Silver Price Projection, U.S. Dollar Correction

Commodities / Gold and Silver 2015 Mar 12, 2015 - 03:06 PM GMTBy: DeviantInvestor

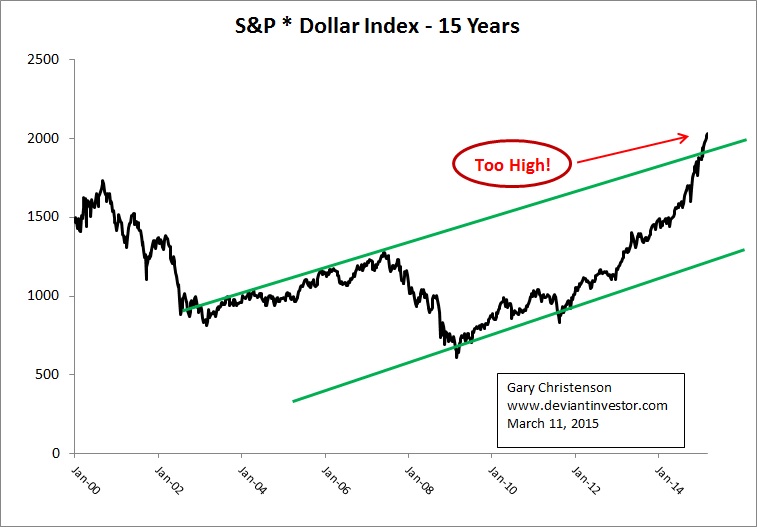

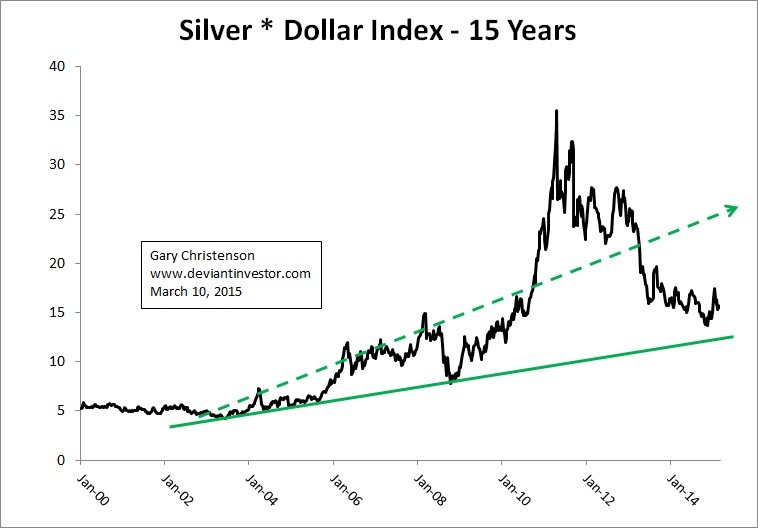

Take the S&P Index and multiply by the US dollar index. This removes most of the currency variation. Do the same with silver. The chart of silver times the dollar looks very much like silver priced in euros.

Take the S&P Index and multiply by the US dollar index. This removes most of the currency variation. Do the same with silver. The chart of silver times the dollar looks very much like silver priced in euros.

Note the following:

- The S&P times the $ has been rising since 2002, is now at all-time highs, and is above the top of the trend channel as I have drawn it. The massive increase in debt since 9-11 has created liquidity which has levitated the S&P.

- Silver times the $ has risen since 2002, is well below its 2011 high (markets correct) and has dropped almost to the support trend line as I have drawn it. The massive increase in debt since 9-11 created liquidity that helped silver spike higher in 2011, but it has since corrected.

Facts and Speculation:

- Debt is increasing rapidly. Global debt is approximately $200 Trillion and US debt exceeds $18 Trillion. Unfunded liabilities are much higher. Deflationary forces threaten central banks, hence they pump dollars, euros, and yen into the system to levitate the bond and stock markets. Interest rates have been crushed to multi-generational lows to further levitate the bond market and increase bank profitability. Currently the squeeze on the dollar has pushed it into a parabolic rally, and such rallies always correct. When the dollar corrects (crashes), silver and gold prices will benefit from the ensuing financial chaos.

Examine the silver times $ graph again with speculation regarding possible values after prices compensate for currencies printed to excess.

Current:

Silver $15.60

Dollar Index 0.99

Silver times $ 15.47

Zone 1 (perhaps 2017):

Silver $55.00 or $62.00

Dollar Index 0.90 0.80

Silver times $ 50.00 50.00

Zone 2 (perhaps 2019-20):

Silver $125.00 or $155.00

Dollar Index 0.80 0.65

Silver times $ 100.00 100.00

The above are speculations regarding prices for silver and the dollar index. What is not speculation are the following:

- Markets always correct.

- Parabolic rises usually crash and burn.

- Unbacked paper currencies are being printed to excess and they will devalue in purchasing power.

- Silver and gold have been real money and valuable for thousands of years, in contrast to hundreds of paper currencies that have been inflated into nothingness.

- I don’t know what will happen to the S&P, but we can be relatively certain the prices for gold and silver will rally substantially as all paper currencies inevitably weaken.

Sadly, most people will continue playing on the Titanic financial system and believe it is unsinkable.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.