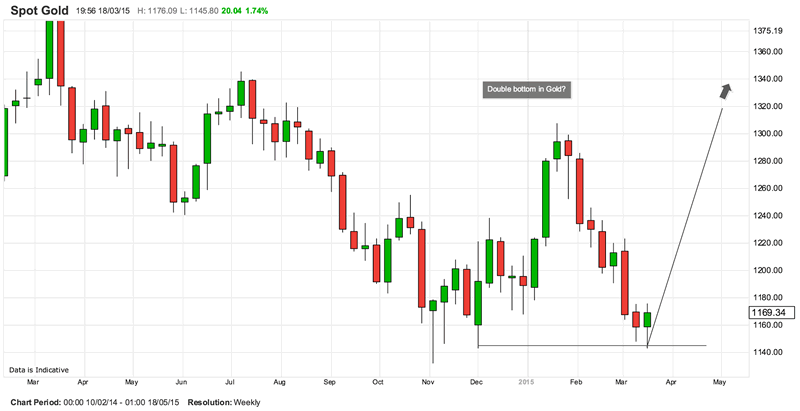

Double Bottom in Gold Price

Commodities / Gold and Silver 2015 Mar 18, 2015 - 09:26 PM GMTBy: Mario_Innecco

With the Fed looking like it is wimping out on raising rates in June 2015 and the dollar index crashing back below 100 it looks like gold has bottomed and formed a double bottom.

Jan Hatzius of Goldman Sachs now sees the first rate hike in September and last year GS was talking about a March or June hike. The strength we have seen in the dollar these last few months was based on expectations of rate hikes by the Fed so I think the FX/Gold market could get pretty wild as expectations of these rate hikes by the Fed dissipate.

Don't forget that we have seen major market disruption in the September/October period in 2001 and 2008 so it looks like we could see some kind of financial market turmoil later on this year during the same September/October period. It could be that we have a seven-year cycle coming up then. Shemitah comes to mind.

The price objective for the double bottom would be around $1460. Time wise I would say it could happen within the next three months.

Best regards,

By Mario Innecco

A Futures and Options broker in London for twenty years

Mario Innecco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.