Stock Market Up 206% in Six Years... Time to Sell?

Stock-Markets / Stock Markets 2015 Mar 26, 2015 - 07:52 PM GMTBy: DailyWealth

Dr. David Eifrig writes: Do yourself a favor and forget this next fact entirely...

Dr. David Eifrig writes: Do yourself a favor and forget this next fact entirely...

The stock market has risen 206% over the past six years.

We recently hit the sixth anniversary of this stellar bull market. It was March 9, 2009 when the market bottomed after the financial crisis. If you had the guts to buy stocks at that time, you've done great.

However, the bull market is getting old. Six years is a long time. That makes a lot of individual investors and some market prognosticators nervous.

But it shouldn't. Here's why...

The stock market has no memory. It doesn't know where it has been. It doesn't care how much it has risen or fallen. Over any realistic time frame, it responds to economic strength, business fundamentals, and valuation.

Forget about the bull market. It doesn't tell you what's going to happen next.

Instead, we need to look at what's happening in the market today and discern what that means for our investments. Here's what we're seeing right now...

Flights are full... A few weeks ago, my flight was loaded and I accepted $600 from the airline to take a later flight. It's one of my favorite money-saving "hacks," and it's happening more frequently because the airlines are overbooking again.

Rental cars are sold out, too. I was recently asked if I'd take a minivan instead of my reserved compact car – a swap I was less happy to accept.

No question, the economy is doing well. But it's not doing great...

Yes, unemployment has improved from a peak of 9.9% in April 2010 down to 5.5% today. But that's not really "low" unemployment. That's aboutaverage.

The economy also doesn't show any signs of inflation. If anything, deflation is a greater fear. And any student of economic history knows you can't have a runaway boom without rising prices. It's simply contrary to the "laws" of economics.

So while the economy has improved a great deal from its crisis six years ago, it still has a good deal of room to improve.

Meanwhile, stocks aren't expensive...

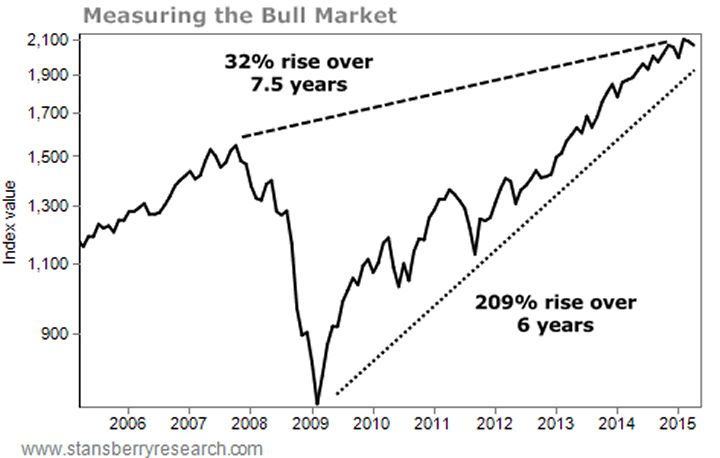

Yes, the bull market has pushed the market up 206%. But the vast majority of that rise was just for stocks to get back to the prices they should have been at without the disruption of the 2008-2009 financial crisis. Stocks are up just 32% from pre-crisis highs. Take a look:

Today, the S&P 500 is priced at about 18.5 times earnings. But consider this... during times of low interest rates and inflation (like we have now), stocks deserve a higher valuation.

With high interest rates, the expectation is that you'll have more money in the future than you would with low rates, so the price you'll pay for earnings today (the P/E ratio) drops when inflation and high interest rates are around.

But when interest rates and inflation are low... a dollar in the future is worth more than it would be if inflation has been eating away at it. That forces investors into risky assets like stocks. And that leads to higher valuations.

Even more interesting to me... since the crisis, corporate earnings per share have grown 934% – more than the market has risen. But that's starting from a time when companies were taking drastic one-time write-offs. So the gains are not as wild as they first look. From the 2007 peak to now, earnings per share are up just 12%.

Meanwhile, corporate debt has declined dramatically. In 2007, using S&P 500 stocks as our barometer, corporations had roughly $0.39 borrowed for every $1 of assets. Today, that has dropped to $0.23. So these companies are much less leveraged, making their stocks safer in turn.

All of a sudden, some stocks don't seem expensive. They seem cheap.

Few people realize it. Most investors are scared right now. But we're excited for what could become the longest bull market on record.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

P.S. If you haven't yet, I urge you to check out my new Big Book of Retirement Secrets. It includes things like how to legally hide money from the U.S. government... get silver from your local bank... a little-known IRS "hack" worth an extra $15,000 tax-free a year... and much more. Better yet, for a limited time you can get a copy for FREE. We just ask for $5 to cover shipping costs. Learn all about it and how to claim your free copy right here.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.