Mal Investments and Money Printing Equals Explosive Unpayable G7 Debt Mountains

Stock-Markets / Credit Crisis 2008 Jun 11, 2008 - 06:38 PM GMTBy: Ty_Andros

The Crack up Boom series has returned due to the enormous amounts of money and credit creation required to save the G7 financial and banking systems. As I have outlined in recent letters, we are only in the second inning of a nine-inning ball game. Over 500 billion dollars will have been created out of “thin air” and it will require over a trillion to rescue the reckless bankers from their journey into the world of speculation and hedge funds in disguise. Their efforts have failed miserably and now they are paying the price of misuse of leverage. This leverage has just continued to get worse, contrary to reports about de-leveraging. Assets which used to be able to be priced as recently as last fall have now moved into the roach motels (see Tedbits Archives for August '07 at www.TraderView.com ) known as Level III assets, AKA asset value UNKNOWN.

The Crack up Boom series has returned due to the enormous amounts of money and credit creation required to save the G7 financial and banking systems. As I have outlined in recent letters, we are only in the second inning of a nine-inning ball game. Over 500 billion dollars will have been created out of “thin air” and it will require over a trillion to rescue the reckless bankers from their journey into the world of speculation and hedge funds in disguise. Their efforts have failed miserably and now they are paying the price of misuse of leverage. This leverage has just continued to get worse, contrary to reports about de-leveraging. Assets which used to be able to be priced as recently as last fall have now moved into the roach motels (see Tedbits Archives for August '07 at www.TraderView.com ) known as Level III assets, AKA asset value UNKNOWN.

Note to readers regarding Tedbits availability: Starting in June, Tedbits publications will be available to registered subscribers 2-3 days earlier than to the general public. If you are not a registered subscriber, sign up now.

Come see us at the TraderView Booth at the Freedom Fest in Las Vegas , July 9th - 11th . For more information, please see the note at the bottom of this Tedbits.

Helicopter Ben Bernanke has continued his adventures into the policy of the unknown and the unlimited moral hazard he began when elevated to Chairman of the Federal Reserve. He threw the Federal Reserve on the systemic G7 financial bomb known as Bear Stearns, tipping his hand to the coming socialization of risks of the G7 banking system. This week he stepped over the line again, taking on the role of the US Treasury Secretary, and blew HOT AIR at the dollar exchange market. Pinocchio George and Hank Paulson could no longer be believed when they spoke of a strong dollar policy, so they brought in a new big gun: Helicopter Ben. He is next in line to destroy his personal credibility. Unfortunately for us all, as Big Ben goes so does the credibility of the central bank of the world's reserve currency--the Federal Reserve. No sooner did he jolt the currency and bond markets with hawkish “hot air” then he turns around the very next day and revs up the printing press by doing a system repo of $27 billion dollars to goose the markets—a complete and total contradiction to his RHETORIC.

Remember what I have told you: never look at the headlines or their words as they are empty FOOL'S gold. Look at their actions for the real story. An epidemic of illusions are now the only thing most investors have to work with. Truth has succumbed to political expediency in an election year, as it always does. Anyone that takes the time to look at economic reports coming out of G7 governments knows the decision has been made to NEVER give you a clear picture of what's being reported in the headline numbers, which is what the mainstream financial press splash in front of you. Unemployment numbers, inflation, retail sales, GDP —you name it. All are misleading, to say the least, or outright lies after careful examination.

Decades of de-industrialization, destruction of industry and wealth creation has now deposited us where are now: inflationary recession known as stagflation. The truth of the economies of the G7 is inconveniently terrible and so it is politically incorrect, so politically correct ones are substituted in their place. Public servants seeking reelection see to it that the MASSES never know the truth.

Ben's rhetoric distracted from the ratings downgrades of the dead men walking zombies known as the monoline insurers: Ambac and MBIA. These firms are completely bankrupt, only we haven't been told yet as politically correct regulators fan the flames of the unfolding insolvency of the G7 banking sectors. Those downgrades mean approximately $100 billion dollars of fresh losses for the major money center and investment banks. I believe insolvency is the correct term for the following firms: General Motors, GMAC, MBIA, Ambac, Lehman brothers, Fannie Mae, Sallie Mae and Freddie Mac to name a few (MORE TO FOLLOW). Citigroup, UBS and JP Morgan Chase are also in bad straits but will NEVER be allowed to fail. Public servants, bought and paid for with political contributions, will do whatever is necessary to underpin these entities. Do you know how much MONEY will have to be printed to rescue them? It is an unimaginable amount. As the founder of the Rothschild banking empire so clearly said:

"Let me issue and control a nation's money supply and I care not who makes its laws."

