Greece and EU Running Out of Time as Bank Runs Intensify

Stock-Markets / Eurozone Debt Crisis Mar 23, 2015 - 11:09 AM GMTBy: GoldCore

- EU and Greece running out of time as talks end “in disarray” – again

- EU and Greece running out of time as talks end “in disarray” – again

- Greece warns Merkel of ‘impossible’ debt

- Concerns Greece out of money by end of April

- Friday’s “agreement” in Brussels falls apart hours later as protagonists fail to agree on specifics

- Greece now insolvent – will run out of liquidity by end of April

- Greek banks on verge of collapse as runs continue – €1.5 billion emptied out of banks last week alone

- ‘Grexit’ could propel gold to over $2,000/oz

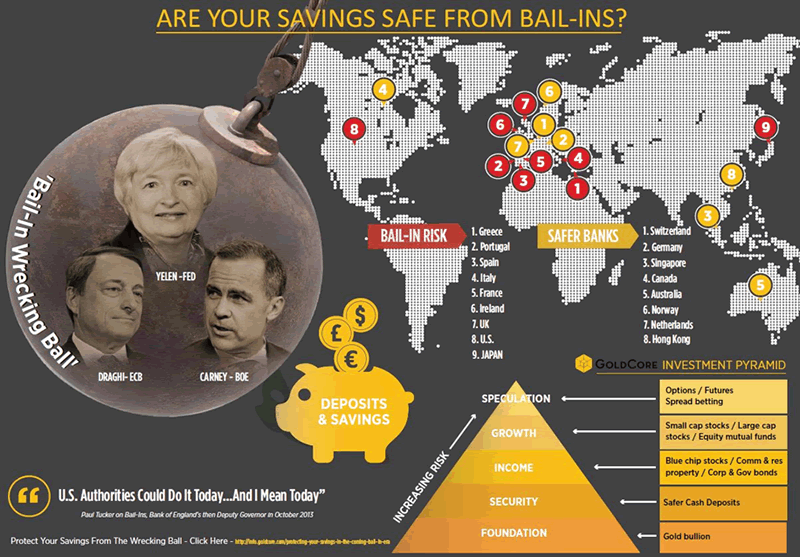

- Cyprus style bail-ins look increasingly possible

Greece’s place in the Eurozone is as precarious as ever as talks between Prime Minister Tsipras and European leaders in Brussels broke down – hours after reaching general agreement – and Greece warned Germany that it will be “impossible” for Greece to service debt payments due in the coming weeks if the EU fails to provide short-term financial assistance.

Greece – faced with illiquidity, insolvency and a potential banking collapse – is running out of time and appears to be on the back foot as its international creditors refuse to countenance any debt restructuring, rescheduling or forgiveness.

The warning from Greece came in a letter from Tsipras to Angele Merkel provided to the Financial Times. It comes as concerns mount that Athens will struggle to make pension and wage payments by as early as next week, the end of March, and could run out of cash completely before the end of April.

The letter, dated March 15, came just before Ms Merkel agreed to meet Mr Tsipras on the sidelines of an EU summit last Thursday and invited him for a one-on-one session in Berlin, scheduled for Monday evening.

In the letter, Tsipras warns that Greece will be forced to choose between paying off loans, owed primarily to the IMF, or continue social spending. He blames ECB limits on Greece’s ability to issue short-term debt as well as eurozone bailout authorities’ refusal to disburse any aid before Greece adopts a new round of economic reforms.

“Given that Greece has no access to money markets, and also in view of the ‘spikes’ in our debt repayment obligations during the spring and summer . . . it ought to be clear that the ECB’s special restrictions when combined with disbursement delays would make it impossible for any government to service its debt,” Mr Tsipras wrote.

He said servicing the debts would lead to a “sharp deterioration in the already depressed Greek social economy — a prospect that I will not countenance”.

At a press conference on Friday Angela Merkel said “the Greek government has the opportunity to pick individual reforms that are still outstanding as of 10 December and replace them with other reforms if they . . . have the same effect,” according to the Financial Times.

That Merkel would consider holding Syriza to an agreement made between Greece’s previous government and the Troika – which Syriza have eschewed – shows how little progress has been made in the intractable negotiations between the two sides since Syriza came to power.

All that has changed is that Greece is more insolvent and Europe has bought time to deal, albeit reluctantly, with a “Grexit”.

Bloomberg confirms that the Greek government may run out of cash to pay pensions and salaries in April.

“Locked out of capital markets and with its coffers running dry, Greece is scraping the bottom of the barrel to pay pensions and salaries amid signs that it could run out of money by early next month.”

At the same time, Bloomberg reports that €1.5 billion was withdrawn from Greek banks last week alone.

January saw record drops in deposits in Greek banks. The banks have been drawing from the Emergency Liquidity Assistance (ELA) program to stay afloat. The ELA is operated by the Greek Central Bank but is reviewed weekly by the ECB.

Greece’s central bank requested a raise to the ELA ceiling to deal with the bank runs. The ECB approved a €400 million raise in the ceiling – less than half of what was requested, according to Bloomberg.

