ECB's QE

Interest-Rates / Quantitative Easing Mar 17, 2015 - 05:46 PM GMTBy: Arkadiusz_Sieron

Just one week after the surprising Swiss decoupling from the euro peg, the ECB unleashed its quantitative easing program. On January 22, the President of the ECB, Mario Draghi, announced a €1.1 trillion monetary injection plan, which would start in March 2015 and last until the end of September 2016, or "until we see a sustained adjustment in the path of inflation". What does this €60bn monthly bond-buying program imply for the economy and gold market?

Just one week after the surprising Swiss decoupling from the euro peg, the ECB unleashed its quantitative easing program. On January 22, the President of the ECB, Mario Draghi, announced a €1.1 trillion monetary injection plan, which would start in March 2015 and last until the end of September 2016, or "until we see a sustained adjustment in the path of inflation". What does this €60bn monthly bond-buying program imply for the economy and gold market?

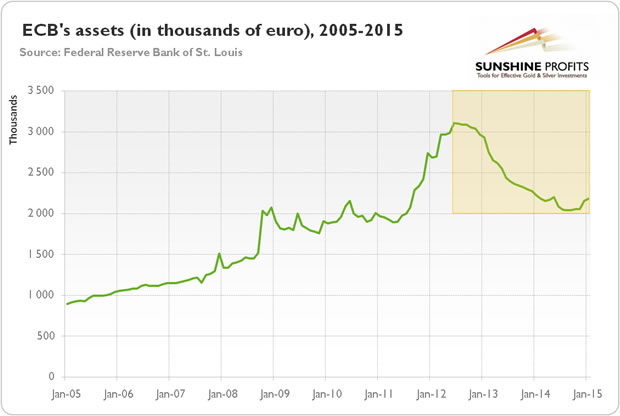

The launching of the QE in the Eurozone means deepening the current divergences between the monetary policies of the major currency areas. Assuming that currency exchange rates are determined mostly by the relative monetary pumping (in the long-run), the ECB's new program will cause the weakening of the euro relative to the U.S. dollar. According to some analysts, the depreciation of the euro in order to boost exports is the very aim of the central bankers' new monetary instrument. Although the currency war narrative sounds quite convincing, let's look at the ECB's balance sheet (Figure 2), which may shed some light on the causes of the QE.

Graph 1: ECB's asset (in thousands of euro) from 1994 to 2014

As you can see in the chart above, the ECB's balance sheet has been decreasing since the second half of 2012. Although the ECB had been conducting easy monetary policy and buying assets even before the QE, its policy was relatively hawkish during the past two years if you analyze its balance sheet. The shrinking balance sheet was caused by the commercial banks, which have been paying off loans from the ECB. Thus, desperate monetary planners from Frankfurt started counteracting the decline in the assets possessed by their central bank. They introduced, for example, a negative deposit facility rate, targeted longer-term refinancing operations (TLTROs), or the asset-backed securities and covered bond purchase program. As you can see in the graph, all of these measures caused only a small increase of the balance sheet.

This is why the QE was introduced. The ECB hopes that this bond-buying program spurs lending to the real economy, which has been contracting since 2011. Although there was a revival of the Eurozone loans to the private sector in the January, there are serious doubts as to whether the QE is able to boost economic growth. The last big monetary stimulus from the turn of 2011 and 2012 did not actually prevent the recession in 2012. The real problem is the lack of creditworthy borrowers due to weak economic growth partially caused by the irresponsible government policies and tax increases since the Global Financial Crisis. In that sense, the German critics of the QE are right: the QE may postpone the necessary structural reforms in Europe.

In other words, an unorthodox monetary policy does not work, where the rest of the economy is not conducive to expectations of good returns on loans (which, oh... surprisingly... are not high in the low interest rate environment). The ECB affects only supply factors, while demand factors make the credit results weak. Sluggish activity, households' efforts to shed debt and banks' efforts to reduce their exposure to risk are holding back lending (non-performing loans are still at a very high level in the Eurozone). This is why Bech, Gambacorta and Kharroubi (2012) found that monetary policy is less effective in periods of recovery following a financial crisis.

What the new bond-buying program can really achieve are even higher assets price inflation and further redistribution of wealth from the majority of the society into financial sector and governments of member states. Some analysts consider the QE as just another bailout program for southern Europe under the guise of fighting with the awful deflation (remember that the Fed's QE was essentially a bailout of the financial institutions with underperforming MBS).

The impact on the gold market is more complex. On the one hand, the QE will mean lower interest rates, which are already at very low levels, but (as recent financial history shows) could dive even deeper. It refers especially to the interest rates on more creditworthy Eurozone countries. Low real interest rates are one of the main drivers of the gold prices. On the other hand, the QE weakens the euro compared to the U.S. dollar, which often, but not always, is negatively correlated with gold prices. So even if gold rises in terms of the euro, it could be harder for gold to rally in U.S. dollars if the greenback is getting stronger. What is more, the QE could squeeze risk premiums, which would be negative for gold, as investors increase their demand for more risky assets such as stocks.

Nevertheless, the QE would not solve structural problems of the Eurozone. The recent situation in Greece shows that the future of the monetary union is still not certain, while bonds in Europe trading at negative interest rates clearly indicates that investors are very pessimistic about the future of the Eurozone and averse to risk-taking. The gold prices actually rebounded after Draghi's announcement (at least initially), which may be some indication of the overall potential effect of the ECB's QE on the gold market.

Thank you.

If you’re interested in reading our thoughts on other gold-related topics, we invite you to our website. We focus on the global macroeconomics and fundamental side in our monthly gold Market Overview reports and we provide also Gold Trading Alerts for traders interested more in the short-term prospects. Sign up for our gold newsletter and stay up-to-date. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.