Crude Oil Surges, Gold price Spikes as Middle East Tensions Escalate

Commodities / Gold and Silver 2015 Mar 26, 2015 - 12:44 PM GMTBy: GoldCore

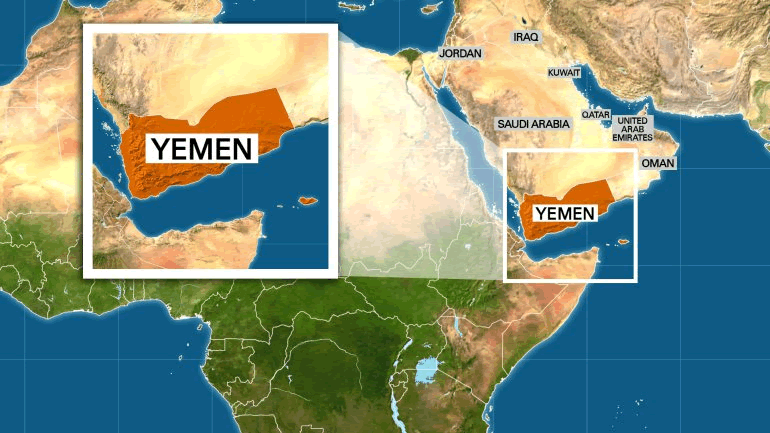

- Geopolitical tensions in Middle East escalate dramatically as Saudi Arabia bombs Yemen

- Geopolitical tensions in Middle East escalate dramatically as Saudi Arabia bombs Yemen

- Yemen’s government seized power in coup – Regarded as hostile to Saudi and ally of Iran

- Saudi attack is an escalation of Middle Eastern proxy war between Gulf States and Iran

- Action has broader geopolitical implications in deepening cold war between the West and East

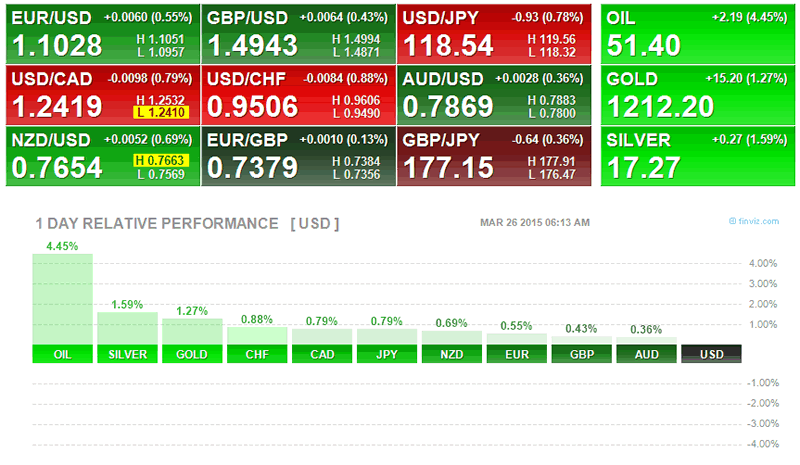

- Oil surged 6% and gold 2% on the the news

- Should oil prices return to new record highs will impact struggling global economy

Geopolitical tensions escalated dramatically over night as Saudi Arabia launched military operations including air strikes in Yemen. The Saudis claim the action is to counter Iran-allied forces besieging the southern city of Aden where the U.S. backed Yemeni president had taken refuge.

Oil surged and gold rose nearly 2% following a sharp drop in stocks on Wall Street globally in response to the bombing in Yemen.

Gulf broadcaster al-Arabiya TV reported that the kingdom was contributing as many as 150,000 troops and 100 war planes to the operations. Egypt, Jordan, Sudan and Pakistan were ready to take part in a ground offensive in Yemen, the broadcaster said.

The Saudi’s seem determined to pull geopolitically strategic Yemen back into its orbit following the coup d’etat in February.

The Syrian state news agency said the Saudi-led military operation is an act of “blatant aggression”.

“Gulf war planes led by the regime of the Saudi family launch a blatant aggression on Yemen,” read their headline. The Syrian government led by President Bashar al Assad is an ally of Iran, which is in turn allied with the Yemeni Houthi rebels who are fighting to oust the country’s U.S. backed president.

Saudi Arabia and other Gulf states have been important sponsors of the insurgency against Assad.

Traditionally Saudi Arabia has kept Yemen under its control through patronage of various tribal factions. This system was disrupted in 2011 when internal social pressures forced the incumbent President Saleh to step down.

In September, the Houthis – a Shia group seen as allied to Iran – seized control of Yemen’s capital Sana’a. Shia’s make up up to 45% of Yemen’s population. In February, the Houthis declared themselves the new government of Yemen filling the vacuum caused by the resignation of the previous government amid a political impasse.

