Another Reason To Worry About The Stock Market

Stock-Markets / Stock Markets 2015 Feb 26, 2015 - 01:00 PM GMTBy: John_Rubino

The world is full of "carry trades" these days, and that's a really bad thing.

The world is full of "carry trades" these days, and that's a really bad thing.

In general terms, a carry trade involves someone borrowing money cheaply in one currency or market and investing the proceeds in something else that offers a higher yield. The strategy is profitable as long as the currency being borrowed doesn't rise by more than the spread between the cost of the loan and the income from the investment.

The yen carry trade, in which institutions borrowed Japanese yen for next to nothing and bought emerging market bonds yielding quite a bit more, was the dominant version for most of the past decade. It paid off nicely when the yen plunged in value last year. Then the dollar carry trade took over, with about US$9 trillion being borrowed worldwide and invested in everything from Brazilian bonds to Chinese infrastructure. That hasn't worked out so well, since the dollar is up lately by more than enough to offset the income from those investments. The impact of this tidal wave of negative cash flow will be felt going forward and could be serious, since $9 trillion is about the size of the Chinese economy.

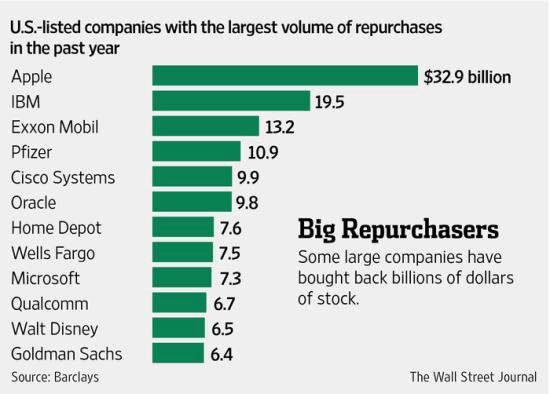

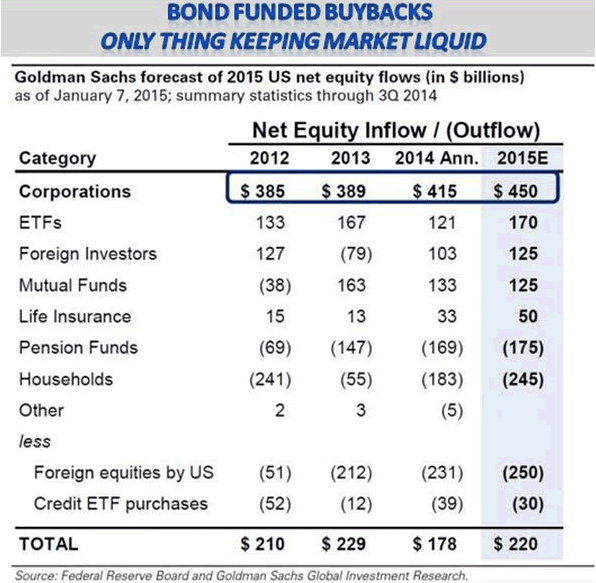

But the really interesting -- and potentially even more dangerous -- carry trade is happening here at home, where public companies are issuing low-interest-rate debt and using the proceeds to buy back their shares. When the bond interest is lower than the dividends on the stock that's being purchased and retired, this is a cash flow positive trade -- with the added benefit of pushing up the share price and therefore company execs' year-end bonuses. Check out the following two charts for a sense of the magnitude of this trade:

So what happens if US equities have the kind of bear market that usually follows their recent spike to record levels? Well, the companies that have borrowed heavily will still owe interest on their bonds, but the shares they've bought will be worth 20%-30% less. This negative change in their net worth (real if not in terms of financial reporting) might make their shares even less attractive and put extra downward pressure on them, and so on, until a garden-variety bear market turns into something nastier.

This in turn will throw the "wealth effect" (in which higher share prices lead to higher consumer spending) into reverse, possibly turning a manageable slowdown into another Great Recession.

That's of course unacceptable for the people running today's governments, for whom rising asset prices are now up there with the war on terror and lobbyist pay scales in terms of untouchability. So lately even minor stock price corrections have been met with an army of Fed, Treasury and congressional talking heads promising fast action to keep the gravy train going.

All of which makes current speculation about Fed interest rate policy seem a bit silly. The truth of the matter is that interest rates, monetary policy in general and pretty much every other government policy is now dictated by the need to keep the asset bubble from bursting.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.