-- Mayer Amschel Rothschild, Founder of Rothschild Banking Dynasty

The Federal Reserve is owned by foreign bankers, and of course we can see this today as Wall Street and the money center banks are RARELY held to the rule of law or current regulation. They routinely IGNORE them on their road to FLEECING YOU! They are never held to account. They are just BAILED out by you, me and the taxpayers who are their regular prey. So it's hi-ho, hi-ho off to the printing press we will go…

Why are these things important? It is because they represent MEGA opportunities for prepared investors. Just as high crude and commodity prices are not caused by evil SPECULATORS as public servants, would have you believe. The truth is these problems are completely a result of their “decades of poor policies” which serve their elite constituents rather than the public they are sworn to serve. Ethanol, global warming, agriculture and energy policies serve NO ONE or anything but BIGGER government and their subsidized constituents. Now that those poor policies have compounded for years and are not easily reversed, the solutions have no support as the required MEDICINE is unthinkable to the “something for nothings” which are now inculcated at all levels in the G7. What all these misallocations of capital and mal-investments are to you is LESS OF EVERYTHING YOU USE FOR MORE MONEY, also known as inflation.

So when these poor policies BITE the public, scapegoats must be found, and find them they do with the help of the socialist media handmaidens and RIGGED inquiries where the results are known before the investigation begins. Then EXPERTS are found to PROVE the false conclusions which they support, such as avowed socialist George S*R*S. I promise you George has invested in his conclusions before he presents them. But pieces of paper and false headlines DO NOT change the fundamental REALITY from unfolding—they only DELAY them. Reality may be delayed sometimes for a day, week or month, but eventually Mother Nature ALWAYS WINS these battles of reality versus rhetoric. Public servants can control their constituents, the mainstream media and their DUMBED down electorates, but Mother Nature and GLOBAL MARKET fundamentals are OUTSIDE their grasp. Demand-driven, supply-constrained markets DO NOT succumb to political rhetoric or attempts to manipulate prices by ignorant public servants. THESE ARE ENORMOUS OPPORTUNITIES AND YOU MUST VIEW THEM AS SUCH.

Mal Investments and Money Printing, Round 2

In last week's opening edition of the “Crack up Boom” series (see Tedbits Archives at www.TraderView.com ) we outlined the tremendous amounts of Fiat currencies and credit creation occurring throughout the world. Some of it is self-defensive in nature (sterilization) while other parts substitute for wealth creation, support deficit spending and fuel asset-backed economies for public servants (G7). This has been going on for DECADES and as it has done so IOU's er, currencies have piled up in bank accounts WORLDWIDE.

Trillions upon trillions of IOU's created with sovereign debt known as US dollars, British pounds, euros, Aussie dollars, rubles, etc. have been created by global central banks and the fractional reserve banking systems they run. As Ben Bernanke so aptly described: It is a global savings glut. As this money has been created, yields have declined as money is no longer SCARCE. It is now abundant, thus people who borrow money have had low interest rates as these savers have fewer and fewer opportunities to invest. Thus when combined with fractional reserve banking systems, this has created zillions of FIAT currencies with NO BACKING whatsoever.

This excess money creation is the source of all the big hedge funds' monetary resources, the tremendous amounts of newly wealthy individuals, skyrocketing corporate values and receipts. It is also the reason we are in the current “Thrill ride” 2008 pattern of the year aka “WOLF” wave (see Tedbits Archives at www.TraderView.com ) as part of this paper pyramid is imploding, and the part that is imploding is on the balance sheets of the G7 banking and financial systems.

