Gold and Silver Smashed by Non-Farm Payrolls - Troubled Waters

Commodities / Gold and Silver 2015 Mar 08, 2015 - 03:36 PM GMTBy: Jesse

Bubble bubble

Bubble bubble

Toil and trouble,

Savings burn

While assets double.

That certainly was a 'better than expected' Non-Farm Payrolls report number.

One thing to keep in mind is that the Bureau of Labor Statistics has gone back and revised every jobs report I have in my spreadsheet, back to at least 2004.

They have also revised the imaginary jobs, the Birth-Death model.

To give you an analogy, they did not just move the goalposts. They moved the entire field to a new stadium and redid every line, every marker, and every number that describes the field.

So anyway, in itself this was higher than expected, but hardly a great number. It showed a nation of part time bartenders and low paid servers, with another 390,000 or so Americans being written out of the official record. At least they are only erasing people on paper for now.

The Fed and their partners in government have the itch to raise interest rates. And to do so, without everyone throwing up over yet another in a series of policy errors, they need the cover of an 'improving economy' with a growing fear of inflation.

After all, it is a 'tight' job market. Especially if you want to work the day shift at McDonalds in a suburb for minimum wage.

WHAT IS THE VELOCITY OF MONEY? WHAT IS MEDIAN WAGE GROWTH? Why aren't the whiz kids talking about that when they start fretting about 'inflation.' Because they are willfully blind?

The Fed would like to get interest rates up to one percent. This give them the room to cut rates again when their latest asset bubble collapses. That is it in a nutshell. They see the 'real economy' as cannon fodder in their increasingly self-absorbed financial engineering.

I am going to be more interested in what they do with those huge excess reserves which they have given pretty much for free to the Banks, for whom they are now paying them 25 risk free basis points. Will they keep raising that vigorish for doing nothing to their Banks? Because that is what it is, to say the least. There was intraday commentary about that here.

The propeller heads and careless few are enamoured of 'corporate profits, and wage pressures.' I think they will be much more preoccupied with the 'torches and pitchforks' indicators by late next year.

The dollar took off this morning as you might expect, with Europe pretty much falling into the abyss of their own hubris and delusions. I mean, with most of the world savagely cutting interest rates because they recognize that the global economy is failing, what else is an exceptional people to do except raise rates? Yes, we really are just that good.

And with the stronger dollar the multinational financiers will have sweeter pickings in acquiring assets overseas. As for the real economy well, buck up and stop whining.

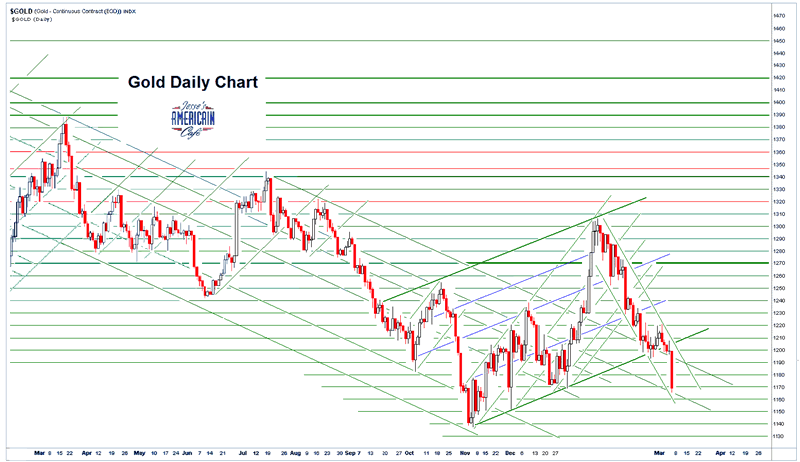

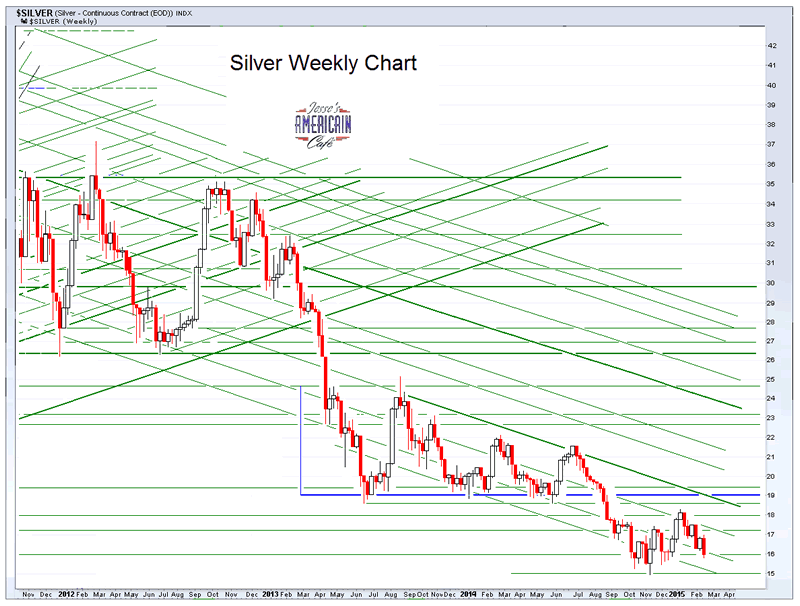

Let's see how gold and silver fare next week. They certainly took it on the chin today. But what else would you expect from a largely unregulated bucket shop where prices are almost symbolic bets, contingent on other bets and leverage? Liar's poker?

Have a pleasant weekend.

Addendum: With regard to the cash levels of PSLV, an emailer who identifies himself as Bron S seems to think that he knows what the options and outcome are, and has suggested something to me via email. I have no such certainty about what he thinks he knows and have told him so in return.

Since he (and apparently a tweeter) have recourse to blogs of their own, dare I suggest that they write their own opinions plainly and put them on their own blogs?

Maybe he is right. In which case, he should put it in print. Let him say what he knows, and what he thinks. And in this he he has directed me to this posting. And I am largely grateful for it, not having seen it before. I have added a comment there today noting that I do not care which particular method Sprott uses to add cash, unless it has some adverse effect. I will look forward to the details from Sprott. It does now appear that a secondary is unlikely.

I am only concerned with accounting for the move in the premium, and that relative to other premiums. If it varies, I would like to know why. I also give a word of alert on the cash levels to those who watch these things, that they may be alert to the possibility.

I try to stick the facts that I can verify and understand for myself. But I am always open to reading another's analysis and opinions. Even about details that do not particularly matter to me, of which there are many. I do that about eight hours a day at least.

I should add that I do not 'follow' PSLV in the manner of an analyst. I had thought I made that fairly clear. I use it in the limited manner I have described several times, in comparing the premium to some other things. And I do find the fluctuations in the premium to NAV to be fascinating. I offer no in depth analysis on the individual securities per se.

And finally, if you happen to read the comments in the above link at Mr. Suchecki's blog, you will notice someone claiming that I am a hyperinflationist, although I have toned it down lately. As anyone who visits here regularly may recall, I forecast for stagflation in a brief paper in 2005, which I have reproduced on this blog some years ago.

I try to keep an open mind on hyperinflation since they do and can occur. But I think it is a very low probability event for the US, especially while it retains reserve currency status. The size and cohesiveness of the US economy will allow its currency to weather much more abuse than a smaller nation.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.