Gold And Silver - Banker Insanity Grows, Precious Metals Decline

Commodities / Gold and Silver 2015 Mar 07, 2015 - 05:59 PM GMTBy: Michael_Noonan

Money does not exist in Europe any more than money does not exist in the United States. What the Greeks received was a massive loan of debt issued by the International Monetary Fund. Who authorized the IMF to issue that debt to Greece? From where did the "funds" come? [Hint: Out of thin air.] The IMF/EU/BIS, call the "lenders" whatever you choose, but no money was loaned, just a digitized I.O.U. The notion of money is as phony as any $3 Euro bill. The entire EU and its bloated, non-representative bureaucrats are a massive Ponzi scheme, led by Mario Draghi and a host of other sycophants who would not otherwise get elected even if they ran unopposed.

Money does not exist in Europe any more than money does not exist in the United States. What the Greeks received was a massive loan of debt issued by the International Monetary Fund. Who authorized the IMF to issue that debt to Greece? From where did the "funds" come? [Hint: Out of thin air.] The IMF/EU/BIS, call the "lenders" whatever you choose, but no money was loaned, just a digitized I.O.U. The notion of money is as phony as any $3 Euro bill. The entire EU and its bloated, non-representative bureaucrats are a massive Ponzi scheme, led by Mario Draghi and a host of other sycophants who would not otherwise get elected even if they ran unopposed.

Two weeks ago, we wrote on Banker's Grip On PMs Not Over, leading off about the Syriza party likely to fold and sell its Greek citizens into more debt servitude, calling the efforts of Tsipras and Varoufakis Kabuki theater, while still a Greek Tragedy for Greek citizens. In one of what has to be German banker's prouder moments, complaining about how Greece does not want to pay back money loaned, they led the charge demanding Greek compliance with more austerity in the cards. Wake up Germany and other European nations partaking in the artificial patchwork called the European Union. No money was ever loaned to Greece!

Last week, we wrote about Insanity Prevails; PMs Without Direction. The above is proof of the insanity under which all Europeans live without any discernible objection. Not only are Europeans willing to live in an artificial world, while heavily spied on by their respective governments, they are willing to commit financial suicide by kissing US butt over enforcing sanctions against Russia. How are them sanctions working out for you, EU?

Under sanctions designed to punish Russia simply for its existence, as far as the US is concerned, the EU has proven stupidity has no national borders. Germany prides itself for its business acumen, yet the country is suffering backlash in lost business and a decline in GDP as a result of acting as the 51st State of the US. Those mostly southern European countries that imposed a food embargo on Russia are confronted with huge losses as their unsold food has no market. Good thinking, EU.

Russia is otherwise prospering quite well, buying food from South America, making more and larger deals with China, selling cheaper oil that is offset by higher in "value" US fiat resulting from sales. The higher valued fiat "dollar" is then being used to buy Western central banker suppressed gold at bargain prices. We guess the US/UK/EU brain trusts have the Russians right where they want them. Keep putting the hurt on!

All of the Western [totally insolvent] central bankers, along with the psychopathic leaders of the US/UK/EU under the banker's charge, will never take responsibility for all of the economic destruction and capital debasement for which they are responsible. In fact, the US is helping destroy the EU as a result of its failed policies of sanctions against a prospering Russia. In order to save face, [like it has any], the US is bound and determined to start another war, even WWIII, if need be, and then blame all of the US economic collapse on its enemies for "creating" economic failure in the US, thereby deflecting all blame from the bankers and politicians responsible.

As psychopaths in charge, none will ever take responsibility for their irresponsible actions. Thanks to their actions, every Western county, including and especially Japan, is suffering from an irreversible high debt to GDP, not just irreversible, but also unsustainable. Ironically, guess which three countries did not make the list of the Western world's worst debt/GDP offenders? Russia, Syria, and Iran. None is in the Western world subject to such fiat economic abuse. Yet another reason why Obama wants to go to war with Russia, no doubt.

Last week, Austria, of all countries, found that its "bad loan" bank, Hypo Alpe Adria, aka Heta Asset Resolution, just got badder. Somehow, no doubt confounding all the financial banker wizards, an audit showed an 8.7 billion Euro "capital hole." Incredibly enough, the bank was recently rated AAA/Aaa, by other bankers, of course. A "bail-in" is imminent. In fact, the Austrian finance ministry said that "creditors can be forced to contribute to the costs of winding down Heta - or 'bailed in' - under new European legislation that Austria adopted this year so that taxpayers do not have to shoulder the entire burden."