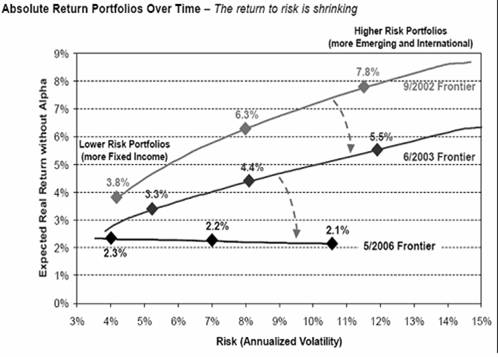

As yields on investments have collapsed investors have reached farther and farther out on the risk curve to achieve even what used to be common returns of 6%. Take a look at this chart from a May 2007 missive of John Mauldin (John can be reached at john@FrontLineThoughts.com ) illustrating the compression of returns on RISKY assets:

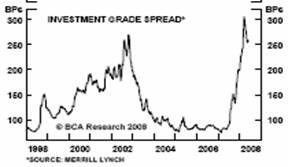

This collapse in yields could be seen in ALL asset classes, stocks (the S&P 500 yield approximately 2%), bonds (junk grade bonds trading at 1.5% above AAA treasuries), and anything which is involved in relative investing as practiced by the mainstream “Wall Street” banks and brokers. As one sector rises to poor relative returns, money just ROTATES into ones which yield relatively more. It is a mug's game, practiced by poorly prepared investment managers. As more money and credit has been created by the central banks and banking systems required more risk to achieve yield. Here is another illustration of investment grade assets yield compression courtesy of Martin Barnes and Bank credit analyst www.bcaresearch.com :

Notice how the yields have repriced (higher yield, lower price) to reflect the REAL risk of the underlying bonds since the wheels started coming off the credit bubble and the investment sausage known as over the counter derivatives.

Notice how the yields have repriced (higher yield, lower price) to reflect the REAL risk of the underlying bonds since the wheels started coming off the credit bubble and the investment sausage known as over the counter derivatives.

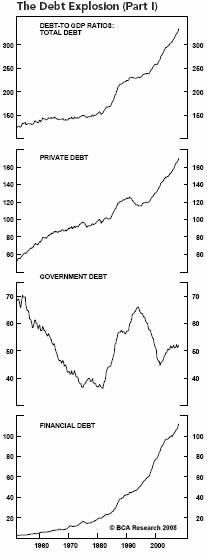

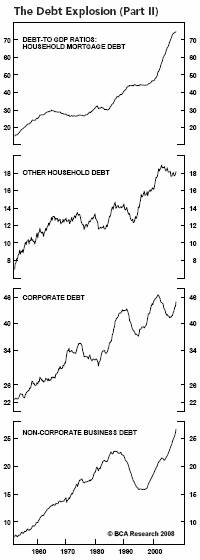

Lets take a look at all the US based and denominated debt (courtesy of Martin Barnes and the fabulous BCA research team: www.bcaresearch.com ) that has been created to create investments for all this excess cash that has been created:

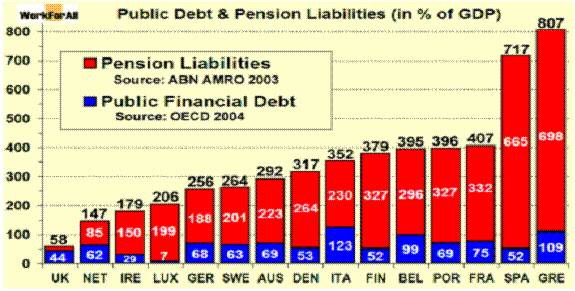

Look at these mounds of paper. It's an astonishing testament to the power of printing money, then inserting it into a fractional banking system with little regard for LENDING standards. Of course the government number is BOGUS as they keep their liabilities safely off the balance sheet to fool their creditors. In reality it is 60+ trillion, not 9 trillion. Just as an SIV (structured investment vehicle) keeps liabilities outside the bank's balance sheet, lawmakers are able to keep theirs off the government's balance sheet. Let's take a look at some of the numbers from Europe from a recent piece by John Mauldin (John can be reached at john@FrontLineThoughts.com ):

These numbers have only GROWN since 2004. Here are the gory numbers for the US :

GOVERNMENT DEBT

Federal Debt: $9 TRILLION

State & Local Debt: $2 TRILLION

Total Government Debt: $11 TRILLION

UN-FUNDED, OFF BUDGET DEBT $62 TRILLION

PRIVATE DEBT

Household Debt: $13 TRILLION

Business Debt: $9 TRILLION

Financial Debt: $14 TRILLION

Foreign Debt: $2 TRILLION

Total Private Debt: $38 TRILLION

SUM TOTAL DEBT

Government Debt: $11 TRILLION

Private Debt: $38 TRILLION

Unfunded Debt: $62 TRILLION

Total Debt: $111 TRILLION

Some of this built-up debt was sold in traditional bonds of one sort or another and has been kept on lending institutions' balance sheets or investor's portfolios. The rest has been securitized. Securitization was an INVENTION to create higher returns in a low-return world. CLO's, CDO's, CMO's, ABS, (collateralized loan, debt, mortgage obligations, asset-backed securities, unneeded commercial real and residential estate, etc). They took risky borrowers (unqualified borrowers such as auto, unsecured credit cards, private equity and mortgages, so they had to pay more in interest to borrow, etc.), mixed them in with qualified borrowers and packaged them into tranches to try and create safety from diversification.

