Consumption and Investment Fallacy

Economics / Economic Theory Jun 11, 2008 - 03:13 AM GMTBy: Gerard_Jackson

For years I have been stressing the media's lousy economics. For those readers who think I have been exaggerating the situation allow me to introduce you to Bernard Salt, a partner in the well known accounting firm of KPMG. According to Mr Salt

It was a no-brainer in the 1950s: half the working age population was not engaged in the paid workforce. Change based on the role of women was always going to transform our society over the course of a generation.

But what's left? Who else can we commandeer into working and spending so as to keep our consumerist society ticking along? How about the long-term unemployed, those with disabilities and the aged? How about a shift in social values to such an extent that we now see it as "good corporate karma" to embrace these previously spurned minorities?

How about a shift to acceptance, to celebrate workplace diversity and especially ethnic and religious diversity? How about an era in which we stream in workers from around the globe to add to economic capacity and to our rising consumer spending base? (Bernard Salt, The Australian, How to keep our consumerist society ticking: spend)

In other words, consumer spending drives the economy. The people have to spend the better off they will be. Complete and utter rubbish. Real demand springs from production and consumption. In English so plain that even Mr Salt can understand it: the farmer's wheat is his demand for other goods. The fact that money is used to effect the exchange is irrelevant to this fundamental fact. If it were not for money removing the need for barter the fallacy that consumption drives the economy would not emerge. In this the sense classical economists were right to speak of money as a veil.

The consumption fallacy leads to the belief that government spending can expand the demand for labour. But a government can only spend what it takes from others in the form of taxes, fees, etc. What we would get here is a change in the pattern of demand, not an expansion. Even if the government prints the money it will still not change the fact that the real source of prosperity is increased investment. Without capital accumulation there can be no genuine increase in "aggregate demand" and hence living standards. It follows that picking the pockets one group in order to fill the pockets of another group is not the smart way to extend a country's capital structure.

Although the classical economists didn't get everything right, they were spot on when came to the nature of demand. John Stuart Mill demonstrated this fact when he wrote:

The utility of a large government expenditure for the purpose of encouraging industry is no longer maintained. Taxes are not now esteemed to be like the dews of heaven, which return in prolific showers. It is no longer supposed that you benefit the producer by taking his money, provided that you give it to him again in exchange for his goods. There is nothing which impresses a person of reflection with a strong sense of the shallowness of the political reasoning of the last two centuries than the general reception so long given to a doctrine which, if it proves anything, proves that the more you take form the pockets of the people to spend on your own pleasures, the richer they grow: that the man who steals money out of a shop, provided that he expends it all again at the same shop, is a public benefactor to the tradesman whom he robs, and that the same operation, repeated sufficiently often, would make the tradesman a fortune. (Essays on Economics and Society, Routledge & Kegan Paul, 1967, pp. 262-263)

What Mill was making clear is that the pattern of spending is of extreme importance. It follows from his logic that real wages cannot rise if spending is diverted from investment consumption. Yet KPMG denies this fundamental economic truth. This is the company that estimated that the Commonwealth Games would raise Victoria's GSP by $1.6 billion over 20 years and create more than 13,600 jobs. The logic of this argument is that sporting events can be a substitute for capital accumulation. (This makes one wonder why the "games" did not save the Roman Empire from economic decline).

Creating jobs is no big deal, something the ancient pharaohs understood. The real trick is to produce a continuous stream of jobs that at ever higher wage rates. How is this done? By continuously extending a country's capital structure. More investment means more stages of production embodying improved techniques and technological progress. As the capital structure expands relative to the labour supply, labour's marginal product continues to rise. In other words, investment raises productivity. Paul Krugman wrote:

History offers no example of a country that experienced long-term productivity growth without a roughly equal rise in real wages. (Pop Internationalism, The MIT Press, 1997).

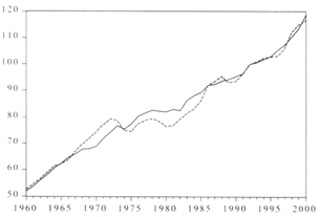

The following chart is just one of many that show wages moving in tandem with productivity.

I would go further than Krugman and argue that history offers no example of a steady rise in real wages in the absence of continuing capital accumulation. KPMG could argue — and probably would — that their GSP figure refutes this argument. The plane fact of the matter is that GSP and GDP figures are not measures of economic growth. Two important economic facts. Firstly, although real growth consists of capital accumulation we cannot measure it because capital is heterogeneous. (To get a better understanding of the nature of capital see Ludwig M. Lachman's Capital and Its Structure, Sheed Andrews and McMeel Inc., 1978).

Secondly, GSP and GDP are not true measures of economic activity. Both exclude spending between the stages of production on the absurd grounds that it would be double-counting. The result is that consumer spending is grossly exaggerated as a proportion of total spending. Moreover, this approach leads to the conclusion with respect to consumer spending: the more the better. But a proper understanding of the nature of capital would warn that directing spending from investment to consumption would lower living standards, or keep them lower than they would otherwise be. As von Hayek explained:

An increased supply of money made available directly to consumers would cause an increase in the demand for consumers' goods in relation to producers' goods, and would thus raise the prices of goods of the lower order in relation to those of the higher order, and this would inevitable bring about a shortening in the process of production [italics added]. (Friedrich von Hayek, Prices and Production, Augustus M. Kelly, 1967, p. 134. There is also Hayek's Profits, Interest and Investment, Augustus M. Kelly, 1975, pp. 255-265).

It is to be deeply regretted that KPMG's economic fallacies are soundly embedded in what passes for economic debate in Australia. What Mr Salt and those like him have not grasped is that a good economist looks beyond the immediate effects of an economic policy; he carefully follows a chain of reasoning which not only reveals secondary consequences but also long term effects; he is not solely concerned with the immediate effects or even long term effects on one group alone.

Finally, it appears that Mr Salt has adopted the politically correct view that we need "a shift to acceptance, to celebrate workplace diversity and especially ethnic and religious diversity". I am perfectly prepared to admit that I am at a complete lost as to what the devil he is talking about. If he knew any economic history and genuine economics he would know that the rule of law and the "impersonal forces" of the free market are the greatest friends that any poor minority group can ever have.

If Mr Salt's nonsense is the sort of thing that corporations are spending shareholders' money on then I think the shareholders should start raising questions about the competence of their CEOs.

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Copyright © 2008 Gerard Jackson

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.