In a sane world, banks that made bad loans would have to suffer the loss and write them off, even go bankrupt if necessary. In a banker-driven world, aka insanity, all bad loans must be recovered at the expense of depositors and the public. Bail-ins, coming soon to a bank near you, Americans. Take heed...your 401ks/IRAs are all at risk of bail-ins, exchanged for worthless government bonds no one wants. [Not that we expect anyone to take heed.]

Why mention the past few articles and point out European financial folly and Austrian banking three-card Monte? Because international Rothschild/elite-led bankers have no limits in the path of financial ruin in which they lead the world, all in their inexorable march to their New World Order, which may already be a fait accompli.

Look at what the international bankers are doing to the price of gold and silver. The point to be taken is that anyone who is relying upon fundamental information and/or expectations that governments will make things right is engaging in mental masturbation. The bankers want to destroy the gold/silver markets for the masses. They want to destroy all hope for higher prices, all justification for holding them as an alternative to their artificial, worthless fiat paper.

The central bankers are on a path of self-destruction, and they will take down the masses with them. They could care less about China and Russia accumulating all available physical gold and silver. The bankers know they are toast to China and Russia, but in their perverted effort to hold onto power for as long as possible, maybe even delusional enough to falsely believe they will always remain in power, they will destroy everything in the process, plain and simple.

We have been saying for the past few weeks, actually longer, the charts are telling anyone who wants to pay attention that prices are not going higher anytime soon. That can change in a week or a month or a year, but until there are signs of change, prices will remain suppressed.

What we have been saying for an even longer period of time, a few years, is keep buying, and personally holding, physical gold and/or silver. Price does not matter. Sure, everyone wants to get the most for their money, but that is not the purpose of buying PMs any more. At some point, it may not be available at these prices, literally overnight when reality finally kicks in and a price adjustment is made in line with true supply/demand. Also, governments being what they are, an outright ban on purchasing PMs can be put into place. Already efforts to confiscate PMs from safety deposit boxes are in place. Expect things to get worse, not better.

If you do not own it now, you are playing a game of [irresponsible]risk. For those who already own PMs, even for prices at the highs, accept it and be glad you own either or both. The insane banker's world in which we live will come to an end, and likely a disastrous one. Keep on stacking, keep on staking. On a relative scale, price should be your least concern.

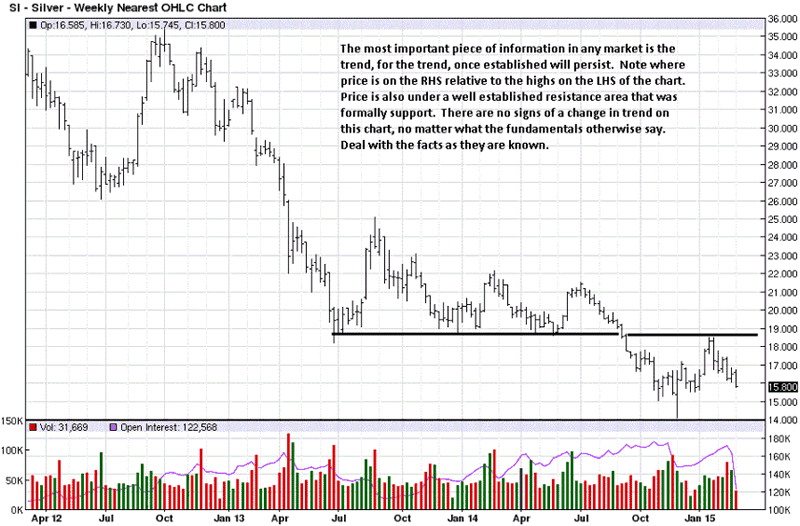

The trend matters the most because the majority of price development will occur within the trend's context. RHS = Right Hand Side, LHS = Left Hand Side. Comparing the location of price on the RHS of the chart, relative to the LHS clearly shows how price has been developing throughout, to the downside, with the trend