Unfortunately, they were still risky borrowers with NO down payments. They were poor or had no ability to repay, or they were plain old CON men or just “something for nothings”, succumbing to their dreams of owning something they could not afford. Reckless lenders have allowed them to do so . Quite often bankers offered investors additional leverage by loaning money against these investments. A bond or security yielding 5-6 % when bought with 25% deposit now returns 20 to 24% interest. In fact, that's what UBS recently did when it unloaded 20 billion of CDO's (collateralized debt obligations). Blackrock bought them at a discount price of 15 billion dollars, put up 5 billion and borrowed the rest from UBS.

Do you know how much of this debt has funded consumption rather than investment? A lot. Money that has been consumed rather than invested provides no returns in which to service the debt. It brings consumption and purchasing forward, robbing future years of demand. Many of the lenders to these people were making MAL INVESTMENTS.

Brokers and quants at the banks then took historical data and extrapolated previous risky loans' default rates and created the different slices so an investor could go to the investment buffet table and choose the investment they wished based on yield and credit agency RATINGS. MANY OF THE ASSUMPTIONS ARE WRONG AND OF NO PREDICTIVE VALUE The highest-rated (AAA, AA, A, etc.) pay out the least and in the event of default are the last to take losses, and the lowest-rated slices (BBB, BB, B, etc.) pay out the most and in the event of default take the losses first!

Then they paid the credit ratings agencies for the RATINGS, and the agencies quickly put the requested RATINGS on the crappy paper for their money center and investment banking masters FOR A BIG FEE. Unfortunately you can label crappy paper “high quality” but in reality it is STILL “poor quality”.

Unfortunately, the assumptions the ratings were built upon were FALSE as very few of these loans were SECURED against anything (credit cards, vacations, furniture, etc.), or something of inflated value (homes, commercial real estate, SUV's, etc.). Higher interest rate environments impair the borrower's ability to repay and diminish any asset values for which the borrowing was used: condos, homes, commercial real estate, etc. Measured against REAL inflation levels, interest rates have been NEGATIVE for over a decade.

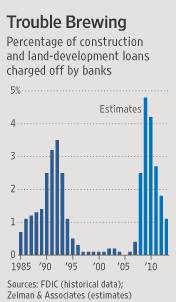

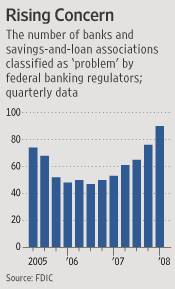

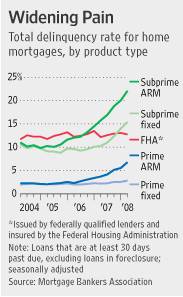

And of course, think of the tremendous asset appreciation that has taken place as all that debt has entered the marketplace to BID for assets. Values have skyrocketed in excess of regular growth rates and inflation. When the bids are withdrawn the balance sheets crumble with the asset values. Homes, office buildings, everything deflates in value as bidders disappear. Take a look at the coming wave of defaults in construction, and the rising wave of delinquencies in homes:

These are reflections of the unfolding collapse of over-the-counter derivatives and bank balance sheets. Many of these loans and crappy paper derivatives are INSURED by credit default swaps, whose value is UNKNOWN as the sellers of them “may or may not” be able to pay. Novation (where a seller of a credit default swap passes their obligations to another counterparty) is the DAISY chain of unknowable counterparties and makes this sector potentially extremely EXPLOSIVE. This is one of the MAIN reasons Bear Stearns WAS NOT allowed to default. No one wanted to discover the weak links in NOVATION. It was a firecracker which NO ONE wanted to witness, so it was cheaper to PRINT the money.

The tremendous overvaluations were caused by too much credit for sub-prime borrowers and prime borrowers as well. The asset value collapse is now creeping into prime borrowers as they all OVERPAID for their homes. They may have placed good deposits down of 20 to 30%. Unfortunately, they made those deposits on homes that were up to 50% overvalued. So as the credit markets recede they are left with NEGATIVE equity in a short period of time.

