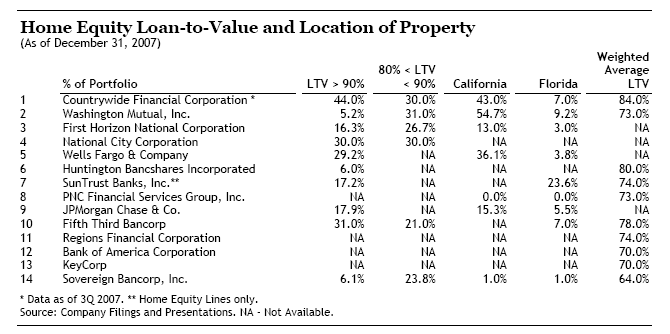

The following LTV tables are from a Fitch report produced in March, reflective of December 31, 2007. Countrywide Financial (CFC) data is reflective of 3rd quarter of 2007. Clearly the situation has deteriorated significantly since then, especially for Countrywide.

Home Equity Loan-to-Value and Location of Property

Other Factors

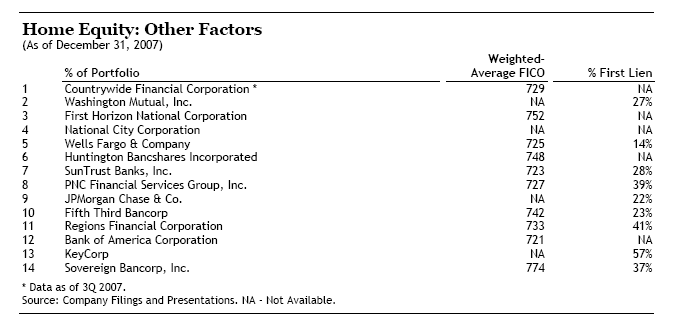

Those issuers with a higher first lien position would be expected to have better credit metrics as they have a priority claim on the liquidation value of the property. Of the issuers that report first lien positions KeyCorp (KEY), Regions Financial (RF), and PNC Financial (PNC) have the highest first lien positions at or above 39%. Wells Fargo (WFC) has the lowest protection, with first liens representing just 14% of the portfolio, although a considerable portion of its portfolio is behind a Wells Fargo first mortgage.

Not only are LTVs in the stratosphere, the first lien positions of many of the banks offering those loans is exceptionally weak. Given further declines in the housing markets since the above data was compiled, and also factoring in first lien positions, the tables echo what Minyan Peter suggested. " Most of those loans are now effectively unsecured ".

The situation looks especially dire for Countrywide Financial. Is Bank of America (BAC) really going to close that deal? If so, at what price?

The housing ATM window is now closed. It no longer dispenses cash. One by one, banks shutoff this once free flowing spigot. (See Countrywide And Chase Shut Off The Cash Spigot and

Credit Lines Dry Up, Homeowners In Withdrawal ). For banks, the reaction was way too late. Losses are going to be enormous. And looking ahead, the ATM will stay closed as home prices continue to fall.

The ongoing effect on the economy will be significantly greater than the $600 or $1200 one time stimulus checks that are now being sent out.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.