Gold Sucks!

Commodities / Gold and Silver 2015 Mar 13, 2015 - 10:30 AM GMTBy: Gary_Tanashian

Ben Kramer-Miller, a fundamental gold stock analyst who I keep an eye on, recently had an article at SeekingAlpha called Gold’s Bull Run Has Not Yet Begun. I remember taking note of the title when it came out, but as is usually the case I did not have the time, nor the inclination to read it. I like to keep my own thoughts square and balanced and don’t need other peoples’ thoughts on gold clouding my own.

Ben Kramer-Miller, a fundamental gold stock analyst who I keep an eye on, recently had an article at SeekingAlpha called Gold’s Bull Run Has Not Yet Begun. I remember taking note of the title when it came out, but as is usually the case I did not have the time, nor the inclination to read it. I like to keep my own thoughts square and balanced and don’t need other peoples’ thoughts on gold clouding my own.

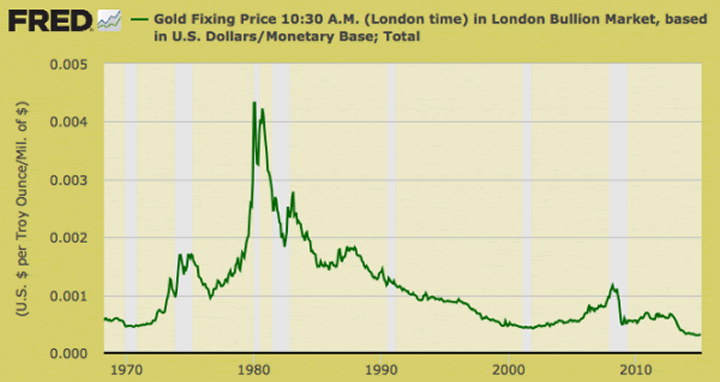

But as I was fooling around over at the St. Louis Fed’s website (it is recommended that geeks register for a free account) doing the following charts I remembered ‘oh jeez, I think somebody’s already on this topic’. So I checked it out and sure enough he did gold vs. the Monetary Base using a graphic from the also-recommended MacroTrends website. Anyway, preamble behind us we move on…

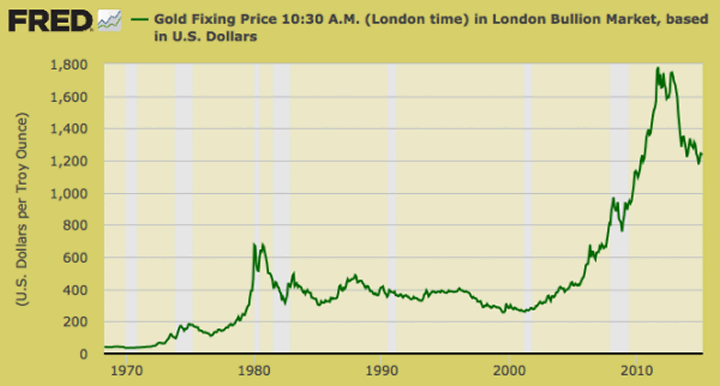

The long-term chart of nominal gold, anyway, has not done so bad. Boy, this bubble from 2001 to 2011 sure was a humdinger. It must have so much further to fall. Look how much higher gold went this time compared to the bubble that blew out in 1980.

Oh wait, this bubble was actually not as bad as the 1980 bubble when CPI adjusted.

Oh wait again, gold is and has been in a bear market in Monetary Base units ever since the US dollar was freed from its shackles in the early 70’s.

Bottom Line

- Either gold sucks

- …or its bull market has not yet begun

…and may never begin if confidence remains intact in policy makers conjuring up digital funny munny units out of thin air while holding our trust in their stewardship.

Stewardship is defined here as blatant manipulation of things that used to mean something, like the rates of interest on loans to be paid back and the productivity that would spring forth from savings, capital deployment and investment. You know, hokey old fashioned stuff like that.

But this is a world where large entities, including governments, don’t need to be responsible for the ‘paid back’ side of the deal and so, gold has sucked because there seem to be no repercussions for it to protect people from. They are creating debt and confidence money and this stupid rock is below the pre-Bretton Woods levels in Money Supply terms.

All the more reason that the ‘gold is not about price, it’s about value’ mantra holds up just fine. It’s price sucks and its value in a traditional sense measured by out of control governmental money creation, has never been better.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.