Gold and Currency War Chaos

Commodities / Gold and Silver 2015 Mar 13, 2015 - 06:20 PM GMTBy: Alasdair_Macleod

This week has been all about currencies, with a weak euro grabbing the headlines. At one point yesterday morning, the euro was 3% down from last Friday's close, hitting a 12-year low against the US dollar. The yen was also weak, challenging its multi-year low point established last December. However, there are signs that gold and silver are being accumulated in the futures markets, and at GoldMoney we have seen a pick-up in demand for physical gold this week.

This week has been all about currencies, with a weak euro grabbing the headlines. At one point yesterday morning, the euro was 3% down from last Friday's close, hitting a 12-year low against the US dollar. The yen was also weak, challenging its multi-year low point established last December. However, there are signs that gold and silver are being accumulated in the futures markets, and at GoldMoney we have seen a pick-up in demand for physical gold this week.

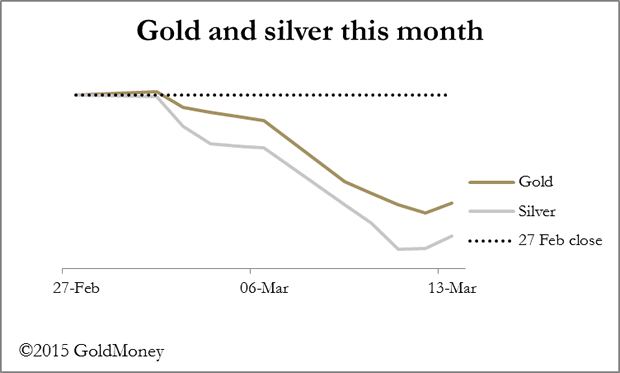

Gold fell heavily last Friday by over $35 after overnight prices failed to hold, reflecting a developing bout of dollar strength. Since then gold has drifted sideways to slightly lower by the close last night, a pattern followed by silver. This month, so far, gold is down 4.5% and silver 6.2%.

Since silver tends to move twice as much as gold up or down, this represents a good relative performance for the former.

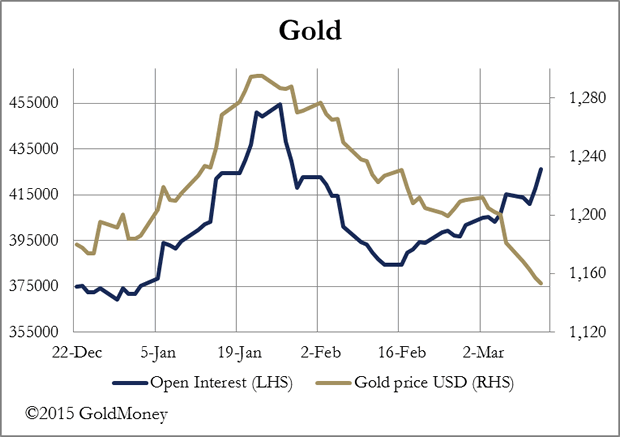

Given the drubbing precious metals have received recently it is a surprise that Open Interest on Comex for both metals is increasing. The next chart is for gold, where this can be clearly seen.

The only Comex category which appears to be adding to its longs is "Other Reportables", which includes dealers that don't fit into the other defined categories. Otherwise, Money Managers are adding to their shorts and Producers and Merchants are reducing theirs, which is normal for gold in falling markets.

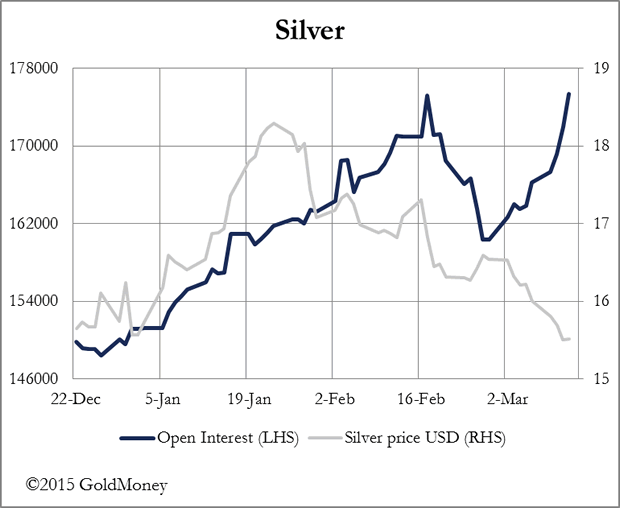

The rise in Open Interest in silver has been more dramatic, which is shown in our next chart.

Open Interest is heading back to new highs. Here again, it is the "Other Reported" category that is going long, together with the "Non-reported" category. It looks like undefinable parties are accumulating long positions.

So what is going on?

When Open Interest accompanies a rising price, it indicates healthy buying is present. Conversely, a falling price, which most of the time is through lack of bids, is usually accompanied by falling Open Interest. The relationship between Open Interest and the price is different at turning points, and it looks like that is what's happening.

Rising Open Interest on a falling price, which is the condition we have here, indicates increased buying support on falling prices, telling us that the price trend is likely to be on the turn. The bullish implication of this new demand is confirmed by silver showing resistance to further price falls relative to gold: silver should have fallen by about 9%.

In other news this morning, deliveries from the Shanghai Gold Exchange rose to 44.52 tonnes for the week ending 6th March. This is more than for the comparable week following New Year in 2014.

Next week

Monday. UK: Rightmove House Price Index. US: Empire State Survey, Capacity Utilisation, Industrial Production, NAHB House-builders Survey, Net Long-Term TICS Flows.

Tuesday. Japan: Leading Indicator, Customs Cleared Trade. Eurozone: HICP, ZEW (Economic Sentiment). US: Building Permits, Housing Starts.

Wednesday. Japan: BoJ MPC Overnight Rate. UK: Average Earnings, Claimant Count Change, Claimant Count Rate, ILO Unemployment Rate, Budget Day. Eurozone: Trade Balance. US: FOMC Fed Funds Rate.

Thursday. Japan: All Industry Activity Index. Eurozone: Labour Cost Index. UK: CBI Industrial Trends. US: Leading Indicator, Philadelphia Fed Survey.

Friday. Eurozone: Current Account.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.