Before Gold Bugs Blaze Their Trumpets…Gold is Due for a Significant Bounce

Commodities / Gold and Silver 2015 Apr 21, 2015 - 03:52 PM GMTBy: Harry_Dent

Gold bugs are still waiting on the great hyperinflation that will cause the U.S. dollar to fold over and send gold soaring to the heavens to the tune of $5,000.

Gold bugs are still waiting on the great hyperinflation that will cause the U.S. dollar to fold over and send gold soaring to the heavens to the tune of $5,000.

That might have looked remotely possible in 2011 when gold almost hit the $2,000 mark… but not now.

We’ve seen everything gold bugs could hope for: endless money printing, 0% interest rates (both short-term and long-term adjusted for inflation), rising debt and debt ratios in the public and private sectors…

So where’s the damn hyperinflation?

We’ve been saying it for years: It just ain’t gonna happen!

Why? Because we’re in a deflationary period, what we call the “economic winter season.” This comes after every great debt and financial asset bubble we’ve ever seen, driven by the kind of debt and leverage that has fueled our current bubble to such heights.

Money printing has kept deflation at bay for a number of years, but pretty soon that dam is going to break!

But I’ll give gold bugs this: They understand that you can’t get something for nothing better than even most economists. Some things may seem to be free, but you always pay for them later. There is no free lunch!

What gold bugs don’t get is that when such something-for-nothing policies fail, we will see deflation. Not inflation and certainly not hyperinflation.

Gold has already started to feel this painfully:

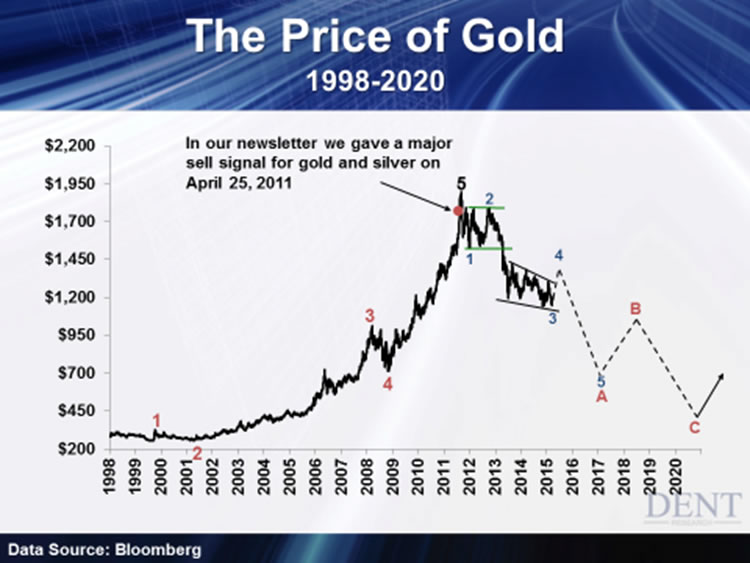

As you can see in the chart, we gave a sell signal on April 25, 2011. Sure, gold inched just a little bit higher to $1,934 in later that year, but then it fell and never returned past the value we sold at.

After 2013, when an acceleration in QE by the U.S. and Japan saw inflation rates fall from around 2% to 1%, gold plummeted out of its bubble. By getting out in 2011, we saved ourselves two years of senseless worry, because we knew the result well ahead of time.

Now, after a waterfall collapse into early 2015, gold looks like it is due for a substantial bounce higher.

When the next financial crisis starts to build — as we’re already seeing it start to — gold bugs will respond in kind, retreating into the supposed safety of their precious metal. It may bounce up to as high as $1,380 or even $1,425… but when the financial world realizes that gold is not the saving grace gold bugs think it is, the asset will suffer a very bitter fall from glory.

Think back to the last financial crisis just a few years ago. Gold continued to climb five months after the last great bubble started to tumble between late 2007 and 2008. By late 2008, gold finally went through the deflationary consequences of the financial meltdown, collapsing 33%.

So don’t sell what gold you have left, at least not yet.

But be warned, I see gold crashing again, well below $1,000 by early 2017 or so, when the next stage of deflation sets in. In fact, I’ve accepted a bet with Jeff Clark of Casey Research that gold will go as low at $740 an ounce before 2017 is over. There are two one-ounce Gold Eagles waiting for me on that one.

The question is: Do you want to listen to us, who have been dead-on about gold falling in the past, especially after real crises have hit… or do you want to keep listening to the gold bugs, whose moralistic arguments continue to miss the finer details?

There’s much more at stake here than just the price of gold. Deflation will ripple through the entire global economy. This matter is so crucial that I insisted we release next month’s issue of Boom & Bust early. I covered this matter in great depth, so if you want the full details, read on.

By Harry Dent

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.