Gold and Silver Will Likely Rally While the Stock Market Whipsaws!

Commodities / Gold and Silver 2015 Apr 06, 2015 - 01:31 PM GMTBy: Brad_Gudgeon

Some interesting things have come to my attention: 1) it looks like precious metals are going to rally strongly over the next week and a half; 2) at the same time the stock market is going to go through some wild swings both up and down.

Some interesting things have come to my attention: 1) it looks like precious metals are going to rally strongly over the next week and a half; 2) at the same time the stock market is going to go through some wild swings both up and down.

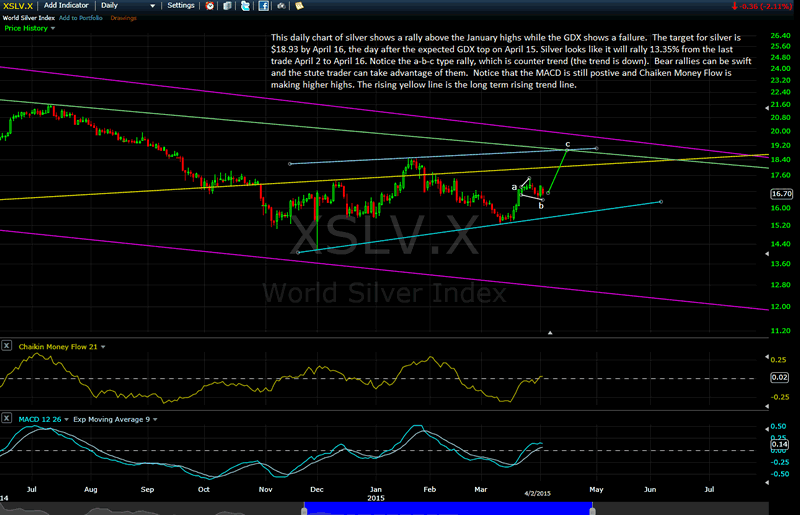

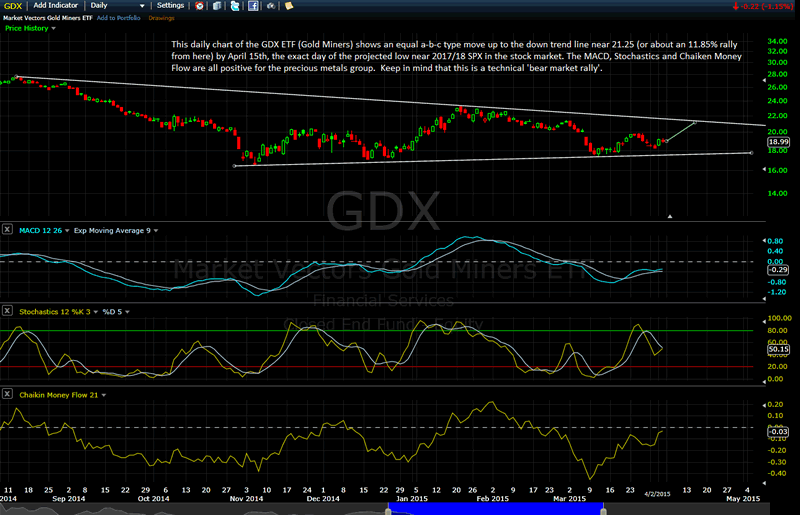

Below are daily charts of silver and GDX (the Gold Miners ETF):

Silver Daily Chart

GDX Daily Chart

Beings it's a Holiday weekend there are some things I have missed due to family coming into town, etc. One of those things is the fact that the S&P 500 futures went down 19 points on the employment report Friday while the market was closed, which brings us to a couple of issues: 1)-- when futures trade when the cash market is not open, they tend to exaggerate moves; and 2) but... it is something we cannot ignore, which brings me to this conclusion: we are in one of those rare moments (I can only remember one other time this happened in 30 years!) when the corrective 'b' wave exaggerates its move and the dominant Gann 8/16 trading cycle becomes the sub-dominant, whereupon the whole phase shifts to the sub-dominant being dominant with about a 4 trading day (3-5 trading days on tops) shift (Uranus and Pluto [negative] with Jupiter [positive] at the same time).

Bottom line: It looks like we are going down to test the .236 retracement at or near 2030.88 SPX by Tuesday; and the 19 points down is not likely to be fulfilled on Monday morning once the night traders who trade futures take their profits on shorts Sunday night and the cash market supports it the next day. Likely we are down about 10/12 points overall Monday morning and we should probably come back to be down about even (or close) mid- session, but the clear fact is we have a clear case of a phase shift and we are going to take action by waiting for the market to come back and re-shift to a short position.

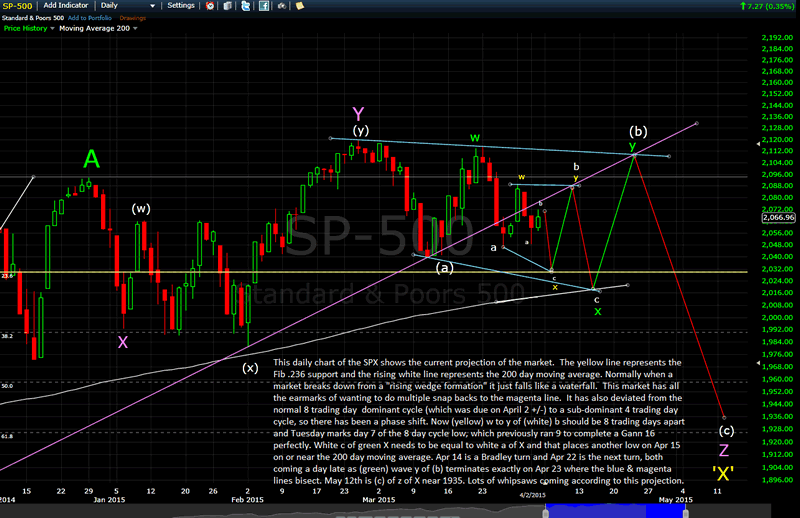

Here is the reorganized projection for the SPX:

S&P500 Whipsaw Daily Chart

So, I expect 2030 to be tested on Tuesday and then a sharp rebound to test 2087/88 by Friday, this sets up for a move down to test the 200 day moving average near 2017/18 on the Bradley turn due 6 trading days after the April 7 low (which itself is 6 trading days after the last low which was 9 trading days (average is 8 td's). A huge rally to the next Bradley turn on April 23(9 trading days from this Friday) to near 2110 is due and that would be wave y of B, a huge rally indeed, but the recent distortions cause these kinds of swings.

Like I said before, I didn't become #1 at Timer Trac because I was right all the time, but because I could recognize when I was wrong and I was wrong about expecting a gap up Monday. Once you understand this most important rule of being a trader, the better off you will be. It is a lot like playing black jack in a casino and you are a card counter. You are not going to win every hand, but you can walk out of there a winner when all is said and done, if you know how to play the game.

According to Ray Merriman, the Cardinal Climax with Uranus and Pluto in play has caused a lot of havoc with the normal cycles etc., since 2008 (this ended on March 17, 2015). It still has its influence though as we are still close by in time and we have to deal with it.

Just a note: W.D. Gann was the most famous trader who ever lived and he used astrology amongst other tools (which are for the most past lost to antiquity) to amass what would be today about a $1,000,000,000 fortune with about a few thousand dollars to start. Even he wasn't perfect.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.