Gold, Dollar and the Swiss Surprise

Currencies / Fiat Currency Mar 10, 2015 - 05:38 AM GMTBy: Arkadiusz_Sieron

Let's step back in time. As we all remember, on January 15th, a surprise decoupling from the euro peg caused the Swiss franc to rally up to 23%, an unprecedented move in the currency market. Why was the peg introduced and later removed?

Let's step back in time. As we all remember, on January 15th, a surprise decoupling from the euro peg caused the Swiss franc to rally up to 23%, an unprecedented move in the currency market. Why was the peg introduced and later removed?

The SNB pegged the franc to the euro on September 6th, 2011, in the very middle of the Eurozone debt crisis. A few peripheral countries, whose debts had been downgraded to junk status, asked for bailouts. Therefore, investors ran from euros and moved into the Swiss franc, a traditional safe haven. The SNB introduced a minimal exchange rate at CHF 1.20 per euro (0.83 euro per franc) in order to resist the currency appreciation (the CHF gained 28% since the beginning of the Global Financial Crisis). Although gradual appreciation is positive and reflects the strength of a currency, sudden capital inflows and exchange rate fluctuations may be quite detrimental, and therefore the SNB began printing and selling francs to keep the currency from exceeding 0.83 euro.

The peg worked quite well, but not without costs. The SNB expanded its balance sheet to 80% of GDP and the foreign currency reserves doubled from around 250 billion to 500 billion francs. At one point the SNB was buying half of the new government debt issuance of the Eurozone.

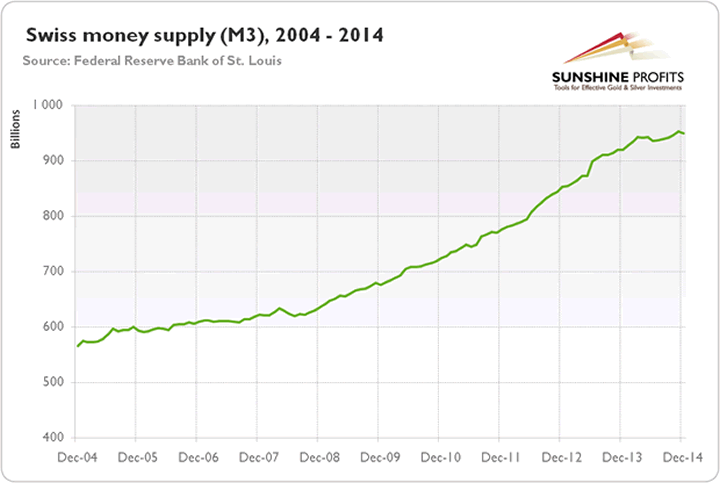

Thus, the SNB removed the peg due to concerns about the large expansion of the money supply. Not only did the monetary base expand but also broad money (Chart 1), which actually increased as it did in Ireland or Spain before the Global Financial Crisis.

Chart 1: Swiss money supply (M3) from December 2004 to December 2014 (in billions of Swiss francs)

According to the SNB, 70% of the increase in the M3 money supply, which occurred between October 2008 and October 2014 (311 billion francs), can be attributed to the increase in domestic Swiss franc lending. Between 2011 and 2014 the bank's lending rose from 145% to 170% of the GDP, which set off a property boom. Swiss real estate prices rose by an average of 6% per year between 2008 and 2013, and flat prices more than doubled since early 2007 until now. Consequently, the real estate bubble index published by the UBS found itself in the 'risk zone'. Thus, the SNB's move could have resulted from adopting a tighter monetary policy to avoid a further bubble and followed the housing collapse that crippled the economy in the early 1990s.

Perhaps, the gold referendum in November, 2014 added some political pressure to tighten the monetary policy, while the expected announcement of the QE in the Eurozone on January 22 might be responsible for the timing of the SNB's decision. Note that its move came just a day after the European Court of Justice paved the way for a program of sovereign bond buying. Additionally, as Thomas Jordan, the president of the SNB, pointed out, "The euro has depreciated substantially against the US dollar and this, in turn, has caused the Swiss franc to weaken against the US dollar." For once, one of the reasons of keeping the peg was removed.

What are the possible consequences of the SNB's move for the global economy and the gold market? The removal of the peg caused significant franc appreciation, which harmed exporters (strong currency is not bad for the economy, but abrupt exchange rate movements are usually harmful) and banks which granted international loans. Due to the Swiss franc's safe haven status and low interest rates, lots of loans in Europe are denominated in Swiss francs, which creates a new risk in the old continent (for example, Austrian borrowers hold 10% of GDP in CHF loans). Removing the peg could entail the European mortgage backed security crisis, which would be supportive for gold, the ultimate safe haven.

Theoretically, it could cause another shift from the euro into the Swiss franc. The ECB's QE would also strengthen the Swiss franc. However, the SNB lowered the interest rate for balances held on sight deposit accounts from -0.25% to -0.75%, in order to deter the capital inflows and currency appreciation, inducing banks to conduct more "real" lending to boost the economy. Interestingly, the SNB introduced the negative interest rate in December, 2014 to a large extent in order to stem a tide of money flowing in due to Russia's financial crisis.

The predicted slight recession in the 2015, a possible bursting of the real estate bubble, and banks' problems with the international non-performing loans would also weigh on further price appreciation. Therefore, after some depreciation (initial movements in the currency movements are often exaggerated), the Swiss franc may likely trend sideways in coming months (unless the Eurozone collapses). However, investors should be aware that the negative interest rates between 1972 and 1978 introduced by the SNB did not prevent the 75-percent appreciation of the franc. The long-term future of the Swiss currency depends to a large extent on the pace of printing money and whether the SNB is willing to abandon price stability in favor of an exchange rate target.

In the short run, the winners would be the greenback and gold, because there is one less safe-haven currency in town. The yellow metal and the U.S. dollar can additionally gain if the SNB re-allocates some of its euro-denominated holdings into them, which seems to be logical step after removing the peg to euro. Although some foreign investors (like Russians, which is quite understandable, taking into account the ruble's uncertain future) still want to hold Swiss francs and pay 0.75%, gold has become relatively cheaper to hold as a safe-haven. Any further decreases of the Swiss interest rates, thus, would positively affect the gold prices.

Would you like to know what the major central banks' action mean to the global economy and gold market? We analyze the recent surprising SNB's action in our last Market Overview report. We provide also Gold & Silver Trading Alerts for traders interested more in the short-term analysis. Sign up for our gold newsletter and stay up-to-date. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.