U.S. House Building Off to Slow Start in 2015; Starts Miss Expectations

Housing-Market / US Housing Apr 17, 2015 - 10:35 AM GMTBy: Mike_Shedlock

Add home building to the list of disappointing economic reports.

The Bloomberg Consensus for seasonally adjusted starts was for 1.04 million. Instead we saw .926 million.

Highlights

Housing is still sluggish based on the latest starts data which disappointed. Starts in March slightly rebounded a monthly 2.0 percent after plunging a monthly 15.3 percent in February. Expectations were for a 1.040 million pace for February. The 0.926 million unit pace was down 2.5 percent on a year-ago basis.

By region, starts gained 114.9 percent in the Northeast-almost certainly a weather related rebound but in a small region. The Midwest also saw a weather related gain of 31.3 percent. However, the large South region declined 3.5 percent and the West fell 19.3 percent.

Housing permits were a little stronger but still disappointed, falling 5.7 percent after gaining 4.0 percent in February. The 1.039 million unit pace was up 2.9 percent on a year-ago basis. The median market forecast was for a 1.085 million unit pace.

Overall, housing is still soft even with weather improving. The latest data will likely keep the Fed on the loose side in the near term.

Recent History Of This Indicator

Housing starts unexpectedly fell sharply in February. Starts fell a monthly 17.0 percent, following no change in January. The 0.897 million unit pace was down 3.3 percent on a year-ago basis. This was the lowest starts level since January 2014 with a 0.897 million unit annualized pace. Adverse winter weather likely played a role. Single-family units dipped 14.9 percent in February, following a 3.9 percent decrease the month before. Multifamily units dropped 20.8 percent after rising 7.9 percent in January. Housing permits, however, were more positive, gaining 3.0 percent after no change in January. The 1.092 million unit pace was up 7.7 percent on a year-ago basis.

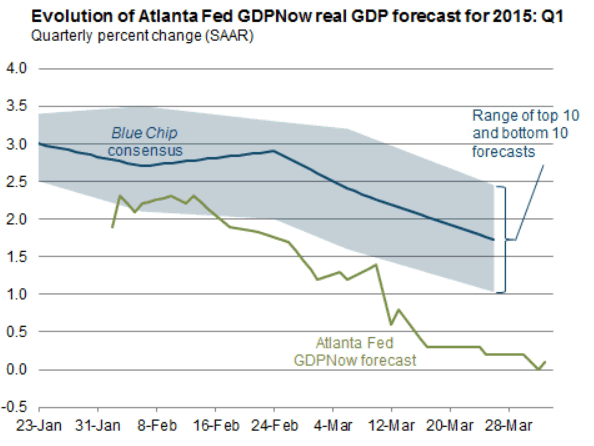

Atlanta Fed GDP Forecast 0.1%

The Atlanta Fed's GDPNow Forecast ticked down to 0.1% growth for the quarter, based on yesterday's poor Industrial Production numbers.

Today's poor showing in the Philly Fed manufacturing survey (see Philly Fed Positive, but New Orders Stall, Backlog of Orders Contracts, Prices Contract; Why the Optimism?) coupled with weakness in housing, I would expect the GDPNow forecast to decline back to zero, if not negative.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.