Silver Weekly Chart

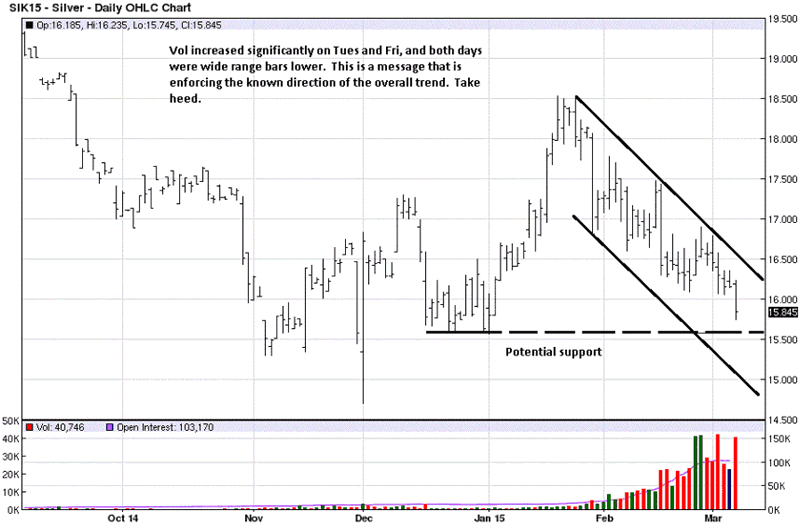

When you compare this chart to that of daily gold, silver has a better relative show in how it is holding within the down channel. We get key information by observing how price reacts/responds to obvious support/resistance levels. If it bounces off and rallies higher, support will hold. If price stays at/near support, the likelihood is greater that potential support will not hold.

It is not our job to guess which but to watch and then respond to the confirmed market activity, if a tradable opportunity arises.

Silver Daily Chart

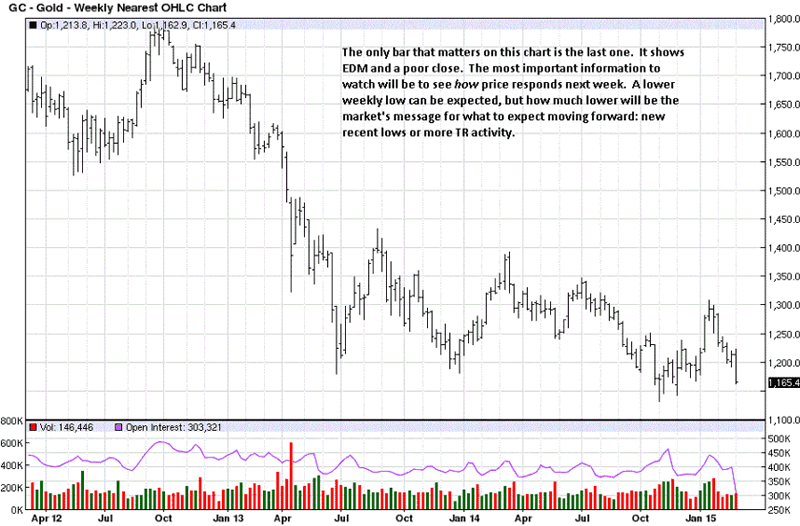

While last week's down bar in gold strongly suggests lower prices, it does not necessarily follow that lower prices will occur. For that reason, we watch to see how price reacts in order to have important information moving forward.

Gold Weekly Chart

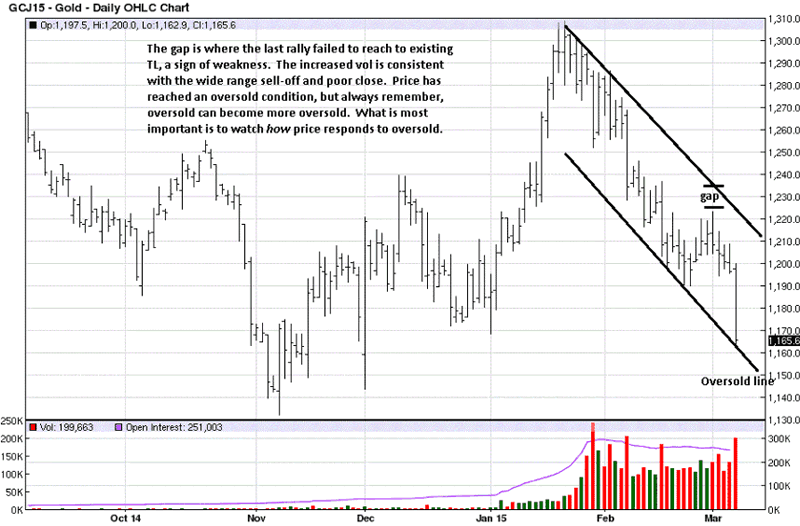

The chart comments are apt. You can see how the daily gold chart is relatively weaker than that of silver. However, both remain in a down trend, and that is what matters.

Gold Daily Chart

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2015 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.