Gold Waiting on the US Dollar

Commodities / Gold and Silver 2015 Mar 07, 2015 - 12:25 PM GMTBy: Jordan_Roy_Byrne

Gold had held up well in recent months considering the upside explosion in the US$ index. That is because Gold surged nearly 21% against foreign currencies in three months. Yet, this is not enough to carry Gold. Its rebound petered out (in nominal and real terms) after the Swiss news and has growing downside momentum due to the surging US$ index. We've seen some positive developments under the surface for precious metals but its clear the sector won't begin a sustained rebound until the US$ reaches its next peak.

Gold had held up well in recent months considering the upside explosion in the US$ index. That is because Gold surged nearly 21% against foreign currencies in three months. Yet, this is not enough to carry Gold. Its rebound petered out (in nominal and real terms) after the Swiss news and has growing downside momentum due to the surging US$ index. We've seen some positive developments under the surface for precious metals but its clear the sector won't begin a sustained rebound until the US$ reaches its next peak.

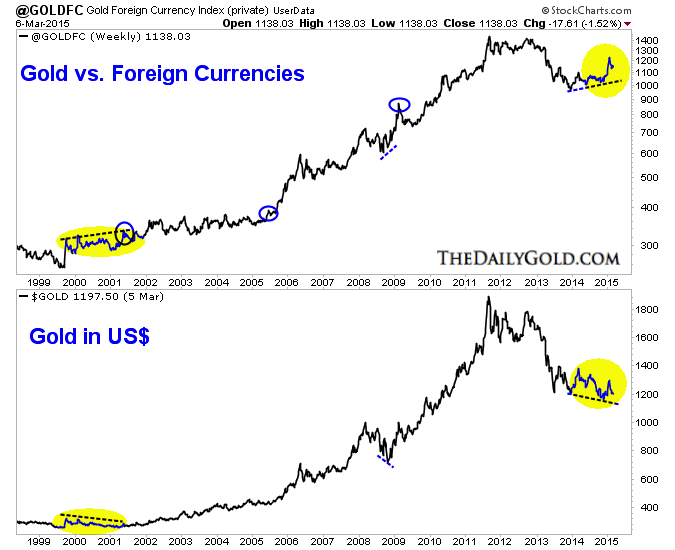

Gold priced in foreign currencies (FC), as discussed repeatedly is often a leading indicator for Gold as shown below. Gold/FC led Gold higher during the 2001 and 2008 bottoms and led Gold to new highs in 2001, 2005 and 2009. The current period could be similar to 2000-2001 during which Gold/FC trended higher as Gold trended lower. Then, the first divergence showed up in February 2000. Gold stocks bottomed nine months later and Gold bottomed 13 months later. The first big divergence this time around was near the end of October 2014.

Turning to currencies, in recent weeks we noted that the US$ index had reached its third most overbought point since 1971. First it was Yen weakness driving the US$ higher. Recently it was both the Yen and the Euro. In recent weeks the Yen has not made a new low while the Euro has plummeted. Clearly, the US$ index won't correct until the Euro's decline finishes.

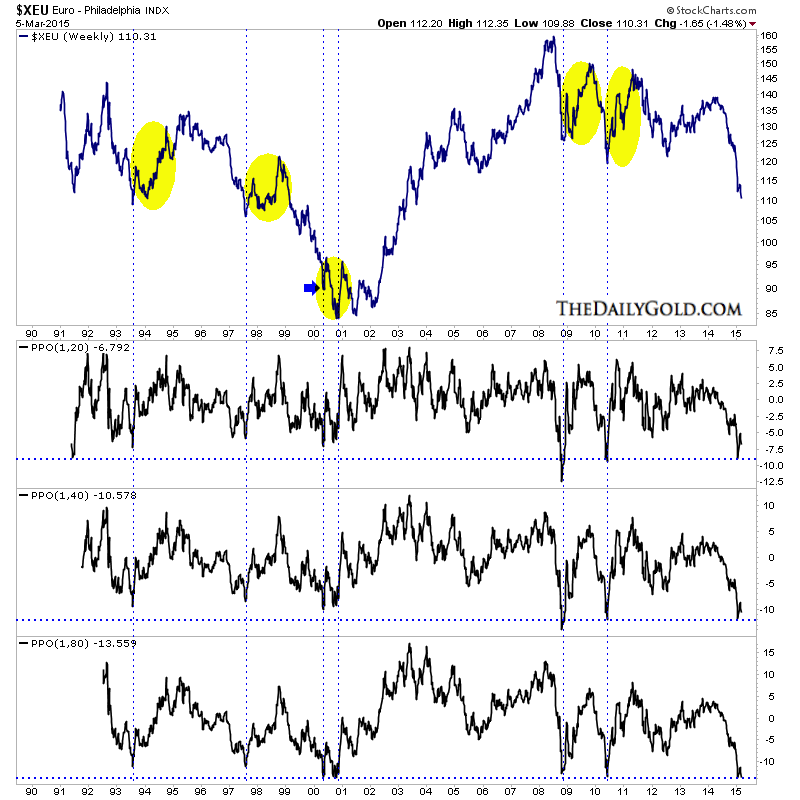

Below we plot a weekly chart of the Euro that includes indicators showing the Euro's distance from various exponential moving averages (20,40,80). We mark and highlight the rebounds from the most oversold points. A few weeks ago the Euro was arguably at its second most oversold point since 1990. Considering the depth of the Euro's decline and its current standing it appears in a somewhat similar spot to early 2000. See the arrow.

In considering the extremes in the currency markets, we are looking for big counter trend moves in the months ahead. However, in the short term the Euro which we think is the key lacks major technical support until parity. It has room to fall further. While a major snapback is likely ahead (and the reverse for the US$) it is not necessarily imminent.

As I penn this Gold is trading at $1167 and GDX has 12% downside to test its daily low. Don't be surprised if precious metals bounce next week as Gold has support at $1160. That being said, Gold looks like it's headed for a test of at least $1080 (the 50% retracement of the bull market) while the miners are headed for a retest of their lows. That is the bad news but the good news is precious metals are finally moving closer to the end of the seemingly forever bear market.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.