Depositors in Greek banks, both individuals, small and medium enterprises and corporates are becoming increasingly concerned about the twin risks of default and return to the drachma or remaining in the monetary union and potentially having Cyprus style bail-ins imposed on Greek savers.

Time certainly appears to be running out for Greece. Either Syriza capitulates and returns to the Troika’s bail-out mechanism – highlighting a complete loss of sovereignty, or Greece defaults and exits the Eurozone.

‘Grexit’ should propel gold higher with respected analysts saying gold could quickly rise to $2,000 per ounce should a ‘Grexit’ occur.

The Greek and EU debt ‘can’ has been continuously kicked down the road. We are running out of road …

“A must read for depositors globally seeking to protect their bank deposits from bail-ins”:

Protecting Your Savings in the Coming Bail-In Era

MARKET UPDATE

Today’s AM fix was USD 1,181.40, EUR 1,086.15 and GBP 791.77 per ounce.

Friday’s AM fix was USD 1,171.75, EUR 1,096.17 and GBP 794.73 per ounce.

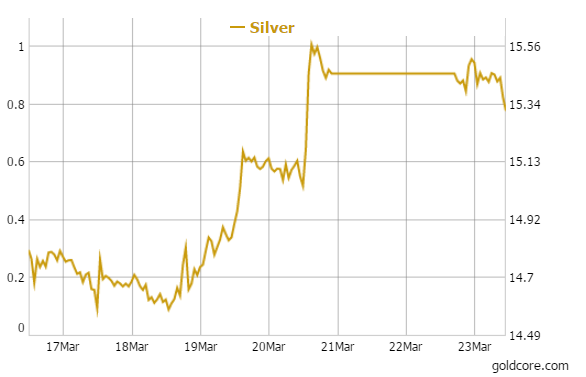

Silver in U.S. Dollars – 1 Week

Gold and silver were both strong for the week – gold rose 2.42 percent and silver surged 7.45 percent.

Gold climbed 1.1 percent or $12.90 and closed at $1,183.20 an ounce Friday, while silver surged 3.72 percent or $0.60 at $16.73 an ounce.

In Singapore, bullion for immediate delivery in afternoon trading was $1,181.71 an ounce. Gold remained steady not moving much since the close on Friday.

In London spot gold in the late morning is trading at $1,181.66 or down 0.03 percent. Silver is at $16.70 or off 0.20 percent and platinum is at $1,138.09 or up 0.10 percent.

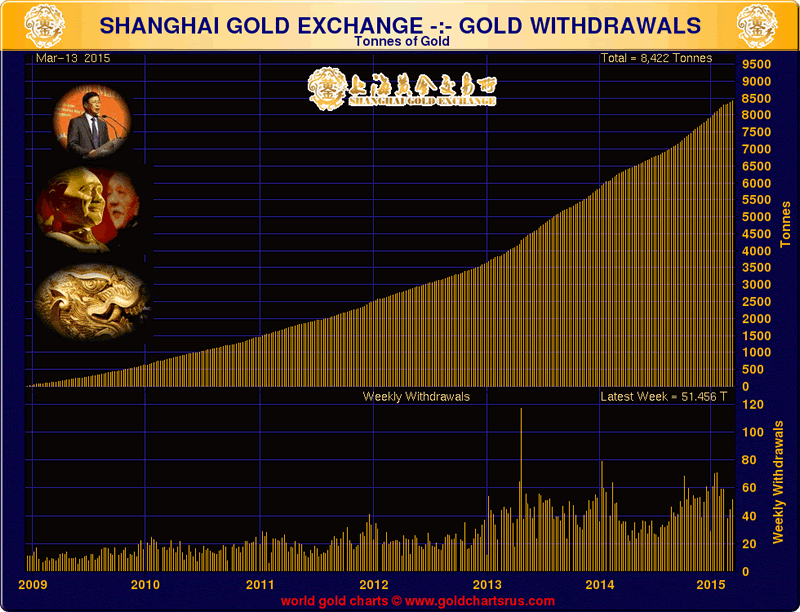

Premiums on the Shanghai Gold Exchange (SGE) have fallen $2 to $4-$5 today compared with $6-$7 on Friday. This suggests that gold demand in China eased after the gains last week. However, Chinese gold demand remains very robust as seen in the 51.5 metric tonnes of gold withdrawals on the SGE last week.

European markets today are cautious due to concerns regarding Greece, ahead of a meeting between its prime minister and Germany’s Angela Merkel.

In Europe, Greek Prime Minister Alexis Tsipras is meeting with German Chancellor Angela Merkel today. Greece is running out of cash quickly which is heightening the risk of a ‘Grexit’ and a return to the drachma, or alternatively to Cyprus style bail-ins.

Open Europe a research group estimated a ‘Brexit’ or Britain leaving the European Union could cost Britain 56 billion pounds ($84 billion) a year by 2030 unless the country keeps its borders open, based on a departure by January 2018.

Bullion coin demand remains robust as seen in the latest data from the U.S. Mint. Sales of gold American Eagle coins by the U.S. Mint have already out sold last March’s total by well over 50% this month, reaching 34,500 ounces with another week of the month left to go according to Reuters. In March 2014 as a whole, they reached 21,000 ounces.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.