Saudi’s actions in Yemen is a dramatic escalation in the proxy war between the Gulf states and Iran now raging in Iraq and Syria. The tensions arise out of competition over who has access to the lucrative, oil-hungry, European markets.

That a country would choose to directly intervene militarily in the affairs of another country is a dangerous precedent and could lead to a wider conflagration in the region – especially if Syria or Iran decide to retaliate against Saudi Arabia.

Iran now may claim to have justification to involve itself directly into the affairs of neighbouring countries and the potential for direct conflict and a full scale regional war has just increased.

It may also lead to heightened tensions in the simmering Cold War between the West and the East. Russian diplomacy disrupted moves by the West and western-backed Gulf states to remove yet another secular leader, one of the few remaining secular leaders, in the Islamic world – Assad in Syria.

Iran and Syria have close diplomatic and business ties with Russia. The White House has already made its support for Saudi actions clear and it is likely that Russia will support Iran in any response it may deliver.

Given the strategically vital nature of the whole region it is unlikely that either the U.S. or Russia will allow events to be determined by local players and this has serious implications in the new Cold War.

Oil surged over 6% on the news. A full-on conflict between Iran and the Gulf states would likely shut off the Straits of Hormuz, dramatically reducing the supply of oil coming out of the Gulf and a spike in oil prices.

This would benefit both Russia’s struggling economy and the U.S. energy sector but impact struggling consumers in the U.S. and internationally. Indeed, Europeans are particularly vulnerable to a sharp rise in oil prices now after the significant fall in the euro in recent months.

Gold’s rise is indicative of its function as a hedge against economic and geopolitical uncertainty. A supply crunch in oil in the middle of a slump driven by lack of demand would put even more pressure on industries struggling to sell product to heavily indebted western consumers.

While oil prices remain very depressed, surging oil prices could again be the ‘straw that breaks the global economies back’.

“A must read for family offices seeking wealth preservation”

Essential Family Office Guide to Investing In Gold

MARKET UPDATE

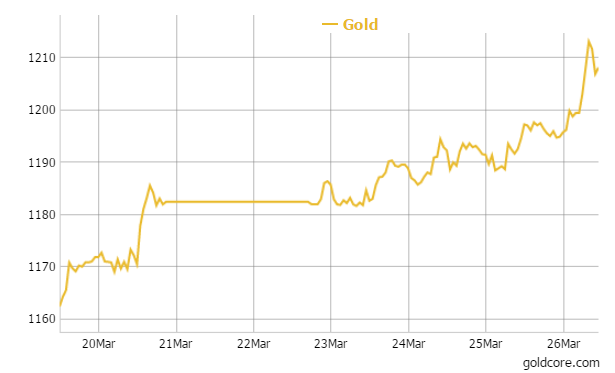

Today’s AM fix was USD 1,209.40, EUR 1,097.26 and GBP 809.23 per ounce.

Yesterday’s AM fix was USD 1,192.55, EUR 1,088.89 and GBP 801.18 per ounce.

Gold rose 0.16 percent or $1.90 and closed at $1,195.60 an ounce yesterday, while silver slipped 0.18 percent or $0.03 at $16.97 an ounce.

Gold has been bid higher due to the escalation of geopolitical risk in the Middle East and technical buying after gold rose above the $1,200/oz level.

Gold in U.S. Dollars – 1 Week

Gold climbed more than 1.4% to a three and a half week high and silver soared almost 3 percent as air strikes in Yemen had a ripple effect on markets.

Saudi Arabia and its Arab allies launched air strikes in Yemen against allies of Iran in the southern city of Aden. The return of ‘risk off’ sentiment for the first time in many weeks, boosted gold, silver and German bunds while equities and the U.S. dollar fell.

The question is whether this is a flash in the pan for gold or the start of a more meaningful rally in prices. Gold appears overbought in the very short term. The last winning streak for 7 days in a row for the yellow metal was in August 2012.

In the end of day trading in Singapore, gold prices rose 0.8 percent to $1,204.20 an ounce, but earlier reached $1,204.60, its highest since March 5th. In London, Spot gold hit a peak of $1,219.40 an ounce and climbed 1.2 percent at $1,210.30 in morning trading. Comex U.S. gold futures for April delivery were up $12.70 an ounce at $1,209.70.

On the Shanghai Gold Exchange (SGE), premiums pulled back to about $2-$3 an ounce, compared with $6-$7 last week.

Silver prices jumped to a three month high at $17.38 per ounce. Platinum was $1,153.25 per ounce up 0.6 percent, while palladium was $770.39 an ounce or up 1 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.