FOMC is boxed in, Gold and Silver

Commodities / Gold and Silver 2015 Mar 20, 2015 - 06:07 PM GMTBy: Alasdair_Macleod

The Federal Open Market Committee (FOMC) statement released on Wednesday was notable for deferring interest rate rises to some unspecified time in the future. This was realistic, given the continuing strength of the dollar, downward revisions to the inflation outlook, and economic weakness in virtually all industry surveys. The Fed's obvious problem in deferring a rise in interest rates is the continuing improvement in the unemployment statistics. However these are seriously flawed: for example in February housing starts fell sharply due to the bad weather, yet seasonally adjusted non-farm payrolls for residential construction jobs were said to rise by 17,200.

The Federal Open Market Committee (FOMC) statement released on Wednesday was notable for deferring interest rate rises to some unspecified time in the future. This was realistic, given the continuing strength of the dollar, downward revisions to the inflation outlook, and economic weakness in virtually all industry surveys. The Fed's obvious problem in deferring a rise in interest rates is the continuing improvement in the unemployment statistics. However these are seriously flawed: for example in February housing starts fell sharply due to the bad weather, yet seasonally adjusted non-farm payrolls for residential construction jobs were said to rise by 17,200.

It appears the Fed is boxed in, and raising the Fed funds rate would probably only serve to increase excess reserves. If so, the Fed would have to shell out interest payments to the banks at a rate it really cannot afford, given its own balance sheet is geared over 70 times. Markets seem to be slow to understand this problem: if the Fed is unable to raise interest rates (i.e. the Fed funds rate) the dollar itself is at risk.

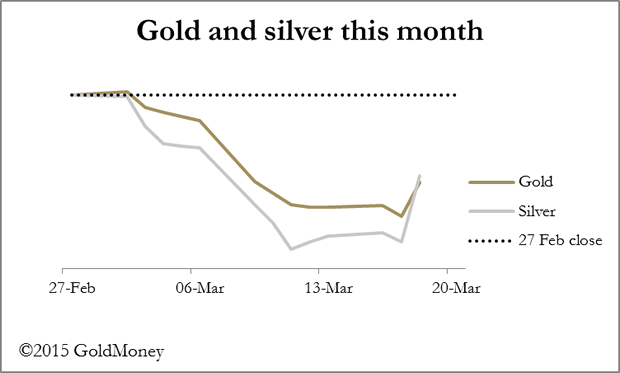

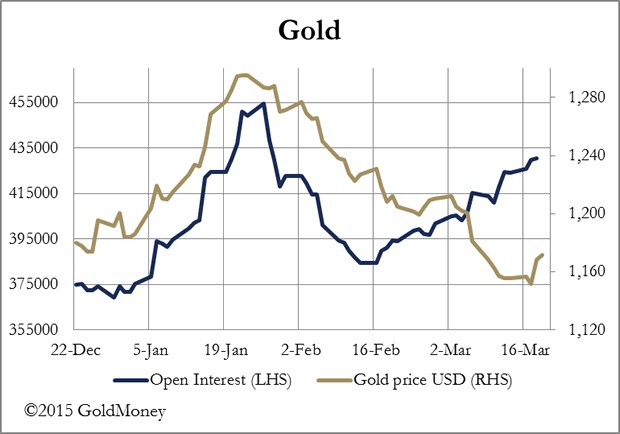

The immediate effect on precious metal prices was to turn them sharply higher, and Open Interest on Comex has continued to climb. Gold was up a net $16 on the week and silver $0.55. Oversold currencies bounced strongly, but gave back most of their gains yesterday. The set-up is now for a bear squeeze in gold and silver, with the Managed Money category on Comex somewhat short. The chart for gold and its Open Interest is shown below.

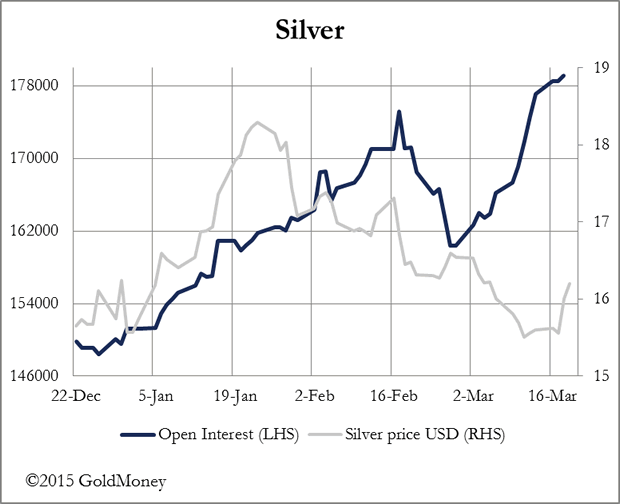

Silver has continued to resist moves to the downside, and here the Open Interest has continued its climb as well. Silver has outperformed gold, illustrated in the chart at the head of this report.

Normally falling prices are accompanied by lower Open Interest. The current divergence is therefore indicative of increased buying support, which may be enough to reverse the bear trend of the last three years.

It has been a momentous week, and rarely do so many important events occur. As well as the Fed showing they dare not or cannot raise interest rates, Greece's negotiations with the other Eurozone members are stranded on the rocks of reality. This was the week when markets suddenly realised the UK faces a general election with considerable political risk so sterling was sold heavily. The UK, Germany, France, Italy, Luxembourg and Switzerland are queuing up with probably Australia and New Zealand to become members of the Chinese and Russian led Asian Infrastructure Investment Bank, compromising NATO and Pacific alliances. Unfortunately for American hegemony, the political line-up is following an economic interest, and this is a party to which America does not have an invitation.

If all that is not enough, the London gold fix changes this morning after ninety-six years from a committee to a platform run by the International Commodity Exchange. Participants (the approximate equivalent of market makers) announced so far are Barclays, HSBC, Scotiabank, Société Generale and UBS. It is interesting that the American and Chinese houses are holding back.

GoldMoney's customers sat on their hands ahead of the FOMC announcement, turning buyers after the event, according to our dealing desk.

Wholesale gold bullion deliveries from the Shanghai Gold Exchange amounted to 51.456 tonnes last week, totalling 507.71 tonnes since 1st January.

Next week

Monday. UK: CBI Distributive trades, Industrial Trends. Eurozone: Flash Consumer Sentiment. US: Existing Home Sales.

Tuesday. Eurozone: Flash Composite PMI. UK: CPI, Input Prices, Output Prices, ONS House Prices. US: CPI, FHFA House Price Index, Flash Manufacturing PMI, New Home Sales. Japan: CSPI.

Wednesday. UK: BBA Mortgage Approvals. US: Durable Goods orders.

Thursday. Eurozone: M3 Money Supply. UK: Retail Sales. US: Initial Claims. Japan: CPI, Real Household Spending, Unemployment, Retail Sales.

Friday. US: Core PCE Price Index (3rd Est.), GDP (3rd Est.), GDP Price Index (3rd Est.).

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.