A home purchased in 2006 in Florida is a purchase price of $350,000 dollars and the monthly payments are $3200 dollars at a 5% interest rate. If you rent it out you get $1200 dollars a month. The asset you purchased does not pay for itself and in fact, it is the definition of insolvency--it consumes more than it produces. Year over year the Case -shiller home prices index are down over 14%, and declining at a 24% rate.

This overpayment extends to many other asset classes including private equity.

Each time the Federal Reserve has tried to raise interest rates over the last 15 years these poor yielding investments COLLAPSE in value as interest rates approach neutral, since they are MISPRICED (overpriced) in relation to the risk and yield they return. Think back to Greenspan in 2000 and Bernanke in the spring of 2007. As interest rates approached neutral, the financial hocus pocus collapsed when it required that they PAY returns in excess of inflation. They can only pay off and hold value if interest rates are NEGATIVE (below the rate of inflation). Look at a chart of fed funds going back 15 years. Every time they raised rates the highs were below the previous cycle highs and the lows have been below previous cycle lows. Some people believe Bernanke is done easing. My bet: NO WAY IS HE DONE!

We are in the payback time for previous decades of easy money and over-stimulation. The mal-investments which they funded are NOW collapsing. Those mal investments are: commercial and residential real estate, unsecured credit card liabilities, many auto loans, many private equity deals, junk bonds, etc. This in turn is leading to the reflation we are now seeing as the G7 Public Servants and central banks work to PAPER over their previous MISTAKES!

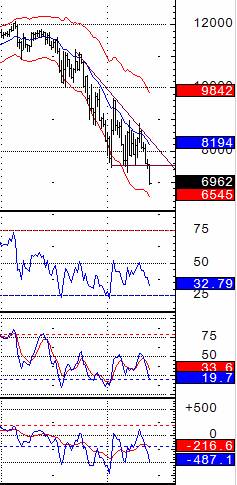

The next round of debasement has begun. The G7 banking and financial system have commenced their next leg down in expectation of RECOGNIZING the looming balance sheet bombshells that reside within their leverage schemes. Take a look at these charts of the banking and brokerages as they break DOWNWARD from corrective patterns:

BKX Banking Index XBD Broker's Index

2007 2008 2007 2008

It's “bombs away” for these money center and banking powerhouses as the next move down has begun as well as the next wave of announcements of balance sheet BOMBSHELLS! Nothing is as astounding to me as bankers not understanding leverage and risk control. They traded good judgment and risk controls for leverage and bonuses. They MISUSED their privileges of money creation and succumbed to greed. They have created all these investments that can best be described as toxic waste and picking up quarters in front of steam rollers. Bankers are not speculators and do it in a poorly designed manner. Now we know why Glass Steagel was passed in the Depression, separating banks from speculative activities of investment houses. The creation of Citi group required this law be repealed and 10 short years later the banks are bankrupt.

There are trillions of IOU's out there called G7 currencies. As I outlined last week, the average compounded rate of fiat money and credit creation WORLDWIDE is approximately 16%, literally five times the rate of GDP growth. The difference between economic growth and the rate of money and credit creation is INFLATION. In the United States it takes OVER $5 dollars of debt creation to create $1 dollar of GDP. The other four dollars of GDP go to government fees/ taxes, and foreign suppliers of goods and services. Since the G7 has de-industrialized and regulated and taxed production until it has left their shores, this GDP creation will NEVER return. For a business to return to the G7 spells doom in the competitive global markets and the requirement that you produce MORE FOR LESS to thrive.

You can't impose socialism into a capitalist economy and expect it to succeed, be able to create wealth and growing middle classes. Socialism destroys the middle class. It robs them of their INCOME GROWTH and the ability to SAVE money. Savings are the seed corn of new businesses of the future. So many new businesses are never born. Socialism is misery spread widely and it attacks the people on the lowest rungs FIRST. Monetary debasement is the purest form of socialism and redistribution of wealth. They take the purchasing power from the holdings of savers and the broad public, then print new money and redistribute it!

Winston Churchill once said: “Socialism is the philosophy of failure, the creed of ignorance and the gospel of envy; its inherent virtue is the equal sharing of misery” (Thank you Bill King of the King report).

Look all around you as this is the state of affairs in the G7. Its truth is the bedrock of ALL G7 public servants--you have a social responsibility to pay for others' basic needs, and now their POOR JUDGEMENT in investing.

This is the platform all G7 public servants run on to exploit the desperation their inflationary monetary systems impose on their citizens. SOMETHING FOR NOTHING-- we all want it and will never get it as: “there is no such thing as a free lunch”. Remember the lowest rungs on the ladder are the most desperate for CHANGE. Now you know why the G7 will never create enough wealth to repay its obligations. They will rob the productive elements and feed it to the unproductive—cannibalism of the productive private sectors which are the creators of ALL wealth. Government has never created wealth. It only consumes it.

The enormous sums of currencies which have been created since Bretton Woods II forever destroyed any requirement of fiduciary sound government monetary and fiscal policies. This fiat currency and credit creation has underpinned the G7 “asset backed economies” in substitution of the policies of wealth creation. Income is collapsing in the G7 on all levels of society as wealth creation has been increasingly destroyed and transferred to government subsidized industries which cannot create more than they consume. It is the policy of insolvency.

In conclusion:

The obligations have become UNPAYABLE on all levels of G7 society. Thus you can either DEFAULT (which precludes future borrowing) or inflate the obligations away. You can expect the G7 public serpents, er, servants, to print to save the money center and investment banks, as well as many defaulting homeowners, G7 national champion businesses (Fannie Mae, General motors, and Freddie Mac to name a few), state and municipal governments, walking zombie big businesses such as I outlined in the opening and any other big constituency which is DEPENDENT on government subsidies and financial guarantees. They will not be allowed to fail as it would be political and financial SUICIDE. Public serpents— er, servants and bankers are NOT suicidal. They are pathological predators.

Since G7 obligations are DENOMINATED in domestic currencies the solution they will take and have taken to date is they will “print the money”. It is as simple as that. They will substitute another IOU (G7 currencies) for the existing ones. Default is unthinkable as they won't be able borrow anymore, or print money and exchange them for REAL things like imports and energy supplies. It is inflate or die, so they will inflate .

These realities are hard to accept, but the one bright spot is that YOU are aware of them. You can organize yourself in such a manner as to not be victim of them, and in fact benefit from them. Investors are in general confused as the assumptions they have been taught are NO LONGER true. BONDS and paper investments are POISON to your future. Learn how to SHORT CURCUIT the unfolding monetary debasement and confiscation of your wealth by your SOCIALIST, COLLECTIVIST public serpents and their banking masters. Markets must constantly REPRICE UP and Down to reflect the unfolding situation, creating volatility in all market sectors. VOLATILITY is OPPORTUNITY and it will unfold in spades over the coming years. You learn to make money in up and down markets, short circuit the debasement of your holdings. Its quite simple to do

Inflation will rear its ugly head over and over again in the coming years, but the public will not understand the altered relationship of their money. The day of recognition by the general public is YEARS away. They have no idea what is transpiring, nor do they know the source of the inflation problem--public servants and their banking masters. The mainstream media, public schools and your public servants have made sure you never get the straight story and that most people and their children don't have the ability to recognize a lie said straight to their faces.

How do we know recognition is years away? Try and explain this to your friends. They will stare at you blankly! When they don't return a blank stare you KNOW the “Crack up Boom” is at hand, at which point you must be out of all paper currencies and in GOLD or something that can't be printed. In the meantime, inflation will continue as private and central banks pile infinite amounts of new currencies into their economies to service unpayable old debts, maturing obligations, support inflated asset values, and confiscate wealth from the citizens they are sworn to protect —to protect the value of their balance sheets and get more people onto the debt slavery rat wheel. The “Crack up Boom” looms directly ahead.

Flash: I don't know what is transpiring but everyone at the fed and treasury are TALKING up the dollar, Richard Fisher, Tim Geithner, Helicopter Ben Bernanke, Hank Paulson. Smoke is in the air, I wonder where the fire is? I am sure we will soon find out!

Important Note: I will be at the Freedom Fest in Las Vegas July 9 th - 11 th , with a break out session and round table discussion scheduled. I look forward to meeting you there. I will also have a TraderView booth in the main exhibition hall and scheduling individual meetings with those of you are interested in getting together privately. If you would like to schedule a meeting come to the booth or schedule a meeting with me by emailing info@TraderView.com .

Please remember that beginning the first week in June subscribers will receive Tedbits two to three days before it is posted on the web. Subscribers will also start getting guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.